Repository

https://github.com/steemit/steem

Analysis Goals and Conditions

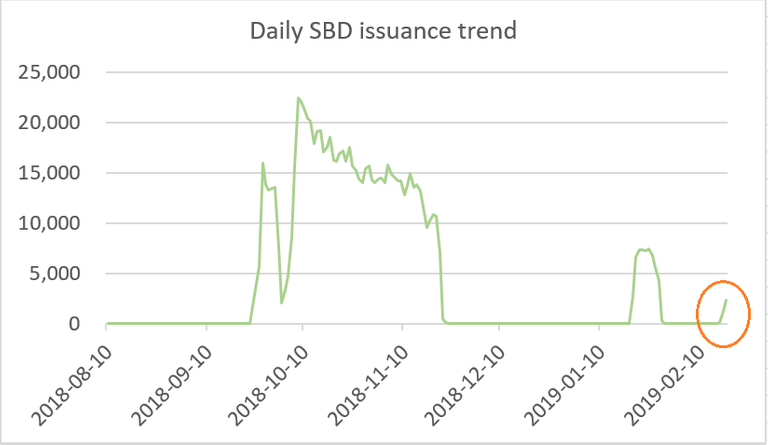

Thanks to the continued decline in SBD supply balance and the rising STEEM price, SBD is being reissued. Coincidentally, the SBD supply balance dropped below 10 million, and the SBD price was close to US$1

Therefore, it would be good to review the overall situation of SBD.

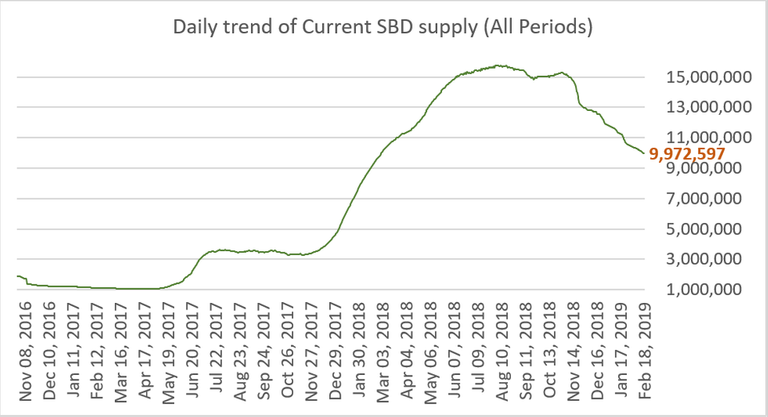

First, we briefly review SBD supply balance trends for all periods since the start of the STEEM chain.

And for a specific time period, look at SBD supply balance trend, key features by phase, top 20 SBD conversion accounts, and top 20 SBD holding accounts.

The target period is from August 10, 2018, when the new issuance of SBD was first discontinued, to February 18, 2019. The update date for the material is February 18, 2019 at 16:00 UTC.

Analysis Table

SBD supply balance trend (all periods)

SBD related, key analysis (2018-08-10 ~ 2019-02-18)

① SBD supply balance trend (2018-08-10 ~ 2019-02-18)

② Key features by phase

③ Top 20 SBD conversion accounts

④ Top 20 SBD holding accountsConclusion

Contents

1. SBD supply balance trend (all periods)

Since the end of 2017, the rapidly expanding SBD supply balance has been steadily declining, reaching a peak of 15.7 million units, now down to less than 10 million units.

2. SBD related, key analysis (2018-08-10 ~ 2019-02-18)

① SBD supply balance trend (2018-08-10 ~ 2019-02-18)

On August 10 of last year, SBD new issuance was first suspended. At that time, there were 15.7 million SBD supply balances. In addition, the upper limit for SBD debt ratio was only 5%.

Due to the hardfork 20 at the end of September, the upper limit of the SBD debt ratio was significantly raised to 10%, and naturally the SBD new issuance was resumed.

Nonetheless, as STEEM prices fell further, SBD entered haircut status on November 28 last year. At that time, SBD supply balance was 13 million.

Since then, the SBD supply balance has been steadily declining and now has fallen below 10 million.

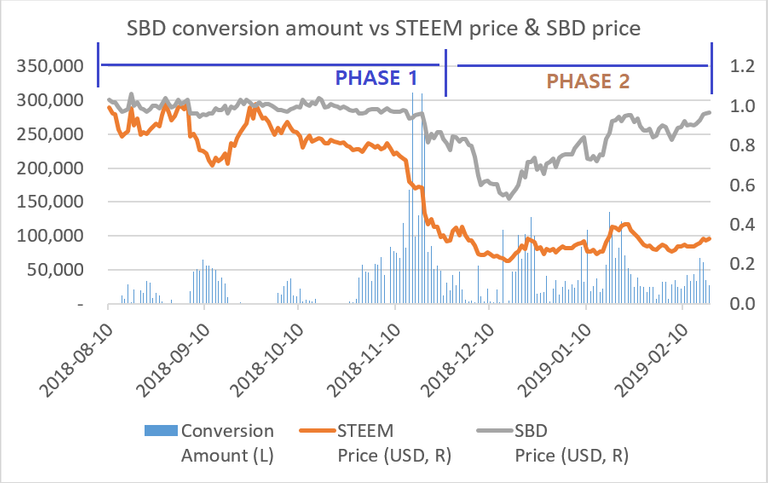

② Key features by phase

Please refer to both charts above.

Phase 1 is the period from August 10 to November 28 last year, when SBD supply balances were forcibly reduced.

SBD supply balances remained at high levels for a while, then sharply declined in November last year. Conversely, we can see that the SBD conversion volume has greatly increased at that time.

In order to prevent the SBD from entering the haircut state, this appearance was caused by forcibly shrinking the SBD under the leadership of the witness @smooth. In Phase 1, STEEM prices dropped significantly and SBD prices remained near US $ 1, so general users were not motivated to try SBD conversion.

SBD Debt Ratio Management Trend Analysis : Who removed our SBD?

Phase 2 is an era in which SBD supply balance is reduced autonomously from November 29 last year to the present.

At that time, not only the STEEM price but also the SBD price dropped significantly below US $ 1. When the STEEM price went up temporarily, there was a large number of applications for SBD conversion in many accounts, perhaps to get some profit. It was not led by a specific person, but various accounts were involved.

In other words, it can be interpreted positively as a result achieved autonomously. This autonomous balance adjustment between STEEM and SBD is also a benefit of the STEEM system design.

Analysis of SBD supply balance trend

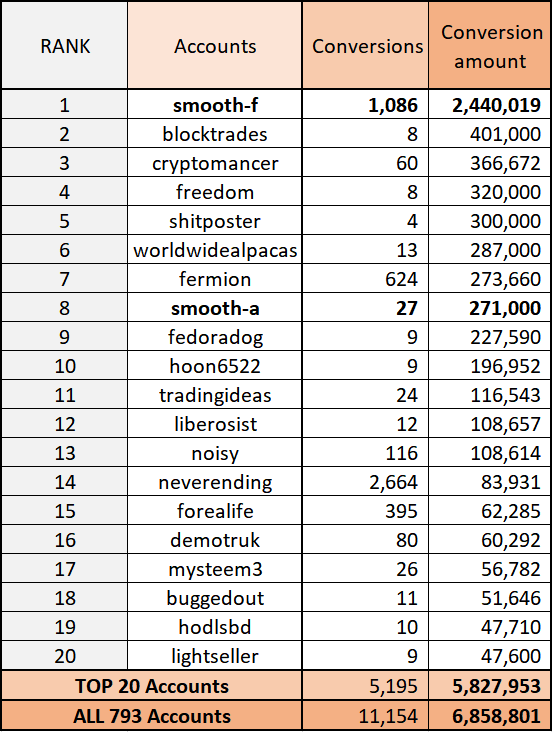

③ Top 20 SBD conversion accounts

The table above shows the top 20 accounts based on SBD conversion from August 10 last year to the present.

A total of 6.85 million conversions were made, of which 5.82 million, or 85% of them, were made up of the top 20 accounts.

In Phase 2, relatively large numbers of accounts were autonomously engaged in the transition, but because of the high dependency on a particular account in Phase 1, the top 20 account dependency is still high overall.

In particular, even for the entire period, the witness, smooth, contributes about 40%.

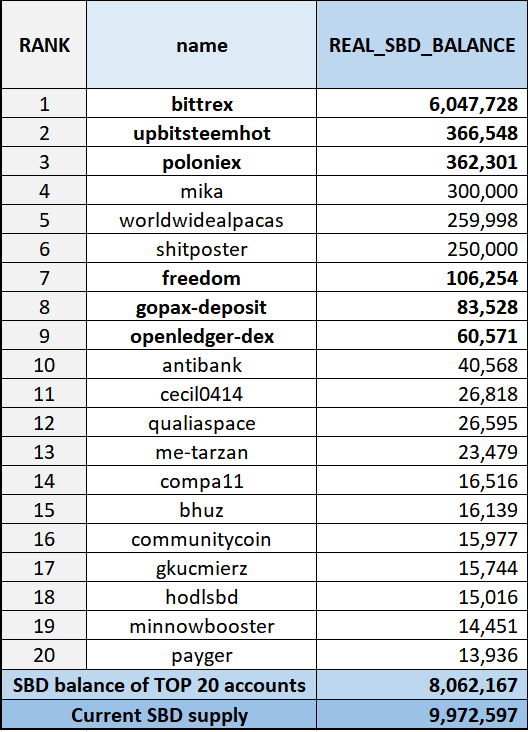

④ Top 20 SBD holding accounts

The top 20 accounts hold about 81% of the remaining SBD balance.

In particular, about 60% of the total, is on the bittrex exchange.

It is difficult to reduce SBD balances without switching to STEEM by buying SBDs from multiple exchanges because most of the top accounts are exchange accounts. Therefore, it seems unlikely that the decline in the SBD balance will be faster.

3. Conclusion

① The SBD returns ?

We have reviewed the SBD-related key facts in detail.

In the chart above, new issuance of SBD has been resumed from time to time since August 10 last year. In other words, this resumption is not the first but is already the third resume.

Is SBD really coming back this time?

② Between enthusiasm and coolness, let's lower our expectations and watch calmly.

In recent months, there has been a lot of concern about STEEM, but the community and STEEMIT_INC have made some compromises, and there are obviously positive things like games and many dapps coming out.

Still, STEEM prices are not high, and problems that have been raised for a long time remain.(improving the fairness of compensation distribution and the need to avoid excessive abuse) Of course, the inherent limitations of the SBD debt ratio design have already been witnessed with several discontinuities.

These expectations and concerns will be on the chart above. Here we can see how the SBD supply balance has changed based on the STEEM price and the SBD price, and we can respond based on this.

For several months, SBD prices were volatile. And although the recent SBD balance has declined a lot, it is still very high compared to the past, which was steeply pumped.

So, between passion and coldness, we need to lower expectations and watch calmly.

Thanks for reading. I will return with better analysis.

The Data and Queries

I did this analysis by connecting to the @steemsql db with MSSQL client(Microsoft SQL server management studio), Excel.

Refer to My Github

(My main analyzes)

Analysis of Voting Pattern: From posting to payout

SBD Debt Ratio Management Trend Analysis : Who removed our SBD?

(STEEM) All we need is time? Nope. More innovative action is needed.

The current (actual) inflation rate of STEEM is quite different from the design.

Proof-of-Brain or Power-of-Bid(bot), that is the question.

Analysis of SBD supply balance trend

The recent rise in STEEM prices may have been driven by Tanos' thumb.

Analysis of actual curation yield distribution

.

Thanks for the comment!

In fact, I am much more pleased with your return than SBD. :)

During this period, I incinerated 6,800 SBD, which is small, but the order of contribution was 66th in the total account. South Koreans burned at least a few hundred thousand sbd, and I also plan to increase the size of the incineration in the future.

Thank you for your review, @crokkon! Keep up the good work!

This post has been included in the latest edition of SoS Daily News - a digest of all you need to know about the State of Steem.

짱짱맨 호출에 응답하였습니다.

Hi @lostmine27!

Feel free to join our @steem-ua Discord serverYour post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation! Your post is eligible for our upvote, thanks to our collaboration with @utopian-io!

Hey, @lostmine27!

Thanks for contributing on Utopian.

Congratulations! Your contribution was Staff Picked to receive a maximum vote for the analysis category on Utopian for being of significant value to the project and the open source community.

We’re already looking forward to your next contribution!

Get higher incentives and support Utopian.io!

SteemPlus or Steeditor). Simply set @utopian.pay as a 5% (or higher) payout beneficiary on your contribution post (via

Want to chat? Join us on Discord https://discord.gg/h52nFrV.

Vote for Utopian Witness!