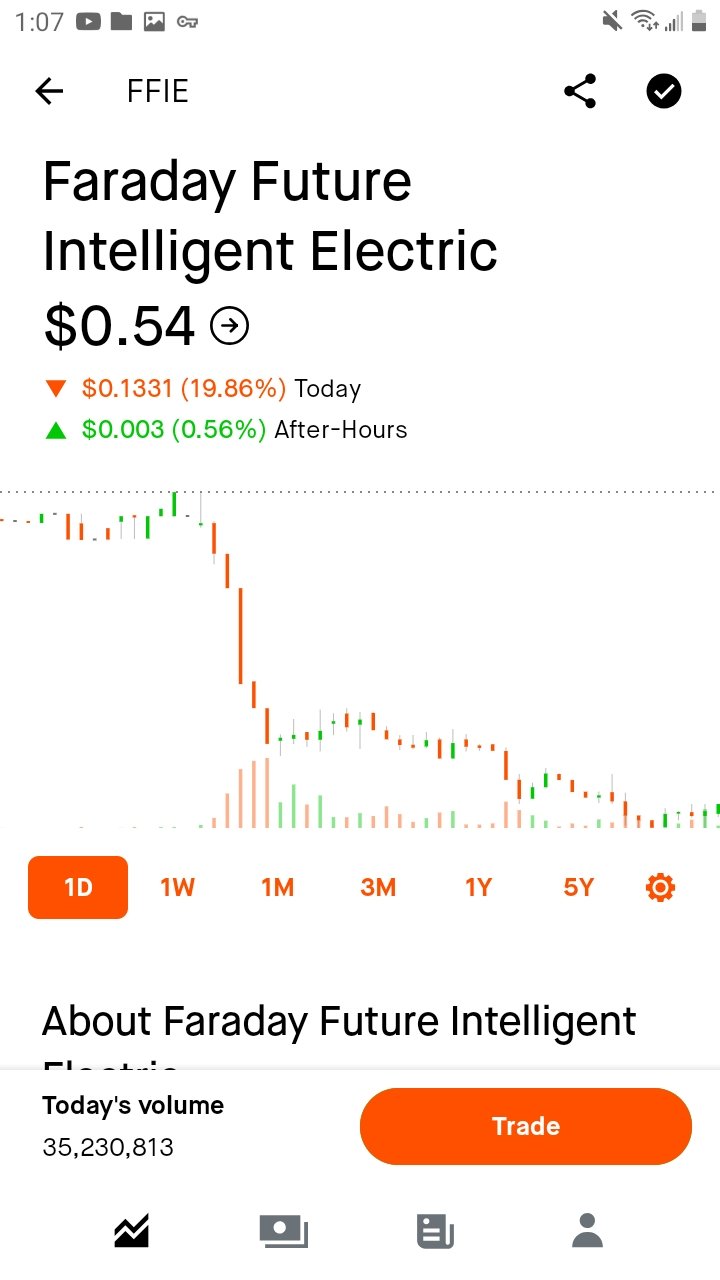

Phew that was a close one! Just yesterday I was talking about how poorly $FFIE, Faraday Futures, was doing. The stock price is reflecting the loss in retail investor sentiment and trust. People are dumping it as quickly as they can and there isn't a buyer in sight.

By buying back my cash covered put it removed my obligation to buy 100 shares at $1 each by October 21st. This is good because I would have been taking a small loss if I was assigned to but them.

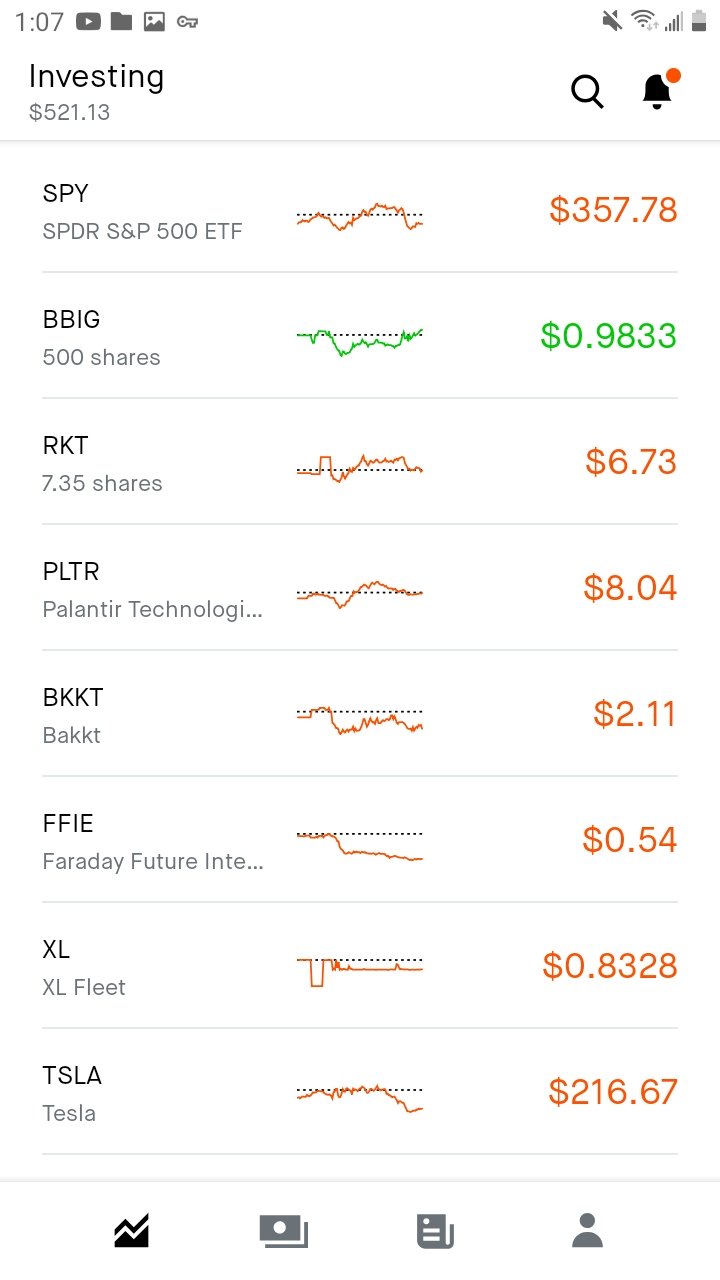

$BBIG, Vinco Ventures, on the other hand is the only green stock on the watchlist it seems and it's helping to keep my portfolio afloat. The price is hovering just below $1 which is fine for me since I need my $1 calls to expire out of the money Friday.

It has been almost one entire month since I began this challenge- results are still negative but not horribly considering the state of the markets. Trading in this environment is like minesweeping blindfolded.

Faraday took another tremendous loss and at this point its beyond recovery. They have a failing business that will inevitably have to declare bankruptcy. I could chase more short positions on this but its a slow grind to zero on that kind of stock.

Id rather focus on collecting cash premiums on a stock I can hold comfortably. This also gives me the flexibility to profit in two ways, by setting my desired strike price and in collecting the premiums.

Til tomorrow!

Posted Using LeoFinance Beta

@ecosaint Please bless this post with more $BEE curation

We need it to upgrade the ICEBRK.io front end for Hive :)