At first, I was also glad to hear we would have institutional money come pump my bags and make me rich, but then I began wondering what is behind this recent move. Do you think Bitcoin, Ethereum, Solana ETFs are good for the ecosystem?

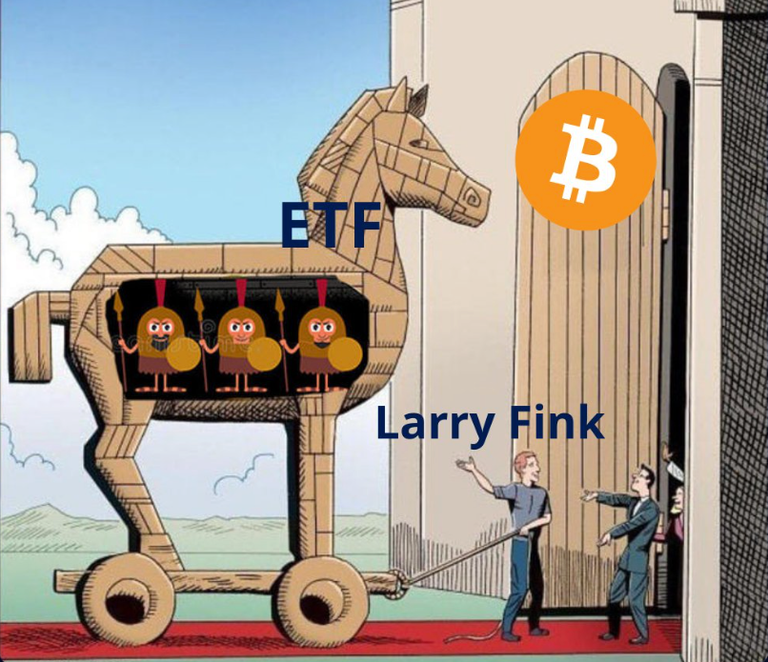

Think again, they're nothing but Trojan horses to make controllable what was meant to be uncontrollable.

As I said, I was happy at first, but now I just get more disappointed when I see respectable voices in the space rejoice over the approvals of ETFs Bitcoin, Ethereum, etc. Have you never found it strange that suddenly major institutions are interested in crypto? Don't be a sheep, you absolutely need to understand what's happening.

In the past, BlackRock was a big critic of Bitcoin. Larry Fink said, "Bitcoin just shows you how much demand for money laundering there is in the world. That's all it is.", and then suddenly, they magically understood it was a revolutionary technology and released a spot ETF on it!

Don’t you find that strange?

But BlackRock is not just into Bitcoin, as you can see, they are interested in many ecosystem projects.

They have a public plan for global tokenization, meaning they want to tokenize all the world's assets such as real estate, energy, agriculture, etc.

You may say, so what? It's good for us! But actually, not really...

Let's start with Bitcoin! Everyone knows Bitcoin is an unbreachable barrier, and BlackRock understood that the only way to corrupt Bitcoin was to attack it from the inside.

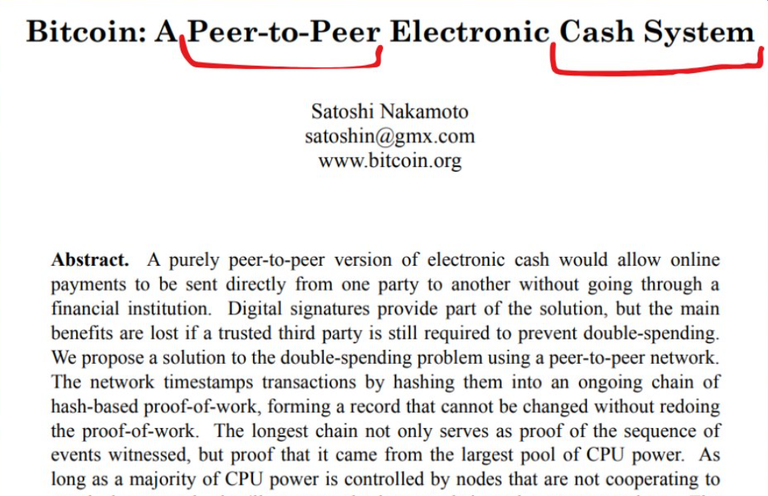

ETFs turn Bitcoin into a speculative product or a store of value. This deviates from Satoshi Nakamoto's original utility, which is peer-to-peer payment system. For those who think this is not possible because transaction fees are high or validation times are too long, there are Layer 2 solutions on Bitcoin that can resolve this.

The Lightning Network is a perfect example.

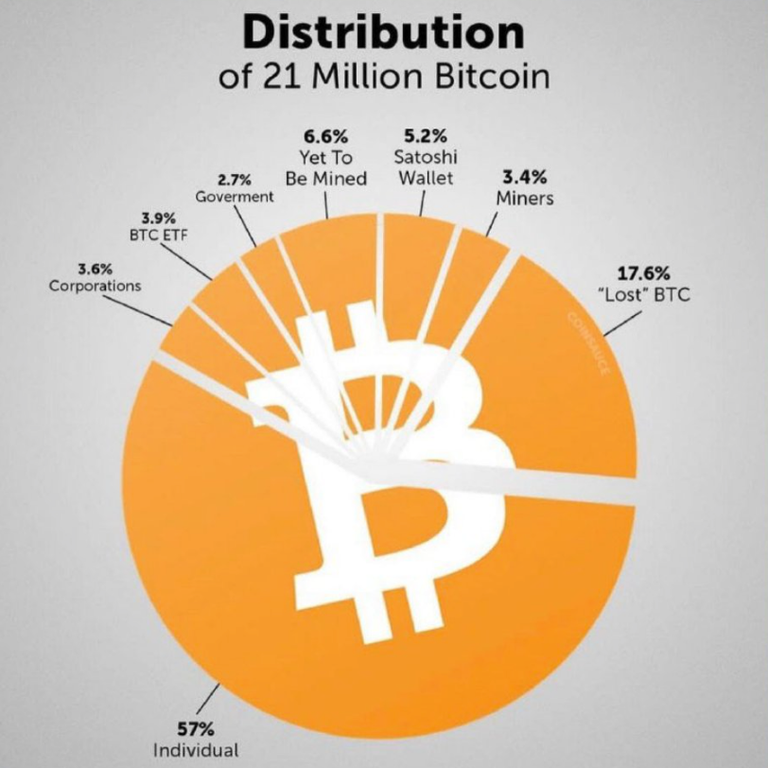

The lack of BTC liquidity could prevent Bitcoin from being used in L2, giving it more utility and us more freedom. Fortunately, for now, most Bitcoin is held by individuals, but this share is bound to decrease over time.

As you can see, ETFs represent 4% of total BTC, which may seem low, but note that this is just what they have accumulated in a few months; 4% is what is needed to make the Lightning Network a payment network that could rival Visa and MasterCard.

ETFs make Bitcoin more manipulable.

Did you know there are clauses allowing the Bitcoin ETF to be liquidated at any time?

All ETFs have this same clause. For any constraint (such as regulatory), all Bitcoin can be liquidated and ETF holders reimbursed in dollars. Imagine the massive liquidation this could cause, but that’s not the only way the price can be manipulated.

BlackRock chose J.P. Morgan as one of its counterparts for its spot Bitcoin ETF, JP Morgan is the largest bank in the United States in terms of assets, but it's not free from financial scandals.

On December 6, 2023, J.P. Morgan CEO Jamie Dimon said he would "close down" Bitcoin and crypto if he were the government, 20 days later, they were named by BlackRock as a counterpart for the Bitcoin ETF.

Do you see the trickery better now?

Anti-Bitcoin but not anti-Blockchain. Last October, they launched a PRIVATE Blockchain called the Tokenized Collateral Network (TCN) to allow the use of assets as collateral, and guess who is involved in one of the largest transactions on this network? BlackRock, of course!

J.P. Morgan was accused of manipulating prices using gold ETFs, they had to pay a fine of more than $1 billion, they manipulated the gold price, and you really think they won't manipulate Bitcoin prices? The medium/long-term goal is the creation of a system where everything would be tokenized and controlled by financial elites.

I'm talking about forests, trees, rivers, etc, and all this follows a public plan set for 2030 in the UN's sustainable development goals.

There are 17 goals set by the UN, the ones crypto bros (us) care the most about are:

• Digital development with integrated wallets

• Development of health cards

• Creation of digital currencies

• Design of smart cities (15-minute cities)

• Development of blockchain technologies

BlackRock shares this vision with the UN and seems to be moving in this direction.

The first question you should ask yourself is, what are my goals?

For me, it's freedom and independence in payment systems but also in technology. Blockchain, as introduced with Bitcoin, allows all that.

But BlackRock, the government, etc., have opposite goals.

Do they want your freedom? Your independence? Of course not!

In that case, don’t make things easy for them, keep your Bitcoins, and be more wary of the future products they announce.

Posted Using InLeo Alpha

I do like that your article is controversial which gives us a balanced view on how things are going and how the government is trying to control the value of assets. Honestly I will like to see you focus on the real estate side of things, it seems pretty good to not do especially as it sounds better than a REIT investment.