Curious to see where we are in the market.

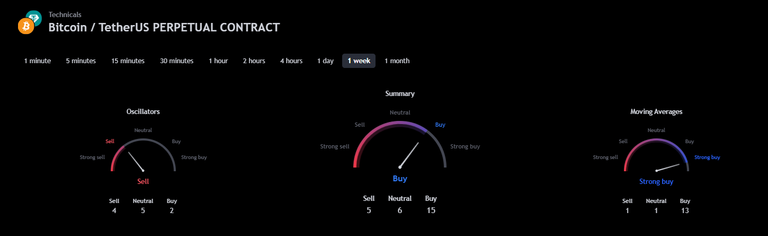

Tradingview makes a summary in any time frame, I think the most significant is the weekly time frame.

In it you can see that at least 4 oscillators are indicating SELL (RSI, CCI, WILLIAMS MOMENTUM), 5 in neutral zone and 1 in BUY.

On the other hand, the summary of 13 types of MOVING AVERAGE indicates 9 BUYS, only 1 is neutral and 1 is SELL (HULL MA9).

The truth is that to make decisions I am inclined to think that the oscillators are much more reliable for this purpose...the MOVING AVERAGES only tend to highlight the market trend...although there is one to which I pay more attention and it is the HULL MOVING AVERAGE. This usually anticipates more changes in the market, and shows me SELL...

Conclusion?

I have no fucking idea man...but it seems that $100,000 is not going to be so easy to overcome...maybe this weekend we have a new correction...

We'll see.

@toofasteddie

Keep calm, zoom out and enjoy your weekend :)

That's a lot of sell indicators. But as someone already said, it all depends on the time frame. In the medium term (few months up to a year), I believe we're still on our way up.

Right now we are seeing more buyers in the market and one thing we have to watch here is the grade which is very high. New entry should be taken only when the market stabilizes above $100,000.

100,000 is a tough barrier to beat. It's a round number that a lot of people looking at. When it gets past that, I think it will skyrocket. I do think there will be a correction though because right now it's just hype for the new administration, but we have yet to see any policies to reflect it as they haven't taken office.