WEALTH IS NOT JUST MONEY

How wealthy are you? Do you think about wealth as in how much you have in your bank accounts or something else?

Society tends to associate wealth with money and that those with the greatest amounts of money are the wealthiest. This model of wealth is both simplistic and possibly destructive to our well-being.

The truth is, wealth is subjective and multidimensional. In terms of subjectivity, what one determines to make them wealthy may not be the same for another. A scholar might deem knowledge as their greatest source of wealth, whilst a farmer might deem the lands they own as their wealth.

The multidimensional aspect of wealth suggests that wealth depends on various elements working together. For instance, one simply does not acquire wealth automatically, but through investing time and energy to build wealth.

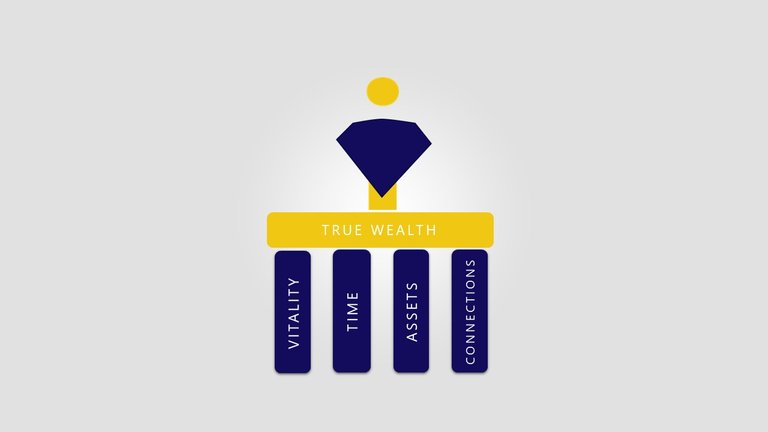

For this reason, I define true wealth as having multiple elements of your life come together to sustain and enrich it.

One interesting definition of wealth I came across is:

“Wealth is not how much money you have. Wealth is what you’re left with if you lose all your money” – Roger Hamilton

For the majority of us, we are brainwashed into buying into the notion that money equals wealth. Just think about the ‘rat race’ a lot of us find ourselves in. Perpetually pursuing financial reward in the hopes of attaining the ever-elusive goal of being wealthy. After all, we all want more in life (who thinks “I want less in life”?) and most us are sold the idea that money is the gateway to wealth and ultimately happiness.

As you can imagine, this model is heavily flawed and causes most of us to lead imbalanced lives that can often bring misery and suffering.

I propose a new model of wealth. One that allows us to attain greater levels of true wealth, whilst bringing balance and enriching our lives.

WEALTH IS A BALANCING ACT

First of all, if you want to be truly wealthy, you have to change the mindset of thinking that wealth is a destination or objective of some sort, i.e. I will be wealthy when I become a millionaire.

This mental model or mindset, implies that you are in a constant pursuit for something that you may or may not achieve.

Instead, think of wealth as a state of being or the foundation that you build your life upon. This way, you can be wealthy at any given moment and cultivate even greater levels of wealth.

Remember, mindset is critical. If you want to change your life, you must change your mindset first.

Now the foundation of true wealth is based on 4 main elements or pillars of your life. These are:

• Vitality: Your health and energy levels

• Time: The amount of free time you have to do what you like

• Assets: Anything that is valuable (money, a house, knowledge, skill-sets etc.)

• Connections: The people around you that enrich your life

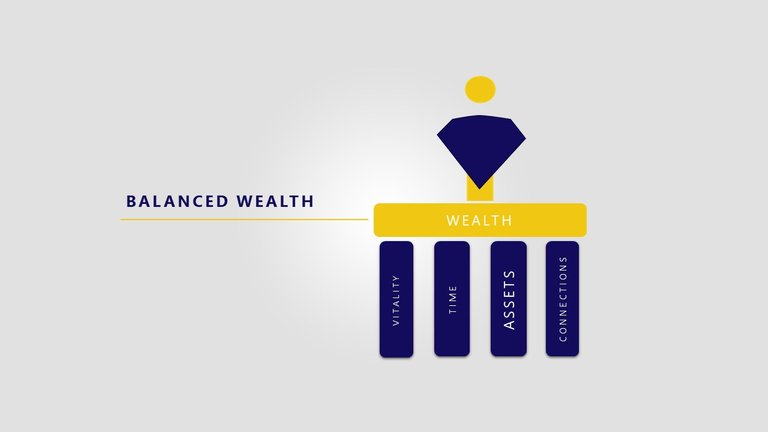

Based on this model, if you want to achieve greater levels of wealth it becomes a matter of building your pillars. Now the key is to balance these pillars. There’s no point to have your foundation of wealth sky high if it will come crumbling down any moment.

Let’s use some examples to emphasize the idea that money by itself doesn’t necessarily equate to true wealth.

Having all the money in the world doesn’t necessarily mean you are wealthy. If a billionaire CEO is on their death bed, are they still wealthy? At this point, anyone with a hundred dollars in their bank account and all the time in the world is wealthier than this CEO.

There’s an interesting phenomenon that happens to lotto winners, especially those that come from low to middle class backgrounds. There have been countless cases of lotto winners losing all their winnings within the first few years, in some cases they became worse off having won the lotto (i.e. filing for bankruptcy, depression, betrayed etc.). They might have had all the money in the world, but didn’t have the knowledge of how to retain it, instead they spend it all on wasteful purchases.

This example exemplifies how mindset can influence our level of wealth.

Similarly, having all the time in the world without any assets or connections, can leave you isolated and neglected by society (i.e. homelessness).

LEARNING THE BALANCING ACT

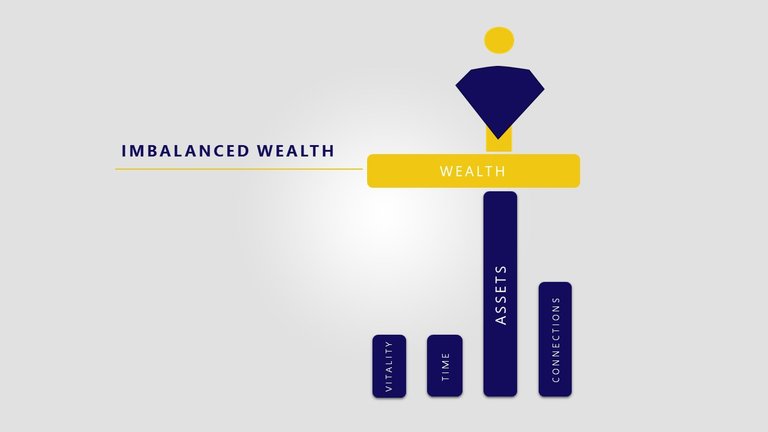

Most people are imbalanced. Their foundations of wealth are built upon uneven pillars which leaves them vulnerable to come crashing down when life becomes turbulent – Whether that’s losing a job, becoming sick, going through a divorce or anything that erodes away your pillars of wealth. If you want to become truly wealthy, you have to learn to balance your pillars.

Now, these pillars of wealth are interdependent, meaning that if one rises, others may fall. For instance, a workaholic’s career might skyrocket (assets), however it might come at the cost of their health (vitality), family (connections) and time. I’m sure we are all familiar with stories of how lives are ruined when you focus too heavily on one pillar and neglect the others.

When the Dalai Lama was asked what surprised him most about humanity, he said:

“Man. Because he sacrifices his health in order to make money. Then he sacrifices money to recuperate his health…”

Learning this balancing act is all about awareness. Awareness of where your pillars are at so that you can make adjustments to maintain a balance. To build awareness, honestly ask yourself questions such as:

Are you spending all your time on building your assets, whilst neglecting your health and connections? Do you have all the assets but no time to spend it? Are you wasting your time and energy on people (connections) that drag you down in life?

Awareness involves an honest and possibly difficult evaluation of your life. Often times, you will find that your foundations of wealth are being eroded because of certain pillars that are imbalanced, i.e. having negative people in your life, being a workaholic, not taking care of your health etc.

Once you have a clearer image or gauge of where your pillars are at, you can begin to balance your foundation and build your true wealth. Use the model to understand where the gaps are so that you can make necessary adjustments.

BUILD YOUR FOUNDATIONS

In the end, it’s all about finding an optimal balance between these 4 pillars that allow you to build your foundation for wealth. Understanding that it is all about balance allows you to truly build solid foundations for wealth, that are long lasting and enriching.

After all, it is far better to build a house on a solid foundation, than to build a skyscraper with shaky pillars.

Peace~

IMAGE SOURCES

Photo by Sebastian Pichler on Unsplash

Photo by Bekir Dönmez on Unsplash

Photo by RKTKN on Unsplash

This is such an important concept for people to understand! Far too often I see people sacrificing their time and health for money :(

Thanks for sharing!

Thanks man, yeah most people don't realize this truth until they lose their health/friends etc. I'm guessing you are well aware of this concept :p