Bitcoin's (BTC) cost is exchanging a hesitant way in the wake of hitting 19-day lows underneath $6,900 on Sunday, however could get an offer on acknowledgment above $7,100, specialized investigations show.

The main cryptographic money tumbled to $6,890 on Bitfinex yesterday – its most reduced level since July 17 – before completion the day (according to UTC) on a level note at $7,025.

The value activity demonstrates hesitation in the commercial center, yet could likewise be viewed as an indication of bearish depletion as the market is looking ambivalent after a 21 percent slide from the ongoing high of $8,507.

Presently if the bulls can push costs over Sunday's high of $7,090, at that point the fatigue among dealers would be affirmed. Then again, a slide underneath the earlier day's low of $6,890 would just exacerbate the situation for the cryptographic money.

At squeeze time, BTC is exchanging at $6,975 – down 0.80 percent on a 24-hour premise.

Day by day diagram

The above graph appears, BTC made a doji flame (uncertainty) on Sunday at the 50-day moving normal (MA) bolster, making the present close (according to UTC) significant.

A bull doji inversion would be affirmed if BTC closes today (according to UTC) above $7,090 (Sunday's doji flame high). For this situation, a restorative rally to 100-day MA, as of now situated at $7,474, could be seen.

In the mean time, a nearby (according to UTC) beneath $6,890 (Sunday's doji flame low) would flag a continuation of the auction from the July high of $8,507.

Additionally, the bulls need to underwrite soon on the indications of uncertainty or bearish weariness, generally, the concentration would rapidly move back to the bearish elements: descending inclining 5-day and 10-day MAs, breach of the key help of 100-day MA a week ago and a bearish relative quality file (RSI).

Further, BTC's nearness to the extremely essential converse head-and-shoulders neck area bolster (previous opposition) of $6,820 is another enormous motivation behind why the bulls need to make a brisk rebound.

A break beneath $6,820 would invalidate the bearish-to-bullish pattern change affirmed by the opposite head-and-shoulders breakout on July 17 and would move chance for a dip under the rising trendline (yellow specked line).

Regardless, the long haul bullish view has been discredited by BTC's nearby at $7,025 yesterday, as found in the outline beneath.

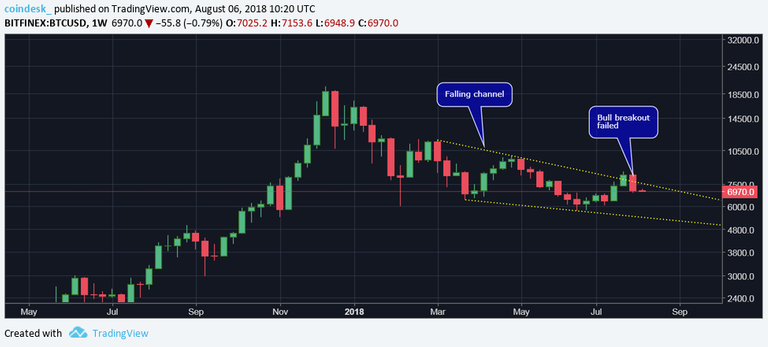

Week by week graph

BTC shut over the falling direct opposition in the earlier week, affirming a long-run bearish-to-bullish pattern change. Be that as it may, the breakout wound up being a bull trap as the cryptographic money fell back inside the channel a week ago, refuting the long haul bullish standpoint.

View

BTC could ascend back to 100-day MA of $7,474 if costs close today above $7,090. All things considered, the fleeting inclination would stay bearish as long as the 5-day and 10-day MAs are slanting south.

A nearby today underneath $6,890 would build the danger of a dip under the key rising trendline bolster, as of now observed at $6,700.

Source

There is reasonable evidence that this article has been spun, rewritten, or reworded. Repeatedly posting such content is considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

🤔