So tonight I have decided to address NVDA's earnings coming up.

Earnings 8-16-18 will be the day. EPS is $1.64 and lands the stock into a strong "buy" zone.

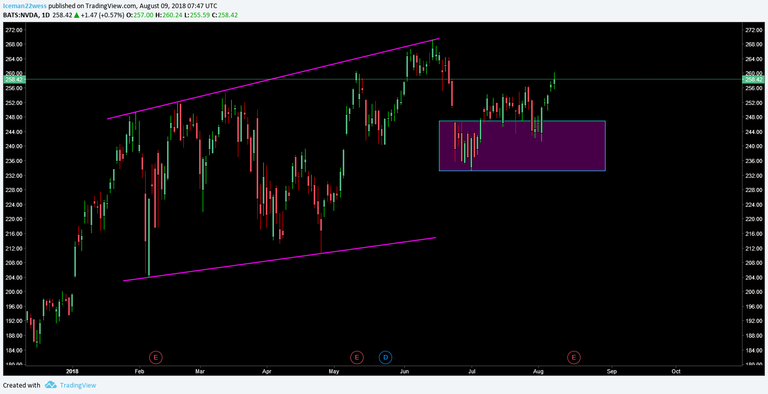

First thing is how bullish the stock has reacted to a few channels. Take a look.

So of course we needed to pull back after such a move up on the blue channel, but look how well the purple channel showed a wonderful reversal. This must be the buying volume coming in anticipation of the earnings report. Actually, let me clarify that. Buying pressure volume has not increased in step with the price increasing, thus I actually would describe this as a lack of sellers, rather than lots of buyers. So I guess the people who have the shares, want to keep them, for now anyways.

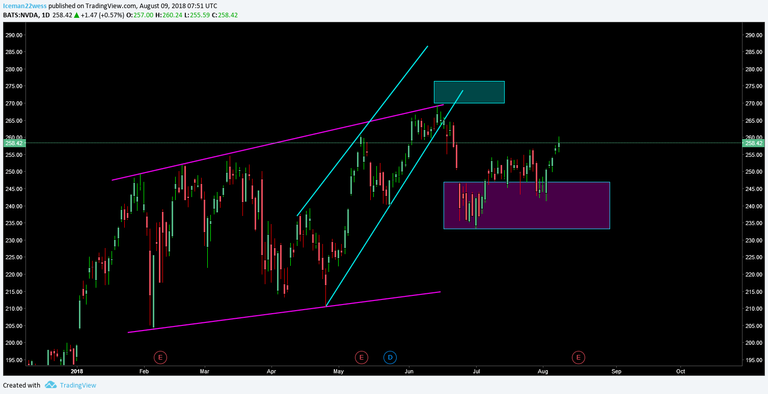

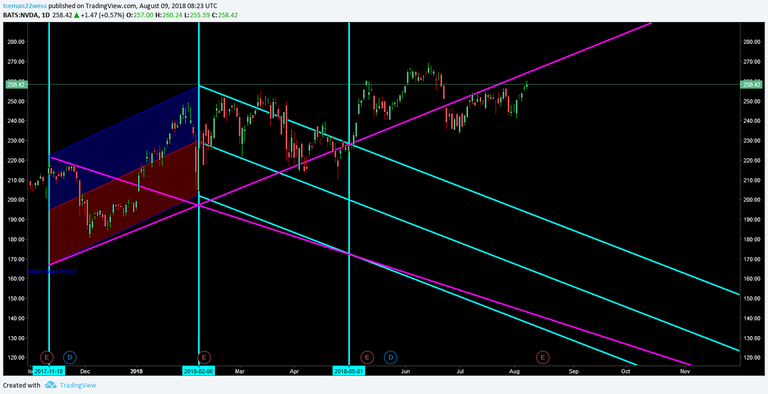

Now if I bring my own charting method into the mix, there is another channel that I used as sample data for price/volume divergence correction.

Now if you really take a second to compare those two charts, the top shows how this is the third time we are entering the reversal zone and makes you wonder if we will break to the upside as we approach earnings. However, in the lower chart, 1/1 crossing fib fans paint a different picture. We have now started trading below the purple line, rather than over it. This is a warning sign NVDA is forming a top.

Comparing this to the last earnings report. We are exactly in the same spot!

An interesting article to take a look at is here that talks about GS' shilling a strong buy for this stock. The interesting part about this story is that it opens up saying that a team of bulls expect shares to rally 26% over 12 months. Admittedly, they hint that this earnings may not be all that bullish after all with concerns about lack of crypto excitement and lack of gaming revenue. So basically they are saying the stock is going up in the long term, but probably isn't ready to go up a whole lot right now. Which I can totally agree with.

Overall, I think there is more room still to the upside before earnings, but I am considering taking a short position as I try to nail the top. IV is +-$17. This IV means to me that the market is expecting a pull back that doesn't break a bullish trend after earnings...aka, healthy consolidation. So there would be two ways of trading this possibly: trying to sell the top around earnings, or buying the consolidation after earnings.

Overall, NVDA is clearly bullish, but there is a possibility to short it approaching quickly.

Thanks for reading,

-Icee-

Please leave me an upvote and remember this is not trading advice.