In my weekends post about best buy, I talked about taking a short position on Monday and indeed that trade worked out and hit my target so I did take profits and exit the trade. Now I would like to take a look after the trade and see if anything has changed.

First of all, this week is a scary week in stocks. Expected dollar strength (expected rate hike on Wednesday), and China trade tensions (Stories released about China clamming up) are certainly creating a bearish bias this week. Considering everything in Best Buy is made in Asia, I expect this concern to be slightly more weighted in the outlook on this stock.

In my original post I pointed out my concern that we were facing a false breakout and expected the price to retrace back into channel. Indeed this happened.

However, the OBV is now below the trend line, and the price has not fallen to the bottom of the channel. At this point, I am of the opinion the direction of the stock could go either way.

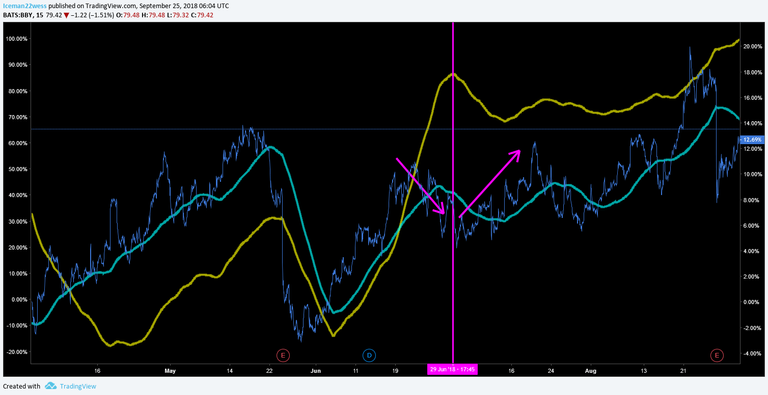

When taking a deeper look into things, I see a growing disparity between the price and OBV MA's that did not begin to correct as I had expected.

Look at how the divergence has grown! This is not something that is exclusive to BBY stock. In fact, I see this same thing happening on many charts right now.

A recent example of this in the past can give some context to how this will play out.

I think overall, more time is needed to make a trade on this stock and I think it is safer to look for a better trade to take elsewhere as it is unclear if the volume will correct to the price, or the price to the volume.

Thanks for reading,

-Icee-

Please leave me an upvote and remember this is not trading advice.