If you sell old equipment or furniture on eBay, Facebook, or even just send money between friends on Venmo you will soon be required to report this to the IRS.

It was recently announced this change will be delayed until 2026, but the requirements for reporting a 1099-K has already changed in 2024.

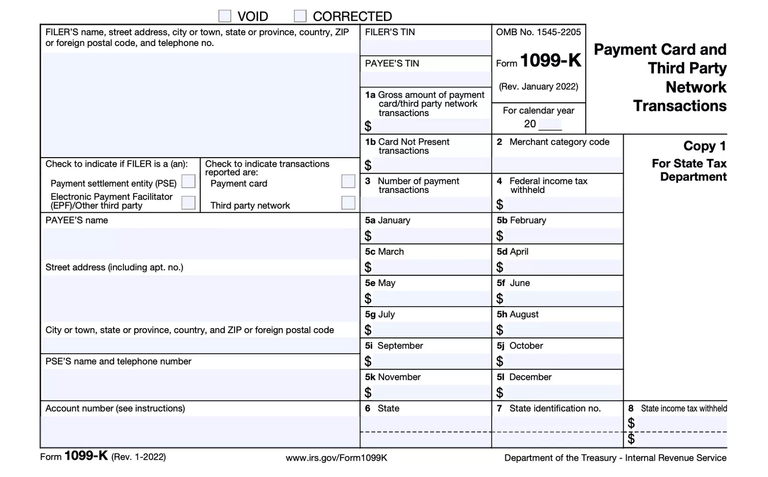

What is a 1099-K?

Most people won't know what a 1099-K is because it is only required when you receive more than $20,000 in a year via a third party network such as PayPal, Cash App, or Venmo. In 2024, this is being reduced to $5,000 as a temporary transition to the final $600 amount now set for 2026. 2025 the threshold is currently planned to be $2,500 unless there are further delays.

It is up to the payment services you use to file a 1099-K and provide you a copy. If you receive this, you will need to file it with your taxes and zero out the reported income if it is a category that should be taxed. Example categories would be receiving money to cover a friends share of ski rental, money received selling used goods that come out to less than what you initially paid, using a service like Venmo to split dinner costs.

This change is to go after the "dirty cheats" trying to steal from the US government but will affect many who are doing nothing wrong. If you sell used gear on eBay at a loss, you are not required to file taxes as you did not make a profit. Under this new law however, the IRS will receive a 1099-K with all transactions you received through these services. You will now be required to defend yourself if questioned and potentially show proof that you did not profit from the transaction(s).

This means that 7 year old used computer you sold for $200 bucks will look like a profit to the IRS unless you provide receipts. There is a good chance most people won't be bothered and this won't be a major problem, but it is now something you need to be prepared for.

I believe they are mostly targeting those who are doing business on eBay or through Venmo selling services or new products. Although these type of people are either are very unsuccessful or are already being reported for making over $20,000.

This isn't a new reporting requirement, it is just the threshold has been drastically reduced. You may be familiar with the $600 threshold as that is the same amount the Biden administration has been trying get put in place for reporting all crypto transactions as well.

If you are doing nothing wrong, you have nothing to worry about but you do have additional responsibility now to report and document this transactions going forward. Although it is highly unlikely most people will run into a problem.

Posted Using InLeo Alpha

It's this kind of shit was why I tried to start @hivelist so that the people here could have a place to do business without having to go through these third parties and be able to use crypto as it was intended. But that failed because all people wanted to do was earn a token and dump it on the market.

Unless people realize that crypto isn't just another financial instrument to make money, and realize, IT IS MONEY, and start using it that way, we will never get out of the grasp of these evil and corrupt fuckers trying to destroy and steal everything we have.

I for one refuse to comply, they can go fuck themselves. Hell, majority of government employees don't even file their own taxes, so why the fuck should we????

TAXATION IS THEFT!!! This is my REVOLUTION! Fuck the system! USE CRYPTO AS IT WAS INTENDED, NOT DOLLAR "NuMb3R gO uP".

$600 is lunch money.

Defund the IRS!

Failing to fill out the paperwork demanded by these thieves is considered "doing something wrong," though. To hell with them all.

This new reporting requirement definitely has the potential to affect a lot of casual sellers who may not have realized the IRS would be tracking such small transactions. It's important to remember that just because you receive a 1099-K, it doesn’t automatically mean you owe taxes on the money—it's about whether you made a profit. So if you're just selling used items at a loss or splitting costs with friends, you’ll still need to be able to prove that if the IRS comes knocking.

The real challenge for most will likely be the paperwork. Keeping track of receipts, documenting transactions, and staying organized will become even more important. It's a bit of a burden for everyday people who are just trying to clear out old stuff or share expenses with friends, but it seems like the goal here is to clamp down on people who are treating these platforms as businesses without reporting their income properly.

One thing that stood out to me is that this law primarily targets the people who are already selling regularly on eBay, Venmo, or similar platforms for profit. So, for the casual seller, it might just be a matter of keeping a few extra receipts and staying on top of reporting. Hopefully, the IRS will make the process smoother and less stressful for people who aren't making real profit from these transactions.

I generally hate tax season because I don't organize all those receipts during the year for deductions on my income property. I have to sit there sorting out all of them, what I can claim 100% on, 50% on, and if I paid anyone over six hundred bucks a year provide the information of who I paid it to. I just have a tray I stack them all on and sort them out at the beginning of tax season. About the most I manage during the year is a general rule of thumb, no receipts go in the trash until I make sure there's nothing I need to report at the beginning of tax season. The time consuming part is writing them all done in a ledger as receipts have a tendency to fade over time, so I number the receipts to the same number on the ledger and write down everything that was on the receipt. When I had my own business too, it was pretty much the same thing, only a lot more time consuming. Plus I had an apartment above my business that I had to keep track of, so finding a way to get it all organized, set yourself into a pattern, helps a lot.

I did not know this...this is good to know...thank you @themarkymark.

Those folks got some funny ideas about freedom.

What freedom?

They clearly think doing what we are told to do, or else, is freedom.

I disagree.

happy only the Tax man

That's just stupid. $20,000 never would have been a problem for me. Even $2500 or $5000, I just don't move that much money through Venmo in a year, but $600 is going to be a pain. Just one more thing for them to track poorly!

Don't use those services or join the revolution and tell them to go fuck themselves. It's pretty simple. I mean if the IRS and other government employees don't file their taxes, and get to keep their government jobs on top of it, as is being exposed recently, then why the hell should I have to report and pay? Nope, I am done.

Mass non-compliance is the freeway to freedom town.

It's too handy for me to just give it up. It's been game changing for how my inlaws and I interact with each other when it comes to who owes who what.

Glad I don't have that inlaw problem anymore, lol...

Actually I say that after I just took my kids to see my ex-mother-in-law, lol, and honestly, she and I never had any issues, lol. She knows her daughter was the problem, lol.

Haha, that is probably the best you could hope for I guess.

Swell.. another thing to keep track of, translate from Japanese, report with my already too complex taxes. I think I have a new reason for being rich—so I can hire someone to do my taxes for me.

Anyway, thanks for the heads up, Marky.

When are you going to stop downvoting my original content 🤔

Do you not make enough money with buildawhale 🤔

Can I ask again why Are you downvoting my original content 🤔

don't be dumb

I really thought you was a good person who was doing good stuff for Hive I was completely wrong 😞

Nah you were right.

Wtf you talking about 🤔

I received a downvote form your account, please let me know what wrong I have done which make you to the downvote my post.Hello @themarkymark