Summary

- The Mid Cap Growth style ranks 11th in Q4'19.

- Based on an aggregation of ratings of 12 ETFs and 378 mutual funds in the Mid Cap Growth style.

- BFOR is our top-rated Mid Cap Growth ETF and NCTWX is our top-rated Mid Cap Growth mutual fund.

- Looking for a helping hand in the market? Members of Value Investing 2.0 get exclusive ideas and guidance to navigate any climate. Get started today »

The Mid Cap Growth style ranks 11th out of the 12 fund styles as detailed in our Q4'19 Style Ratings for ETFs and Mutual Funds report. Last quarter, the Mid Cap Growth style ranked last. It gets our Unattractive rating, which is based on an aggregation of ratings of 12 ETFs and 378 mutual funds in the Mid Cap Growth style. See a recap of our Q3'19 Style Ratings here.

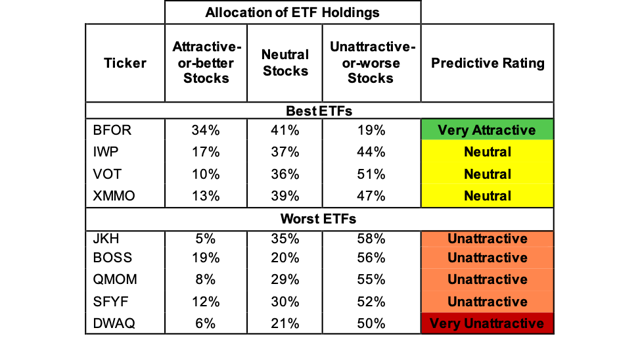

Figure 1 ranks from best to worst the ETFs that meet our liquidity standards and Figure 2 shows the five best and worst rated Mid Cap Growth mutual funds. Not all Mid Cap Growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 14 to 1609). This variation creates drastically different investment implications and, therefore, ratings.

Investors seeking exposure to the Mid Cap Growth style should buy one of the Attractive-or-better rated ETFs Figure 1.

Our Robo-Analyst technology[1] empowers our unique ETF and mutual fund rating methodology, which leverages our rigorous analysis of each fund’s holdings.[2] We think advisors and investors focused on prudent investment decisions should include analysis of fund holdings in their research process for ETFs and mutual funds.

Figure 1: ETFs with the Best and Worst Ratings

- Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Franklin LibertyQ U.S. Mid Cap Equity ETF (FLQM), Nuveen ESG Mid Cap Growth ETF (NUMG), and Innovator IBD Breakout Opportunities ETF (BOUT) are excluded from Figure 1 because their total net assets are below $100 million and do not meet our liquidity minimums.

Figure 2: Mutual Funds with the Best and Worst Ratings – Top 5

- Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

AMG Mangers Cadence Mid Cap Fund (MCMFX, MCMYX, MCMAX) and Cavanal Mid Cap Core Equity Fund (IWVX, APWVX, AAWVX, ACWVX) are excluded from Figure 2 because their total net assets are below $100 million and do not meet our liquidity minimums.

ALPS Trust Barron’s 400 ETF (BFOR) is the top-rated Mid Cap Growth ETF and Nicholas II, Inc. (NCTWX) is the top-rated Mid Cap Growth mutual fund. BFOR earns a Very Attractive rating and NCTWX earns a Neutral rating.

Invesco DWA NASDAQ Momentum ETF (DWAQ) is the worst rated Mid Cap Growth ETF and Optimum Small Mid Cap Growth Fund (OASGX) is the worst rated Mid Cap Growth mutual fund. Both earn a Very Unattractive rating.

...Read the Full Post On Seeking Alpha

Author Bio:

Twitter Account: NewConstructsSteem Account: @davidtrainer

Steem Account Status: Unclaimed

Are you David Trainer? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.