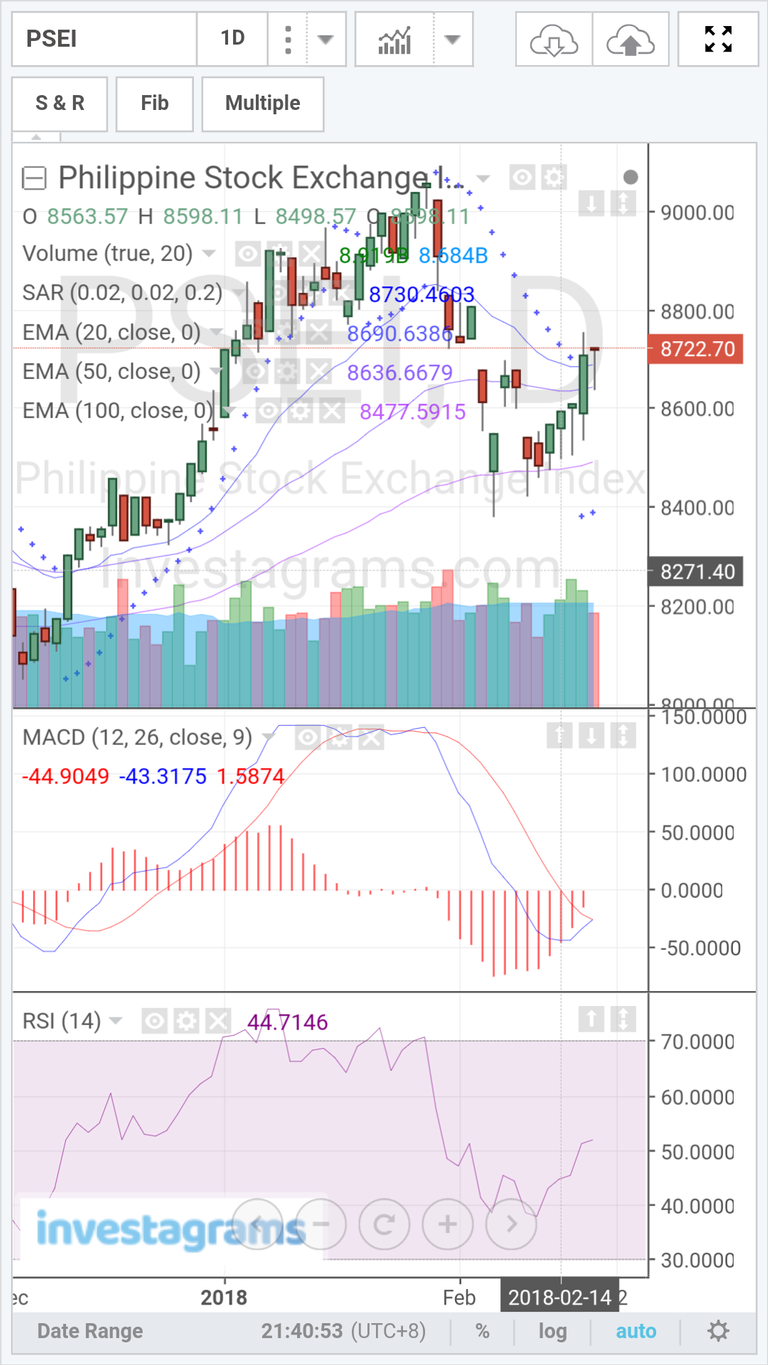

#PSEI Update: 8,722.70

The market continues its bounce from the 8,500 support level.

Looking at the market, the movement that we are seeing now is based on the prospect that the market is bouncing from the 8,500 support level all the way to the resistance at 8,900 / 9000 level. This is a rangebound movement triggered by the breakdown from the 8,900 level and the evidence of buying at 8,500. We can expect the market to move in this direction until we find a acceptable and strong breakout at 8,900 or a strong breakdown at 8,500.

Should a breakout happen I still stand by what I mentioned in previous posts that the market could go to 9,300/9,400 levels. However if the 8,500 range does not hold, we could see the market retrace back to the strong support at 8,100.

From a fundamental perspective the P/E ratio of our market right now is at 21.86. Should it maintain its current P/E and grow at 7.8% which was the average growth rate of the listed companies last year the market could be around 9,400.

The things to watch out for 2018 has not changed.

Inflation brought about by TRAIN, a high USD and oil is pretty much in the table

This will justify the push for the interest rate hike, which maybe be this March or in the succeeding months. Should it happen, this though should not be a surprise to the market because this is something that we have been talking about for quite sometime already. This though can trigger a shift from equities to bonds.

Corporate earnings for the year, that’s surprising.

TRAIN package 2

As projects start to pick up, we will see an up tick on companies connected to construction.

@resteemator is a new bot casting votes for its followers. Follow @resteemator and vote this comment to increase your chance to be voted in the future!