I believe some of our fellow Steemians are still having a hard time understanding and interpreting their post’s payout. Probably some of you aren’t familiar with “Liquid Rewards” yet. Steem Dollars and Steem are two primary Cryptocurrencies in this platform. Through this post, I will help you better understand the liquidity of such rewards.

Disclaimer: I will only focus on the Liquidity of your payouts. I won’t elaborate more on the technical terms and calculation, but @sndbox made the following Steemit Wallet Walkthroughs that could be of help:

- Steemit Wallet 101 - Introduction and Key Terms

- How Much is Your Post Worth? : A Steemit Rewards Guide

First, Let’s understand what Liquidity really is

Have you encountered posts saying, “The prize pool of this contest will be based on this post’s liquid rewards”, “All the liquid rewards of this post will be given to the featured authors”, etc.? Have you ever wondered what Liquidity is?

Liquidity, from its root word, “liquid”, has a running or flowing characteristic on a scientific level. If you relate it to your finances, it is how quickly you can acquire your cash. In simpler terms,

Liquidity is the accessibility of your money whenever you need it.

According to grow.in, Liquidity is how easily and quickly you can convert your investment into cash. From the curve, it started with the most liquid asset, cash, and ended up with the least liquid one, real estate. Shall we call the least liquid asset as solid? It’s up to you, but there is no such financial term as “solid”.

I made a simple graph relating money’s liquidity to its accompanying time of acquisition. I just highlighted four types of financial assets to make it simple. If you take a look at the graph, the assets are descending from the most liquid to the lesser liquid ones: cash, bank savings, stocks, and real estate. The higher the time to encash the money, the lesser its Liquidity is.

It is needless to say that having cash is the most riskless form as an asset. Zero risks, zero returns (unless thieves are eyeing on you). On the other hand, real estate has the greatest possibility of returns but it will take you quite a while to encash its value. Thus, Liquidity has an inverse relationship with the returns.

Greater liquidity yields lower returns, while lesser liquidity revenues higher return on investments.

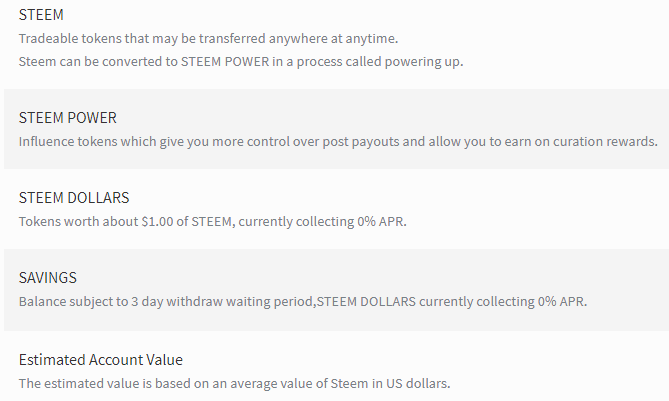

Now, let’s take a closer look at your wallet and let us relate Liquidity to your account’s proceeds, shall we?

If you notice, your estimated account value fluctuates from time to time since such value relies on Steem’s price in US dollars on the external market. It is the only value of your wallet that is constantly changing without doing anything. So if you want to monetize your earnings, you have to take a look at your Steem and Steem Dollars value instead.

As we all know, our posts are being rewarded with Steem Dollars and Steem Power. The only way you can acquire Steem is when you convert your Steem Dollar to Steem or when someone is transferring such cryptocurrency to your account.

Savings is just like a coin bank in our wallet. You can transfer your Steem and Steem Dollars on it but it will take 3 days to withdraw something that has been stored to it. On the other hand, Steem Power is a couple of Steems in a lesser liquid form. You can actually convert it into Steem but it will take a couple of weeks for it to completely turn into a “liquid” Steem. I made the following graph in relating the Liquidity of Steemit Rewards to their respective possibility of returns and time of acquisition.

Steem and Steem Dollars. If we disregard Steem and Steem dollars’ external market prices and just focus on their actual values on our wallets, we can conclude that such rewards can be considered as cash. These cryptos could be monetized anytime you want. Since you are not investing it into something that could give you returns in the future, it will remain as it is (unless you redeem or withdraw rewards), as what is reflected on the first point of the graph.

Savings. Let’s proceed to the second point, which is Savings. As what I’ve said earlier, Savings are just like Steem and Steem Dollars stored in a piggy bank. It can be considered as a time deposit since it will take you days to withdraw its content. The only difference is you won’t get a single amount of return when you transfer your liquid rewards to your Savings. Neither does it contribute to your voting power. The purpose of Savings is to create an extra layer of security to your wallet. Well, you can also think of it as a delayed gratification wallet. Thus, Savings can also be considered as a cash with lesser liquidity, that is why its degree of return remains the same as the first point while its time of encashment has forwarded significantly.

Steem Power. We can consider Steem Power as a Steem with less liquidity since it will take a couple of weeks to liquidate Steem Power through powering down. But the longer your Steem Power stays on your wallet, the higher the returns you can get through curations and self-voting. You can actually increase the chances of having returns by converting your Steem Dollar to Steem, and converting Steem to Steem Power by powering it up. It’s comparable when you are buying a real estate by converting your liquid asset into a lesser liquid while aiming for higher returns.

So there! Did this article help you about understanding Liquidity? Or did it only make you more confused?

Steemit is actually giving us rewards for short-term gains through Steem Dollars and for long-term gains through Steem Power. Are you here for short-term? Or are you investing for long-term? Let me hear your thoughts.

Ate, I am so ikog with your posts. They are very much high quality content, inspirational, and educational. I just read your post about investing with 5,000 on stock market. It's sad how I wasn't able to give you an upvote. Now I'm thinking of investing in stock market as well haha not bandwagoning pero I realized a lot from your posts.

I used to believe na its okay to have a job and live simple but I guess its just people being to lazy to think bigger. Thanks for helping people stack up for their future. Hoping to join your financial literacy seminar soon. Wouldn't want to miss it.

I'm really thinking of powering up to convert my stagnant SBD into something of an asset. I'm here for the long term. Steemit is definitely an investment and I'm glad to be here.

Wow thank you so much @josejirafa! feedbacks like this really motivates me to do more on my financial advocacy here on Steemit. I hope you learned something from our little talk yesterday.

I am confident that you'll be able to apply what you have learned from us in your personal financial journey. If you need further financial tips and advices, please don't hesitate to reach us. It is our pleasure to help our fellow millennials achieve financial successes :D

Even until now, I still do not understand how the system of earnings work here in Steemit. Surely, this can help me get through with the confusion regarding the system. Thanks for this!

Don't mention it, @jsmalila! If you have questions, don't hesitate to drop it here :)

Very helpful. Pawer!

Im glad you found it helpful, petmalung lodi! :D

very well explained sis! Kahit yata ibang newbies hindi msyadong familiar dito, good thing you explained it. 😁❤

Yay! Thank you sis! Nawa'y maraming newbies ang maaabot ng post nato :D

Nice and detailed layman's terms explanation, madam. :) I won't be surprised if you become a financial guru one of these days. :)

Wooow thank you for such wonderful words, kuya Erwin! Still far from it, but hopefully, i'll acquire more financial wisdom during the learning process :D

hehe paotograp na lang po sa book signing mo pagdating ng araw haha

I had to read this more than once to understand. Being a newbie around here, I'm still so confused with the terms. Haha thanks for this Shiela! Big help!

Don't mention it, Dee! :D If you have questions regarding steemit's technicalities, don't hesitate to beep me :D

Steem on!

Thank you for this@snaeunabs! Mas naintindihan ko na. Mejo confused at nangangapa pa rin kasi ako about don. :)

hey! you are most welcomeee! :D If you have questions, dont hesitate to drop it here :D Welcome to Steemit @rruubbiie!! :D

very useful article.

Steem on!

Thank you sooo much for this imaginary token! I feel so honored and humbled to receive such :)

I hope you learned something from this article. Steem on!

Very helpful lodi @smaeunabs road to financial literacy <3

Payamanin goals lodi!

Cheers to Financial Freedom!

Wow @smaeunabs! This is very helpful gyud! ❤️

hahahaha nalingaw kog buhat sa graph, cute ra?

Yes powss hahahah lodi ang mga gif gyud!

Bit coin in the tap well thinking