I love my crypto but it's volatile and apart from Hive and Bitcoin offers very little substance behind your investments. Money in the bank is worthless and worse losing value from when it gets deposited.

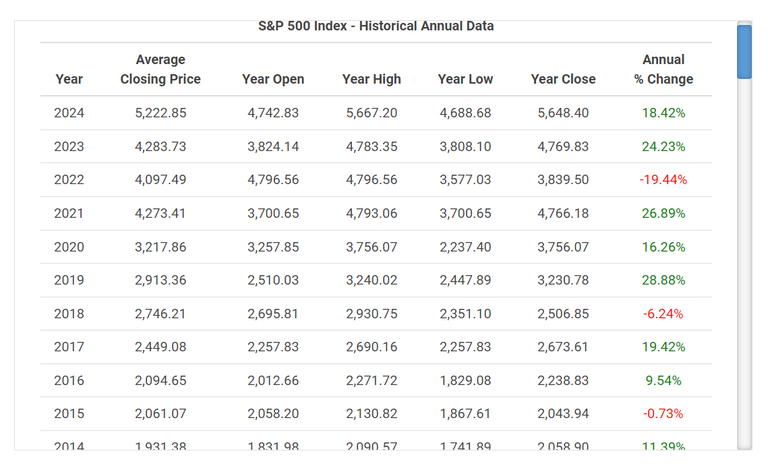

So time to diversify into stocks a little bit i think. I don't know much about them so research will be the first step but it seems that the Vanguard S&P 500 is a fairly safe bet composing of the top 500 companies in America and growing in value at a nice rate over the past twenty years.

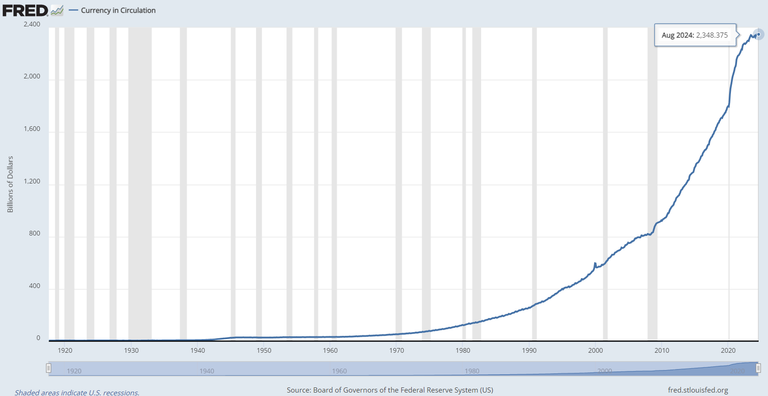

Now I would much rather start buying a year that it is dropping by 20% but that might not happen for a long time again. Instead it will be a DCA into the fund over a period of years instead of a big lump sum. With the value of the dollar dropping at an extraordinary rate it seems that these values should keep increasing as smart money won't be sitting in the banks.

Ref: Fred https://fred.stlouisfed.org/series/CURRCIR

https://fred.stlouisfed.org/series/CURRCIR

From Chatgpt when asked.

Investing in the S&P 500 can be a good idea for many investors, but whether it's right for you depends on your individual financial goals, risk tolerance, and investment horizon. Here are some key factors to consider:

Advantages of Investing in the S&P 500:

The S&P 500 index includes 500 of the largest publicly traded companies in the U.S., spanning various sectors. This broad exposure helps reduce the risk associated with investing in individual stocks.

Historical Performance:Over the long term, the S&P 500 has delivered strong returns, averaging around 7-10% annually when adjusted for inflation. While past performance doesn't guarantee future results, the index has shown resilience over time.

Simplicity:Investing in an S&P 500 index fund or ETF is straightforward and requires less time and effort compared to picking individual stocks.

Lower Costs:Index funds and ETFs that track the S&P 500 generally have lower expense ratios compared to actively managed funds, meaning more of your money stays invested and can grow over time.

Compounding:Reinvesting dividends from S&P 500 investments can lead to significant growth over the long term due to the power of compounding.

A solid and relatively safe bet.

It has a lot of the factors that i look for with my investments. Long term and risk averse. Diverse set of stocks. Compounding investments. Historical gains.

From what i have seen in Ireland it's a very easy task to start investing into the Vanguard ETF. You just need to open an account with a site like Degiro who have zero ETF fees with a handling fee and annual charge instead. Small in the long run.

There are lots of options for buying into these funds but an established site like Degiro has good information on how to get started and makes it easy to jump in at a low cost.

Their total expense ratio is 0.07 which is about as low as you are going to get for these accounts. I'll make a small purchase for now and do more research for the future.

Posted Using InLeo Alpha

You can't go wrong with these index following funds, pick the ones that only look at blue chip stocks and you get good returns.

I like Australia stocks as the gov gives us a tax credit on certain stocks, this brings the returns up to 8 to 9%.

Safer bets don't make headlines so they are not on most people's radar.

What stocks do we tax credit on?

Any of the big four banks, NAB pays good dividends. You can get Wollies and Coles, both pay out nice dividends.

If your only going to go for one, I would pick telstra, they give the best bang for buck regarding dividends and franking credit yield.

Sounds like financial advice, but they are a pretty safe bet IMHO and will offset on your tax returns.

Thanks!

I've been in vanguard spy 500 fund for years the compounded growth is amazing. 40 years at 10K-15K a year invested should net millions.

I like the sound of that. Going to aim for 5k this year and build up from there over time.

I just want to keep adding to the portfolio and putting that money to work.

Are you doing it through an IRA, Roth or brokerage account?

We have limited options here in Ireland for investing in stocks. I have a pension plan through work that is covered by a larger investment company but the fees are huge.

Other than that the only option is through a smaller online broker with self management and low fees.

Unfortunately you get killed with taxes on the back end if you make any profit.

Sorry I forgot you are not in the US. A pension is still great better than anything I have

!INDEED

Although many would confirm that investing in the S&P 500 is a safe bet, it's wise to do your own research and analysis based on your investment preferences.

I believe many will agree that diversifying your investments is also a good practice. I’m on this camp as well 😊.

Lastly, DCA (Dollar Cost Averaging) is definitely the best approach if you're in it for the long haul.

(9/25)

@curamax Totally agrees with your content! so I just sent 1 IDD@niallon11! to your account on behalf of @curamax.

Comparison Bitcoin savings plan vs Nasdaq100 and MSCI World

https://peakd.com/hive-167922/@blkchn/bitcoin-sparplan-bitcoin-savings-plan