“It’s basically guys sitting in China, laughing at the gullibility of US investors. And that’s what this company is all about."

Carson Block on China Internet Nationwide Financial Services, Bloomberg, 20th of December 2017

I’ve always been interested in China. It’s a fascinating country and culture, and it has played a major role in the twenty first century so far. In the books and articles on China I’ve read I often see a recurring idea - the West doesn’t know much about China and is not particularly interested in it, while China knows quite a lot about the West and wants to know more about it. However cliche it might sound, it is hard to disagree with it. That is probably the main reason why thousands of American investors have already lost tens of billions of dollars on their investments in Chinese companies listed on American stock exchange. That’s what Jed Rothstein’s is trying to investigate in his new documentary , The China Hustle , available worldwide on Netflix.

“There are no good guys in this story… including me”

Awesome beginning of a documentary, if you ask me! The China Hustle is, in short, a real story of how American companies introduced Chinese companies on the US stock exchange and then sold their stock to American retail investors who wanted to have a piece of the action in the 'China Dream'. Sounds like a win-win situation at a first glance, so what’s all the fuss about? Let’s look at some fundamentals first.

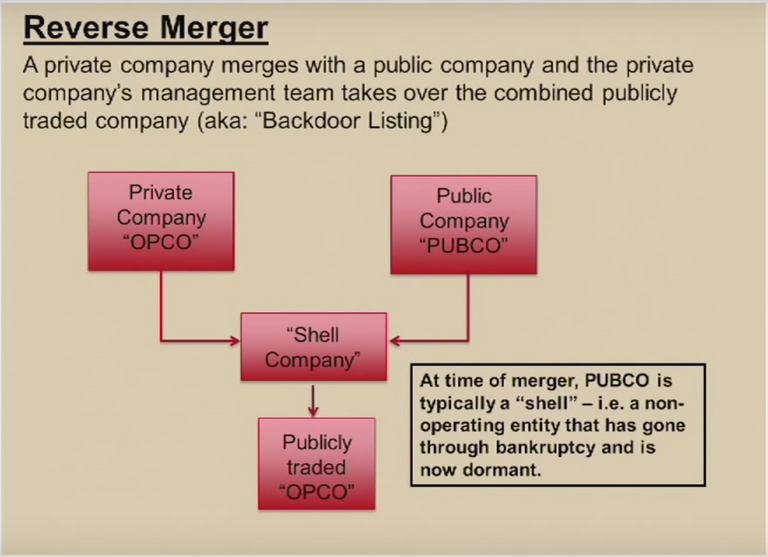

Reverse Merger

How to make a small company from China that wouldn’t meet requirements of initial public offering enter a stock exchange? Well, there is a way and it has been popular in the States since 2000 - reverse merger. Here’s a graphic representation of how it works:

These mergers were also possible thanks to big names in auditing, such as PricewaterhouseCoopers, which confirmed legitimacy of those little Chinese companies, giving a green light to American retail investors. Those big auditors also have their Chinese branches, like PricewaterhouseCoopers China, that provided positive feedback on the companies which later became listed on American stock exchange through reverse mergers. As the main whistle-blowers in the documentary claim, the majority of those companies presented false information in their financial statements, deceptively increasing their production capacity and revenues by 10, 20 or even 100 times. How is it possible that those Chinese CEOs, who should take responsibility for those false statements, have not been punished and got away with billions of dollars from American retail investors?

Fraud Towards Foreigners is Not Punished in China

“When somebody breaks the law here, there is a process when they’re accountable. At some point in a China-based company, that accountability ends. And it ends at the ocean.”

That’s probably the most interesting fact in The China Hustle - it’s not illegal to steal from foreign investors in China. The documentary makers found an employee of the Chinese state financial news agency who agreed to be interviewed for the film, with his face covered and his personal details not revealed to the public. He confirmed that Chinese authorities have no power and won’t take any actions if a Chinese based company gives false information to foreign investors, oftentimes leading to huge losses among them.

However, one cannot put all the blame on the greedy and unpunishable CEOs from the Middle Kingdom. There are many parties responsible for this case: American Securities and Exchange Commission, investment banks like Rodman and Redshaw, auditing companies like PricewaterhouseCoopers, and finally the US Congress that doesn’t seem to be bothered at all by multi-billion losses of average Americans, as we can see in the documentary.

The heroes of the story are short sellers, that is investors who bet against the market. Their goal is not only to make profit on falling Chinese-American mergers, but also to protect others from being scammed and to raise awareness of the issue. They travel to China, give speeches in Hong Kong, talk to politicians in Washington. Some of their efforts are futile, some of them bring results, some end up in jail in China. They have managed to expose a few fraudulent companies throughout the years which seems to be just a drop in the ocean as the scale of the fraud might turn out to run in hundreds of billions of dollars, if not more.

The documentary poses interesting questions for further consideration and discussion. What is capitalism all about? Is it about the hardworking people who, thanks to their effort, have an opportunity to make profit? Or is it about those who use power and influence to get filthy rich by taking money away from the others? How much of a bubble is 'The Chinese Economic Miracle'? Is it it driven by legitimate companies supported by innovation and hard work, or by cunning and greedy self-serving individuals? Wouldn’t American business owners use similar strategies if only they were allowed to?

The movie ends with images of the Alibaba’s owner, Jack Ma, the richest man in Asia. Alibaba was listed on the American stock exchange by IPO in 2014. Different experts raise their concerns about the transparency of the company, which is impossible to be researched, just like many other businesses with their roots in China. Instead of revealing information that experts would like to see, Jack Ma keeps saying: “Just trust us, just trust us”. The closing commentary and a response to him by Dan David, the whistle-blower: “Fuck’em. They’re lying”. Who are you going to trust?

Earworm

Pictures: