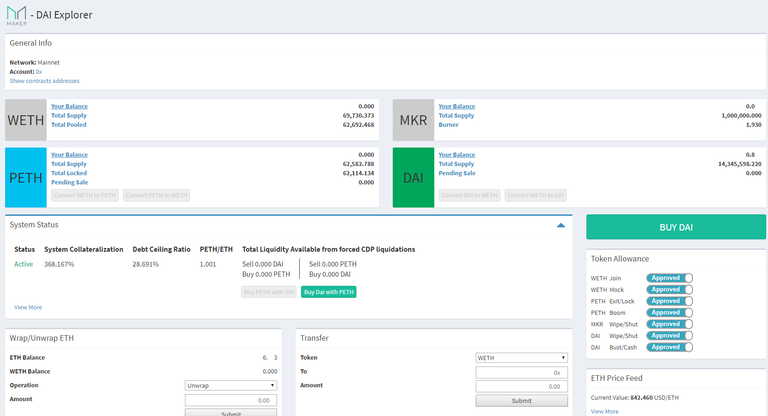

I just created a CDP to lock some ether I hold into a smart contract.

This lets me take out DAI, which I used to buy steem.

I turned the steem into steem power. I will delegate that steem power on Minnowbooster for about 30% APR, and pay back the DAI loan over the next year or two until I've paid the loan back in full.

The process took time. Maker is not yet ready for the masses, but the system works. Once a wider variety of (uncorrelated) tokens are necessary to create a CDP, it will be much safer to use this.

If you're not sure whether you understand the MKR/DAI process, you shouldn't experiment with it. At one point, I thought I had lost a couple of ETH. It is very easy to lose money if you're not careful!

But if you want to see what smart contracts can do to allow people to "be their own bank" and draw a loan against their holdings, you'll find dai.makerdao.com a fascinating website. They've got a great tutorial on YouTube as well.

Again, this is not for the beginner! It was quite the learning process for me. But the system works, and it works well. Whether or not you use it, I'd like to point out that the Maker team has made an incredibly powerful system that will benefit the entire ecosystem.

-Jeff

Maker is one of the more solid projects functioning on ETH right now. They have a good team. Can you explain more what you are doing with minnow booster?

Yes, I delegate some of my steem power to earn steem daily. I explain it in more detail here:

Not sure that I'm at the stage where I'll try that, but it's cool and helpful to know that it's out there. One day when I have the time and energy to look into how to do it properly [to be read: NOT losing my Ethereum] I'll have to give it a look.

Yeah, I am eager for it to be faster and easier than it is now, and for a year or two of use "in the wild" to bring the risk profile down.

Good stuff. I just listened to an interview with the Cryptoverse on DIA. It is an interesting idea, but I struggle to see how they will create CDA on non blockchain assets to expand.

I am now curious about your investment into Steem and your delegation for a 30% APR. I may have to investigate if its worth an investment to do something similiar, although I would most likely just trade one crypto for another.

Check out Minnowbooster and their lease request market. I did a video on it too (linked above in the comments here).

Steem delegation is way undervalued.

Comment by @shadowspub. This is a opt-in bot.Beep!Beep! @shadow3scalpel & listkeeper @chairborne have your six new veterans, retirees and military members on STEEM. We’ll be patrolling by to upvote your posts (because you are on the list) and we'll answer any questions you leave us.

Good stuff, man. This is a great way to build your stack if you can figure it out properly.

Thanks, I hope so!

Do you know that there are much higher APRs out there? And that the minnowbooster rates are actually overstated because of their short-time lengths and the required 7-day cooldown period (where you are not earning anything on delegation or upvoting) when the lease ends?

I'm not sure about the higher APRs, but the rates are not overstated: they take the 7 day cool down into effect.

An example that is live now is requesting 387 steem power for 1 week. It pays 2.979 steem. Repeat that for one year and you'd have 26 weeks on and 26 weeks of cooldown.

You'd be paid 2.979*26, which equals 77 steem (rounded). 77/387 is .19, or 19%, which is the advertised APR.

Ok, cool to know. I guess I just figured they were advertising the APR of the delegation period without the cooldown taken into consideration. But, seriously, I know it sounds crazy, but 19% is LOW!

I've pretty consistently picked up APRs over 30%. That 19% will likely sit for quite a while.

Go throw some SP @therising... They are giving out 43.8% on min 100 SP for a limited time.

Good one. Thanks for the information

thanks for the sharing