The US Bank Cash Plus card is one of the sleeping giants in the credit card game. The Cash+ card offers you 5% back in 2 categories (out of 12) but the most valuable are home utilities and cell phone bills. It's the one credit card that you should keep forever and by the end of this US Bank Cash Plus credit card review, you'll see why.

The $200 sign-up bonus for the Cash+ credit card is pretty good considering that the US Bank Cash Plus card has no annual fee and offers 5% cashback on spend categories that aren't very common. You won't see other personal credit cards giving you this much value.

| Card Details: | US Bank Cash Plus Credit Card |

| Annual Fee: | None |

| Sign up Bonus: | $200 after spending $500 |

| Benefits: | Very generous cashback |

| Earning Rates: | -5% back on 2 categories (up to a combined $2000 each quarter then 1%) -2% back on 1 category (unlimited spend) -1% back on everything else |

| Card Type: | Visa Signature |

| Churnable: | Yes, but it makes more sense to keep this card open forever |

| Tell me something bad: | -There are foreign exchange fees -You have to select your cashback categories every quarter |

| Value: | $200 sign-up + the cashback you make every year |

| Recommendation: | 5% back on your consistent high spend categories like utilities, phone and internet bills. |

| Credit Score: | 690+ |

| Sign Up: | https://www.usbank.com/credit-cards/cash-plus-visa-signature-credit-card.html |

Signing Up For the US Bank Cash Plus Credit Card

Credit Score Needed: The credit score needed to get approved for the US Bank Cash Plus credit card is 690. It's no guarantee that you'll be approved, but it is a prerequisite.

US Bank Reconsideration Number: 1-800-947-1444

In the event that you are not immediately approved, you should absolutely call the US Bank reconsideration phone number. During the call, tell them you just applied for the US Bank Cash+ card and you'd like to know if there was any additional information required to get approved. Be nice and the chances of you being approved over the phone will go up drastically.

How to get the sign up bonus: Typically, the sign-up bonus for the US Bank Cash+ credit card is $150. I'm not sure how long the $200 bonus after $500 will be available, but it's definitely worth it long term. To get the bonus, you'll need to spend $500 within 90 days of being approved for the credit card. This may arrive as a statement credit so you'll be able to cover the costs of your purchases.

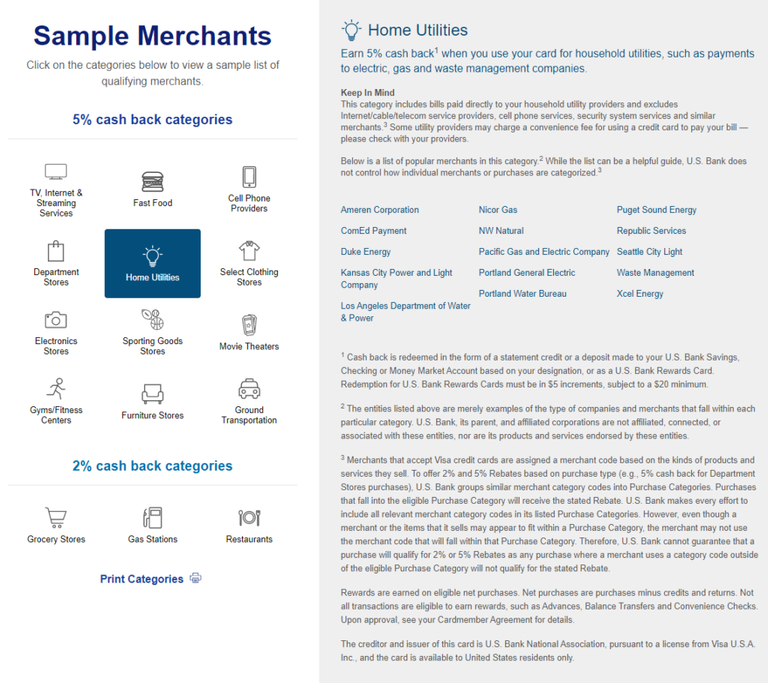

How to sign up for cashback: After receiving your US Bank Cash Plus card, be sure to select your cashback categories here. You will pick any 2 categories in the 5% sections and 1 category in the 2% section.

US Bank Cash Plus Cash Back Categories

The selection of the 5% categories have some unique options when compared to the other credit cards in the market. As for fast food and restaurants, I would recommend getting the Altitude Go credit card. I wrote a detailed US Bank Altitude Go review for more details.

https://cashplus.usbank.com/merchants/index

How does cashback work on the US Bank Cash+ card?

Every quarter, you'll need to sign-up for your cash back categories with US Bank. You can do that HERE. I would highly recommend setting up a quarterly calendar reminder so you continuously get full value from the card. You'll need to select 2 categories for 5% and 1 category for 2% cashback.

- 5% back on 2 categories: 5% back on up to a combined $2000 each quarter then 1%.

- 2% back on 1 category: No limit on cashback

- 1% back on everything else

As for online shopping, Amazon is not included as a 5% cashback category for the US Bank Cash+ card. But, there are quite a few other credit cards that give you cashback at Amazon.

Do the cashback categories for the US Bank Cash Plus card change?

The US Bank cashback categories do not change each quarter. Every quarter has the same available selection for you to choose your 5% cashback. This allows customers to change categories depending on their spending habits. The last quarter of the year is October-December which is the holiday shopping season, so US Bank Cash+ customers might change their selection. Or if you're moving into a new home and want to buy new furniture, that's going to be expensive and 5% back will help a lot.

Fast Food vs Restaurants

The US Bank Cash+ credit card has made a clear distinction between fast food (5% category) and restaurants (2% category). Fast Food includes all places that have a drive-thru and other places like Subway and Chipotle. Restaurants are considered places will full service (places where you would leave a tip) and includes delivery services like DoorDash, GrubHub and UberEats. I recommend just getting 4% back on all dining with the US Bank Altitude Go card.

Should you pay your cell phone bill?

Even though you can get 5% back on your cell phone bill, you might want to consider using a Mastercard World Elite credit card. There's a few Mastercard World Elite credit cards with no annual fee and provide you a very generous phone insurance program. To enroll, all you have to do is pay your cell phone bill with a Mastercard World Elite credit card and your phone is insured for up to $800 with a $50 deductible.

Think about it this way, if your phone bill annually is $1200 ($100/month), 5% cashback each year is $60. Would you rather have phone insurance or $60? You will also have to consider how much your phone is worth

How to get full value from the US Bank Cash Plus credit card?

I only recommend getting the US Bank Cash Plus credit card to use for the 5% categories. The 2% categories aren't worth it since you can get other no annual fee credit cards that offer at least 3% back on the same categories.

Everyone's situation is different, but I want to give you an example of how much cashback a regular single adult could get. For this example the 5% categories selected will be (1) TV/internet/streaming services and (2) Utility bills:

- $60 Internet Bills

- $30 Hulu/Netflix/Spotify

- $110 Utilities

- $200/month, $2400/year and 5% cashback is $120/year

The US Bank Cash Plus card is giving you a $200 sign-up bonus and at least $120/year for the average person. Best of all, that's an extra $120 every year after that. While big sign up bonuses are lucrative, those credit cards have high annual fees and don't give you much value after the initial bonus.

Keep your US Bank Cash Plus credit card open forever

The Cash Plus card is definitely something I recommend keeping forever. I don't know of any other cards that will give you 5% back on your utilities without an annual fee. Keeping a credit card open forever keeps your credit score strong since you have a longer average age of credit, a continuous stream of on-time payments and the available credit limit.

I would also consider getting these credit cards because they have no annual fee and have a lot of cashback:

- Discover It Card: Rotating 5% cashback categories each quarter

- Chase Freedom Flex: Rotating 5% cashback categories each quarter. It's also a Mastercard World Elite which comes with a lot of benefits

- US Bank Altitude Go: 4% back on all dining and an annual $15 streaming credit.

TLDR

The US Bank Cash Plus credit card gives you 5% back on 2 categories that are very unique. Since everyone pays for internet, streaming services, electricity, water and gas, it's likely that they are spending at least $2000/year in bills. Very likely a lot more than that. Being able to get 5% back on $2000/year is a $100. Since the US Bank Cash Plus card has no annual fee, you're paying yourself at least $100/year to have it. That is some full value.

Posted from my blog with SteemPress : https://slycredit.com/us-bank-cash-plus-card-review/