Markets feel good about progress on China trade discussions. Trade action is a switch over in semiconductors and bottom fishing on old dog, General Electric. Ethereum and Bitcoin do a bit of a divergence trick

Portfolio News

Market Rally

The rally continues with industrials leading the charge

This is a perfect time to set up hedging trades as talking heads are talking like this will continue for a while. I have hedge trades expiring this week - I will write some more hedges before expiry.

New Zealand

Royal Bank of New Zealand surprised markets even though it did what was expected - leave rates unchanged. Kiwi Dollar bounced

https://www.businessinsider.com.au/rbnz-cash-rate-nzd-new-zealand-dollar-2019-2

It was the words that drove the currency stronger. Expectations were for words about weakness and the words were more about strength. The talking heads talked about the move this morning with the sharp move more likely to be short covering on short term trades around the announcement content. The dominant trade is actually short AUD and long NZD which is where I am positioned on my recent currency trade. A quick update on a 4 hour chart shows both my trades (pink and red rays) going in-the-money on the news and the pink ray trade staying there.

Still got a long way to go.

Bought

Lam Research Corporation (LRCX): US Semiconductors. LRCX is involved in manufacturing equipment for manufacturing semiconductors. Jim Cramer added a first position in LAM Research into his Action Plus Portfolio. I followed him. I have been invested in semiconductors for some time as part of a Productivity Trade predicated on growing economy. Jim Cramer thesis is the industry has got into a supply deficit for memory chips and will need to ramp up production as the cycle progresses. He also likes the buyback program LRCX just started as this tells him management is confident about earnings potential.

In TIB211, I invested in a range of semiconductor stocks. I missed picking out LRCX at that time though it was on my charts. I will present an updated chart going back to 2016, looking at iShares Semiconductors ETF (SOXX - black bars) compared to LRCX (pink line) and Analog Devices (ADI - orange line) and Intel (INTC - red line).

Normally I would look to invest in the relative laggards (and that is what I did in March 2018). LRCX has outperformed the sector in this time line and is showing some momentum since the rally started. What this trade is looking for is another leg up which widens the gap again like it did in 2017.

Next chart adds one more stock to show what a wider gap could look like - add in Advanced Micros Devices

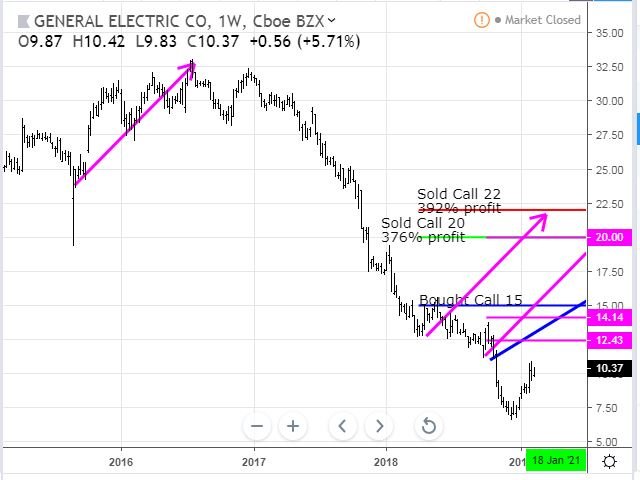

General Electric (GE): US Industrials. Industrial stocks have been the big winners in the China trade rally. The Buy:Sell chart comparing S&P 500 with Industrial Select Sector ETF (XLI) shows this very clearly.

Buy:Sell Chart [Means: Buy the first named stock and sell the second named stock. If the chart goes up the first named stock is outperforming. If the chart goes down the second named stock is outperforming]

GE has been a massive laggard as it wrestles with a mountain of debt and problems in its Power Division. It too has bounced off the lows after dropping below 8 (I am short 8 strike puts). I added a small parcel of stock to average down my entry price. Jim Cramer talked about this in his Friday Mad Money show - his view is a very long haul investment to give new CEO, Larry Culp, enough time to make the changes and if a China trade deal is made. Here is the GE chart - excuse the rats warren of lines as I have a few call options sitting in my portfolios - the message is the bounce off the bottom.

Sold

Under Armour, Inc (UAA): Apparel Manufacturing. Closed out January 2020 20/30 bull call spread for 39% profit since May 2018. In TIB230, I said the rationale for the trade was to buy on the break of the downtrend and the signing of Steph Curry as brand ambassador. I had put a take profit target some time ago to sell out at when options implied a 52 week high. Price popped enough after earnings to get my trade closed out. Price did then fell back. Quick look back at the chart now updated (note: original chart had expiry in wrong place)

Trade looked great after set up and ran close to 100% profit line, then fell back and had another go at 100% and fell back. Concern on the chart is price did not make a higher high but it did make a lower low. Exit looks impatient BUT a profit is a profit though the $100 I made is not enough to buy a pair of Steph Curry's sneakers

Analog Devices, Inc (ADI): US Semiconductors. With the purchase of Lam Research, I chose to switch out of a profitable semiconductor trade in one portfolio. I chose Analog Devices and booked a 16% profit since March 2018. Going back to my original purchase (see TIB211), the rationale for buying semiconductor stocks was the Productivity Trade - as an economy grows and businesses wants to improve profits, they look to improve productivity. Computer chips are needed. I did not know which stocks to pick, so I invested in 6 in equal parcels. The quick chart compares the iShares Semiconductors ETF (SOXX - black bars), which is a market capitalisation weighted ETF, with Analog Devices (ADI - orange line) and LAM Research (LRCX - pink line) for the time since I have held ADI.

ADI outperformed the sector over that time and also LAM Research making this a switch from a leader to a laggard.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $88 (2.5% of the low). Price tried hard to head lower and then had a go at going higher making an engulfing bar for the day with the open higher than the close = an indecisive day

Ethereum (ETHUSD): Price range for the day was $6 (5% of the low). Ethereum market was much clearer for the day - it wanted to go higher and it did, confirming the reversal.

1 hour chart shows how close one of my trades came to hitting its take profit target. If my target was set at $124.95 and not $125, I would have been out.

CryptoBots

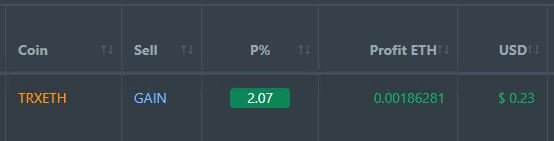

Profit Trailer Bot One closed trade (2.07% profit) bringing the position on the account to 5.66% profit (was 5.65%) (not accounting for open trades).

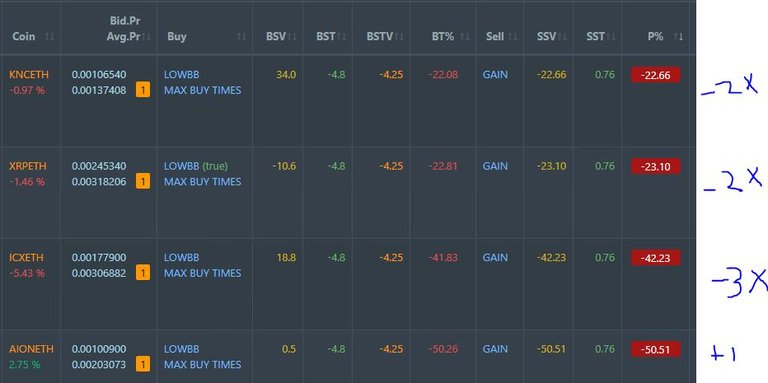

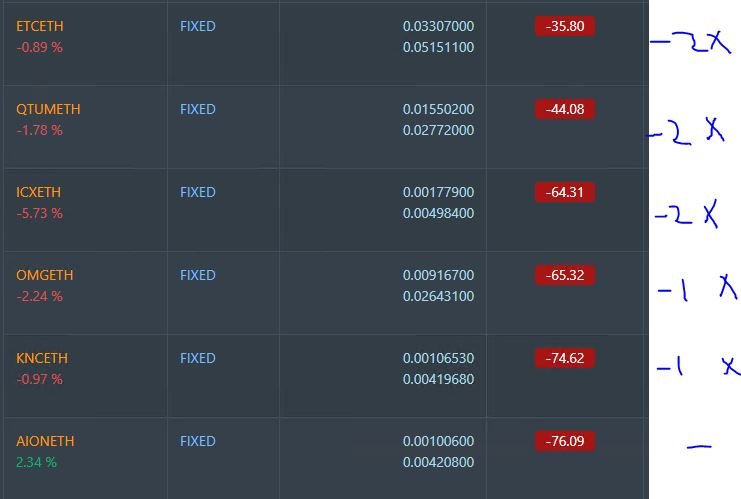

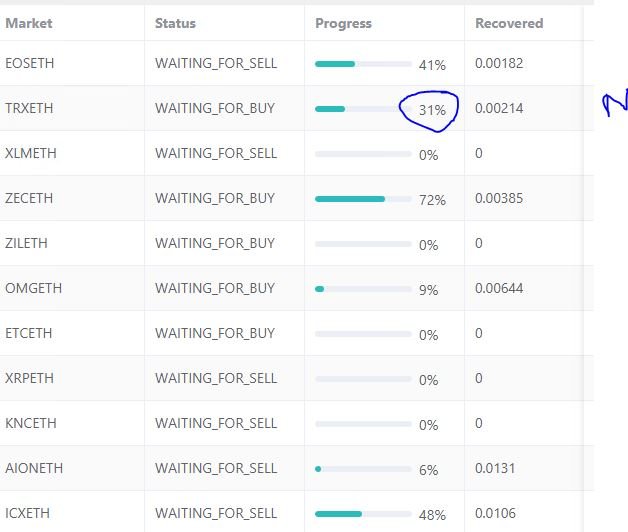

Dollar Cost Average (DCA) list remains at 4 coins with only AION improving.

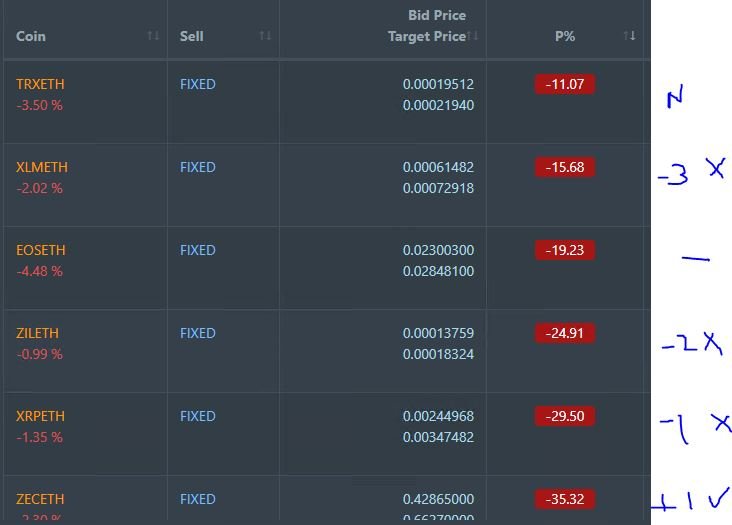

Pending list extends to 12 coins with addition of TRX. Of the rest, 1 coin improving, 2 coins trading flat and 8 worse.

PT Defender defending 11 coins with TRX added and completing first defence trade. There is a mismatch between PTD list and Defending list - something has gone wrong.

New Trading Bot Trading out using Crypto Prophecy. DCA trade closed on FUEL for 1.43% profit on revised target - too bad I revised target as trade raced to other side of the Bollinger Bands.

Currency Trades

Outsourced MAM account Actions to Wealth closed out 4 trades for 0.06% profits for the day. It looks like there is a new trader allocated to running this account who is trading more pairs. I already do not like what I see - trading GBP during Brexit talks. Trading CHF with the stonewall Swiss National Bank lurking on one side of the trade

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Curry snekaer image comes from UnderArmour.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Crypto Prophecy provides a useful tool to identify oversold and overbought coins -

https://mymark.mx/CryptoProphecy

February 13, 2019

GE has to take advantage of this uptick and raise capital despite dilution as they may not survive otherwise if trade war doesn’t get solve or other pressures hit the economy.

Posted using Partiko iOS

Not wrong there. I might hold off buying more shares and use the capital raise to do that.

How do you buy options on forex pairs?

Saxo Capital Markets offers accounts. They offer options up to 12 months ahead - dial your own strike and expiry date and exercise method (cash or spot). They provide mid volatility information at trade set up time

They do operate in US. If you want to open an account, they do run an affiliate program by invite. If you want to open, send me an email address and I will pass it on. I am hopeful the US organisation will honour such a request