DIGITAL ASSET MANAGEMENT

I just got the ICONOMI 2Q Report on Friday. Looks like a lot of new blockchain companies are trying to disrupt everything you can think about. Even industries that are more “old fashioned” like the asset management industry.

In this article I will try to describe some of the option out there highlighting the main difference and perspectives of each one.

1.-ICONOMI

2.-MELON

3.-BRICKBLOCK

4.-PRISM

First we have ICONOMI , which has the highest market cap by far at the moment.

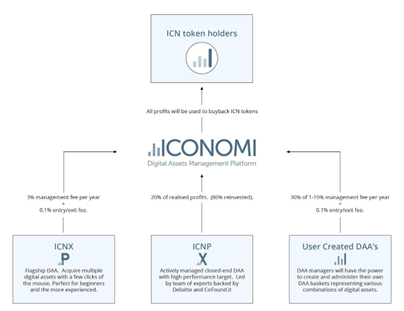

ICONOMI has different tokens ICN, ICNX, ICNP and DAA (available since today)

STRUCTURE

ICN

This is the token of the company that acts like a share (security according to the SEC), it is listed on exchanges and its value depends of the open market

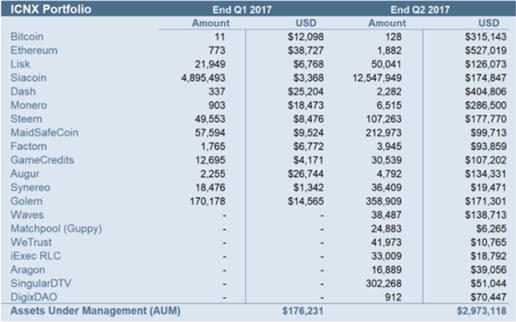

ICNX

Is a passive portfolio, it works similar to an index and it´s weighted accordingly to the market cap of the crypto currency.

Apparently ICNX has a rule within the smart contract that charges a management fee of 3% and an exit fee of .5%

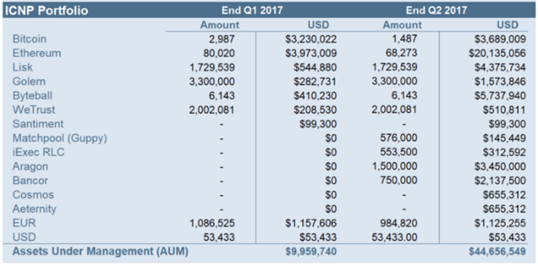

ICNP

Works similar to a mutual fund (yes mutual not hedge), where the fund manager has an active participation and knowledge of the market good enough to charge a 20% performance fee (20% is an industry average).

Personally I think is arguably high since the growth in both funds is as follows.

ICNX (passive)…………….168.4%................286.9%

ICNP (active)………………..96.0%................348.0%

You would be better off just investing in the index since the performance fee still not weighted in.

During the period ICONOMI participated on 7 ICO´s which at the time of the report data was not available since they were not listed yet. (Some of them already are like Aragon).

DAA

Digital Asset Arrays is a product that allow any fund manager or money manager to create their own fund, and the fees are split between the fund manager.

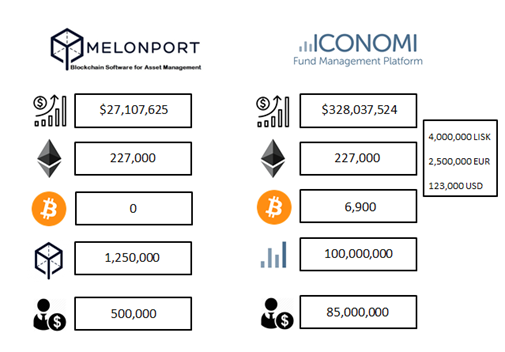

Melon (Melonport), the market cap is lower than ICONOMI´s, and its ICO collected way less money than its main rival did.

Melon only accepted Ether, and there are planning a 2nd ICO 1Q 2018 (Many think this could help them improve and even surpass ICONOMI in market cap), Still early to tell and will have to wait.

The platform is basically something similar to the individual DAA from ICONOMI, The difference (I think a very good one), Is the use of “modules” these are like rules you can integrate in your fund, like the fee, or if the fund losses against “benchmark” fee could be lowered, number of investors can be limited or unlimited, compliance rules etc. If you are a developer you can add “modules” and you get paid according to the modules implementation in funds (if more people uses you module you get some money). There is no information on how much is splitted with the platform but sure is some competition for ICONOMI.

This is a soon to come ICO, which started with the idea of decentralizing Real State. (you can buy real state fund of REIT´s, is basically a real estate portfolio for example there can be people who own 200 lots of land across the country and they are all rented or intended for the Hotel industry, so they make a fund in which when you own a share, price can go up or down according to open market, you get dividends that come from the rent of this lots and the price is theoretically backed by real assets and income incoming from the rooms).

So they made a platform to put this kind of instruments, and want to list also ETF´s, DAMF, CMF and all kind of new instruments.

So if you have a cryptofund you could listed here and people from around the world could join in, just like a ETF, or any other stock traded at the NYSE for example. Something similar to soon to come ICO (LAT Liquid Asset Token) or others trying to make the next digital asset exchange).

“When we started building ShapeShift in the Spring of 2014, we made an uncommon assumption at the time: that blockchains and (especially) the tokens built upon them were going to expand out in all directions. We believed this not because the world needs a thousand crypto “currencies” in the narrow sense, but because blockchain technology would enable all manner of new digital experimentation, financial and otherwise. Bitcoin inspired a Crypto-Cambrian Explosion; a transformative species from which entire kingdoms of new technological life arise.”

Erik Vorhees - ShapeShift CEO

Little information about ShapeShift’s PRISM. It is meant for anyone to build their own cryptoportfolio, it seems the approach is similar to the one platforms like e-toro have where you can build a portfolio and according to your return people from around the world can copy and join in, and you get (as a “fund manager”), a share of the profits.

WHATS IS NEXT?

So there is a lot of movements made in the blockchain space (as usual) in this case the industry is the Digital Asset Management (DAM) and CMF (Actively Coin Managed Fund).

Is there space for everyone? It is difficult to tell since most of the project are still on the testnet or just available like ICONOMI. Do you think fund managers will disappear or will people will still trust an “expert” for managing their funds?

An E-toro like business certainly is profitable but at the moment this model has not disrupted traditional hedge funds, or will this just add some alternatives for someone wanting to diversify part of their assets?

Do you think someone with a crypto fund or CMF could just be listed and be successful as more people joins in their fund globally. At the moment traditional exchanges list a vast number of ETF´s, REITS, indexes etc. These will not compare since barriers are now down for almost everyone to have one. Certainly behind each project and listing will be a due diligence and compliance procedure, Do you think this will prevent non experience investor to become the future fund managers?

And how will tradional asset management jump in since we already have seen movements from Polychain, Blockchain Capital, NextBlock Global, Napoleon X (coming soon) and many others.

Not to count traditional firms merging with blockchain startups in order to get in, or all the soon to come AI and market prediction projects that could certainly add more value to the asset management industry.

Would like to hear your comments

LINKS

(WHITEPAPERS)

https://medium.com/iconominet/iconomi-financial-report-q2-2017-dced466c67e8 https://medium.com/@EthereumRussian/melonport-vs-iconomi-comparison-mln-tokens-icn-tokens-dc80a9b59ab5 https://info.shapeshift.io/blog/tags/prism https://coss.io/documents/white-papers/iconomi.pdf https://melonport.com/melonprotocol.pdf https://brickblock.io/files/Brickblock_General_Whitepaper_v102.pdf

Hi. I am a volunteer bot for @resteembot that upvoted you. Your post was chosen at random, as part of the advertisment campaign for @resteembot. @resteembot is meant to help minnows get noticed by re-steeming their posts

To use the bot, one must follow it for at least 3 hours, and then make a transaction where the memo is the url of the post.

If you want to learn more - read the introduction post of @resteembot.

If you want help spread the word - read the advertisment program post.

Steem ON!

For my understanding the only thing you can copy in PRISM is just the constellation template of coins one fund has.

You can´t make your fund public for others to invest, you can just make your funde scheme public and others can create their own fund based on that

Very good blog. Thanks for bringing this to my attention. Only invest in ICOs if you did the best possible research you can do and really believe in the future of the project. Wetter you're a short- or long term holder you should know what you put your money in. This is quite an interesting website I found: https://www.coincheckup.com The site that lets you check all there is to know about the team, product, communication transparency, advisors and investment statistics on every crypto.