You've only posted three times since getting back into the program. You need at least a week of paid out posts before you can establish an accurate %.

The values in Peakd are estimations, and they use some delayed inputs, so they are not very accurate when the HIVE price is going down.

All Hive SBI units earn rshares at the same rate. Membership is a subscription to an ongoing account-based curation service; members are not investors and SBI units are not an equity stake.

Considering it is advertised as a lifetime program I would argue any money you put into a lifetime program is an investment. This program is unique because in my three years of exp I have found it beneficial to invest into you via your program and Hive as a result, my recent remigration to your program was more so the latter. You even, in past posts indicate possibility of return of initial investment in relation to current prices on market but was also more so in steem days. I am sure you worded investment a certain way.

Also in my exp when price of either steem or hive would rise so would value of vote except now. I will consider the variable for waiting a week for the algo to translate accuratly formulas. Seems that is not the case looking over people's posts I am used to monitoring sbi I would give to.

You are a smart person and it does not take one to look at my past posts and the recent ones to see something is way different. Also Peakd numbers in my exp has been very accurate and have double checked with you before even.

Thanks for your time and I am, as you know, able to get more sbi shares in near future and in a community right now. I have been promoting your program. I will be patient and wait the week

Point taken, but if you buy google adwords to promote a local business, it's an investment for you (and you would likely track ROI on your ad purchases internally) but revenue for them. Google would not see you as an investor (you don't own shares of Google) but as a customer.

Return of initial investment is subject to our return policy, and it requires a qualifying event (a material change to the program since the accounts initial enrollment). Our last qualifying event was when Hive SBI forked from Steem Basic Income at the time of the Hive fork from Steem. Our next qualifying event will be when we complete our 2.0 release (likely in the upcoming quarter). Any accounts that are enrolled on Hive only will not qualify for refunds under our policy until the next qualifying event.

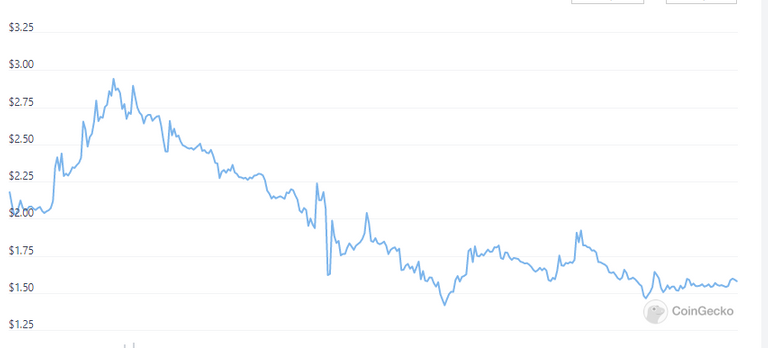

The vote value rises with the Steem/Hive price, but usually on a delayed basis (3-5 days minimum, sometimes longer) and not with a perfect correlation. When price goes up, inactive accounts become active again and it negatively impacts some of our sustainability metrics.

Right now the votes will be very wonky because of the node issues we've been having. There's no new pending balance accrual for hours at a time when it gets stuck, and then it will catch up several rounds of accrual when we detect it and enter replay. We are injecting a better alert processes to detect and remedy node issues more quickly as part of our 2.0 roadmap, but at present we have to either monitor the logs regularly or have somebody inform us when votes are being missed. If it's a long interval before we detect it (this time was about 20 hours) and node issues continue while we try to catch up, it can take a long time to resolve.

We have not announced the changes yet because the timeline is still uncertain.

We definitely took into account that most members like things how they are. The 2.0 release is designed so that new features are mostly opt-in and operations will proceed unchanged for members not interested in the new functionality.

Rather than deleting these messages I will say thank you for your video call today and getting on same page. You were very helpful and explained everything perfetly. So much so that I want to get more HSBI soon!