I started delegating HP to the Leofinance community about 4 years ago which is probably when I came into contact with the project. I remember that they wanted delegation to be able to create new accounts for free using account tokens on Hive. I don't remember what the initial deal was in terms of rewards but I joined in.

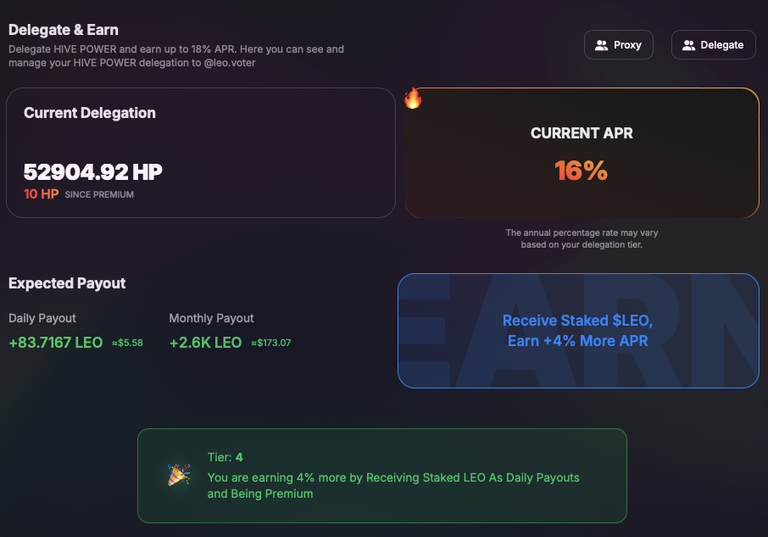

Today the offer is a bit different and multi tiered, you can earn anything from 12% to 18% according to the data on the dashboard. You do need to be premium and get your rewards as staked tokens in order to get the 4% added APR, the fifth tier is the one I didn't get because it does require to proxy your witness votes and I was not willing to do that so I would be stuck to this tier 4 and miss that extra potential 2%

Reflection after 4 years of delegation

Overall I am very happy with my investment, I have accumulated over 80k in staked Leo power which I can use for later, the rewards was particularly good to be part of the Leo ecosystem and it turned out I made inleo.io my primary front-end for long form posts as well since the rebranding and new twitter like interface, it did make me a more active Hive user as I interact more on chain now and threads and threadcast are making it a more normal social media platform and I can see now a way for normies to join the platform and increase the Leo and Hive user base which is what we need for the ecosystem. Growth is really important for investors and also for the success of the network.

As the price of Leo is increasing and the price of Hive does stay the same or goes lower the rewards in terms of Leo is decreasing, getting like 2k per month in Leo when it was like double for a few months prior. I do expect the price to rise and would be happy with my stake and what I will earn by blogging in the future.

Also if LEO does reach parity with Hive, I don't think it will make much sense for me to continue earning Leo via delegation because it would be low in terms of token numbers as it is based on the USD value, and I can only capitalize by selling those tokens in liquid form which would decrease my APR, I think this makes the investment a bit less flexible which is probably good for Leo and I can understand why they made that choice, I think a lot of thoughts actually went into planning the delegation offering and it is an important business decision so glad it is being taken seriously.

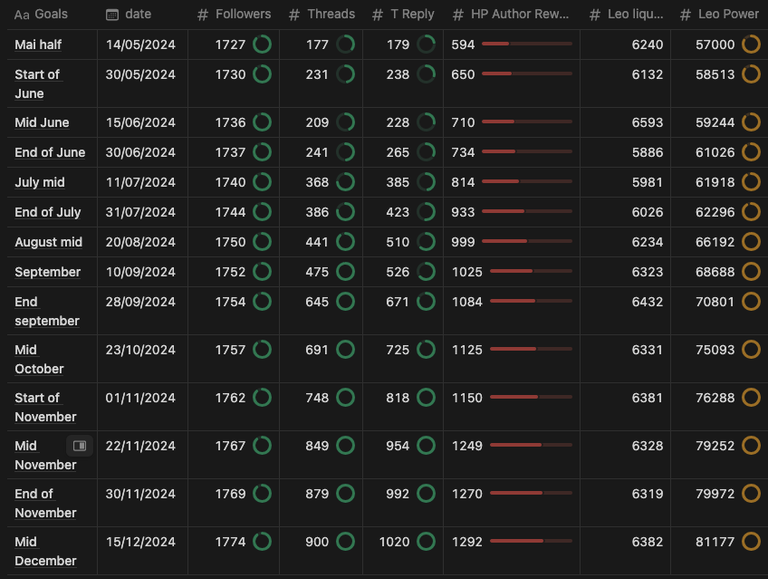

I was tracking my progress since May and here is the details:

My stake increased from 57k to 81k mostly due to delegation rewards which is 25 177 LEO in about 8 months averaging 3 150 stacked Leo per month.

I expect the payout rate to drop under 2k at some point meaning for me to reach 100k stacked Leo I would need another 10 months so going until September/October 2025 and I think I prefer to earn more Hive during that time period and let my Leo grow more slowly.

One of the advantage of holding HP as property is the fact that you can delegate to project without counter party risk on your property which is a really good mechanism, works so well and I want that to be part of the future for financial transactions.

It is one of the reason I really like holding and accumulating in HIVE as a layer 1 token, the fact that projects give out APR on my Hive value is great.

New goals, more HIVE for 2025

At some point I need to think about increasing my Hive stake even more but I don't want to unstake and sell Leo at this point so I decided to start earning more in terms of Hive mostly by being more active in curation work and trying to get close to 10% in curation reward (+3% basically passive for staked rewards)

When doing my calculation I would only lose 3-4% on APR but the fact that I only get the 16% APR on LEO in staked rewards meaning I can't sell for Hive without losing the 4% extra, at this point it wouldn't be making financial since (except Leo price speculation) to keep the delegation as 12% on liquid Leo would be lower then my expected Hive rewards on layer 1.

Learning about your investment

When I started my little hivepki.com project (which I still need to work on) I noticed something that I didn't really pay attention about. I believe you only get the 3% of stacked Hive power reward on your effective HP which made me think does the account receiving the delegation actually getting that APR ?

That kind of changed a bit the way a I see Hive business account being operated here, there is an extra layer of incentive to receive delegation from users on top of just getting more curation rewards.

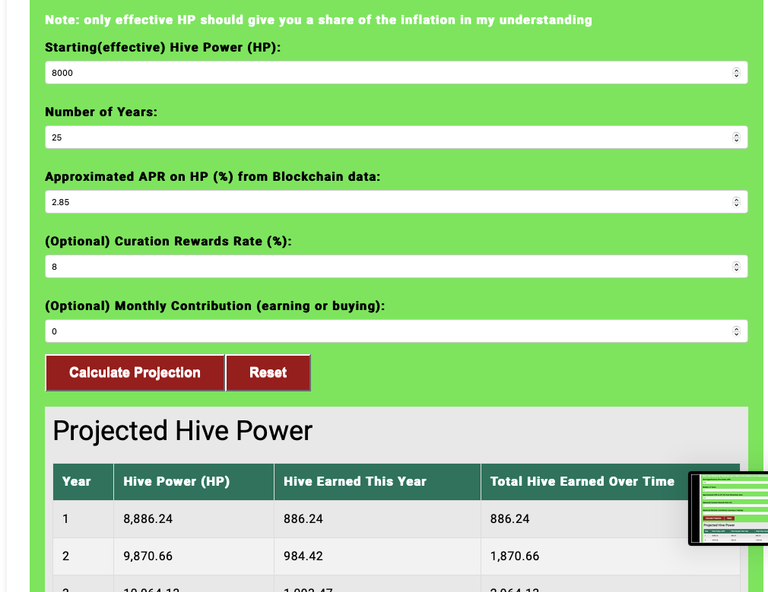

Because the aim of https://hivekpi.com/ was to do a projection of your hive earning in the future to show the power of compounding I discovered that that 3% can impact earnings over 20 years a lot so I needed to rethink my strategy and take that into account.

I also realized that I didn't understand all of Hive and there are some things yet to discover into the in depth functionally and mechanism and this is important for long term investment in the ecosystem, do you own research (DYOR) is really important and you need to understand what you buy to be a more alert investors. All the informations you get over time can be computed into the decisions you end up making. When dealing with more passive investments like delegation it is important to review it because you can be tempted to leave it just because it is already setup and it would take efforts to 'fix' something that is working.

Curation rewards are still the biggest compounding factor for growing your Hive stake over the year because that is where the main APR comes from, not taking into account extra capital inflow and author rewards.

Conclusion

The fact that this decision can also be easily reverted in the future within minutes does contribute to the me making it. I can at any point if I choose to restart delegation.

I am not sure Leo will continue to offer that in the future, is it part of the long term plan to offer such a deal? It is increasing inflation on the Leo token and I am not sure delegators really offer a great deal but I am sure khal did do his calculation as well.

Anyway that was my 2 cents on removing delegation and now aiming to increase stake and revenue on the primary chain which is Hive.

This is a reflection of my thoughts and experience over the years with Hive and delegation and is it not financial advice, just me expressing myself. I don't recommend anything and my strategy might not work for you anyway, do it yourself and take that responsibility.

Bonus:

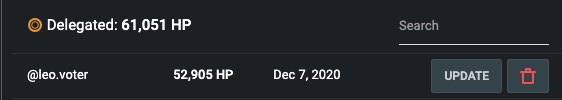

Screenshot of my delegation and when it started, funny on Peakd the first delegation date is recorded on your personal wallet but the updated date is recorded on leo.voter wallet.

My first delegation on the 7th of December 2020 was a lot lower then what it ended up being.

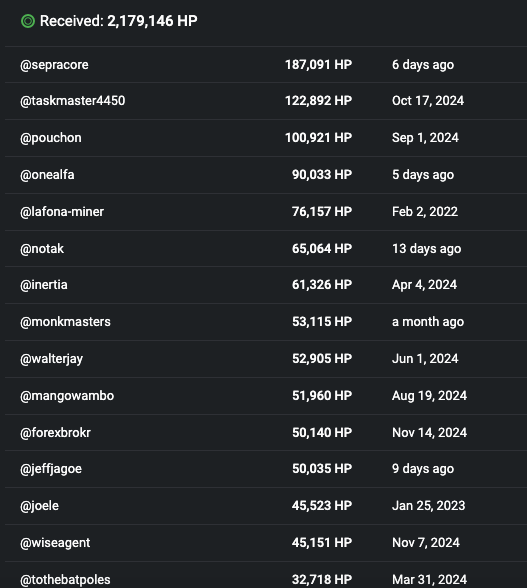

For a long time Leo.voter was my primary delegation on Hive and I was happy to be in the top 10 delegators for the end of 2024.

Looks like my last update was on June 1st in order to get more Leo due to price difference with Hive, that is when I accumulated a lot of LEO, at one point I think it was over 5k/month when hive price was up and before the Leo price increase to current levels.

You can use hivekpi at https://hivekpi.com/ for calculating potential hive earning.

Posted Using InLeo Alpha

As a newbie to Hive, thank you for putting together such a detailed look into how you've approached and benefited from your choices about how to use your author and curation rewards! !BBH

@michael561 likes your content! so I just sent 1 BBH(1/5)@walterjay! to your account on behalf of @michael561.

(html comment removed: )

)