Summary

This is not a story of populism where everyday Redditors are beating up on Wall Street elites and hedge funds. There are a lot of nuances that don't make it into the news because journalist are often just looking for neatly packaged stories. I encourage everybody to peel back the layers because the deeper story is actually way more interesting.

The Good (Winners)

Some Hedge Funds, Some Redditors, and some normal non market manipulating participants

The Bad (Losers)

Some Hedge Funds, Some Redditors, and some normal non market manipulating participants

The Ugly (Biggest Losers)

Trust in the overall markets and the proper functioning of capitalisms

What is happening here is generally bad and I wouldn't celebrate this as a victory even as a person that cares more about main street than wall street.

The net effect of all of this market manipulation will be more speculative behavior which invites more regulation. Both of these things are generally bad, the speculation and regulation.

Normal market participants who are not manipulating markets will be caught in the crossfire and harmed by this. Main street people are playing with their own money and have a lot to lose. Hedge funds are playing with rich people money and I don't really care if they lose money, but for them this is a drop in the bucket.

Lastly, markets as a whole can be destabilized by this behavior which leads to more market inefficiency and less "rationality" in the markets.

Warning - Long Article Below

Narrative of The Short Position

Short sellers believe that GameStop has a dying business model and a lot of long-time gamers including myself would probably agree that this business model is going to be disrupted. This is happening not just in gaming, but there has been a shift away from retail and toward online sales in almost every sector of retail.

Narrative Driving the Short Squeeze

Hedge funds are manipulating markets all of the time and shorting creates no value. Main Street needs to band together and punish Wall Street elites because we have strength in numbers. The hedge funds are just picking companies to drive into bankruptcy and the people should take back that power. The public should determine the winners and losers. Let decentralization prevail.

The truth is much deeper and more interesting

Economics and Mechanics of The Short Position

Shorting in the macroeconomic picture can help to eliminate "zombie" companies from the market. Companies that are not viable are optimal for shorting.

Shorting also reduces volatility. Short sellers have an incentive to short (sell) when the stock price is high and buy back (cover) when the stock price is low. This reduces volatility as the highs don't get as high due to selling and the lows don't get as low due to buying to cover.

Shorting is one mechanism by which stocks can "correct" to their true value. It corrects the "informational asymmetries" that exist in the market and brings the market back into equilibrium. People in the short position reveal contrarian or bearish information while people in the long position reveal bullish information and the stock prices should reflect "full information" and correct to appropriate levels. In markets with low information asymmetry the bid ask spread will be lower and the market price should be less volatile.

Shorting helps to reduce bubbles. When a stock is "overvalued" it creates incentive for short selling. In this case short sellers are mini bubble poppers. Which help to prevent big bubbles.

If the short side is wrong they will be punished for taking the position. Short sellers were wrong on Tesla and they paid for it. In this case the reverse happens and the stock "corrects" upwards and soars to what the real value should be.

If you want to read other examples of how shorting can help markets then read about the Enron scandal or watch the movie "The Big Short". Short selling can reveal illegal behavior and it can point out problems in the synthetic CDOs like in the housing bubble. The story of Herbalife is another example that has a Netflix documentary on it.

Mathematics of Short Selling

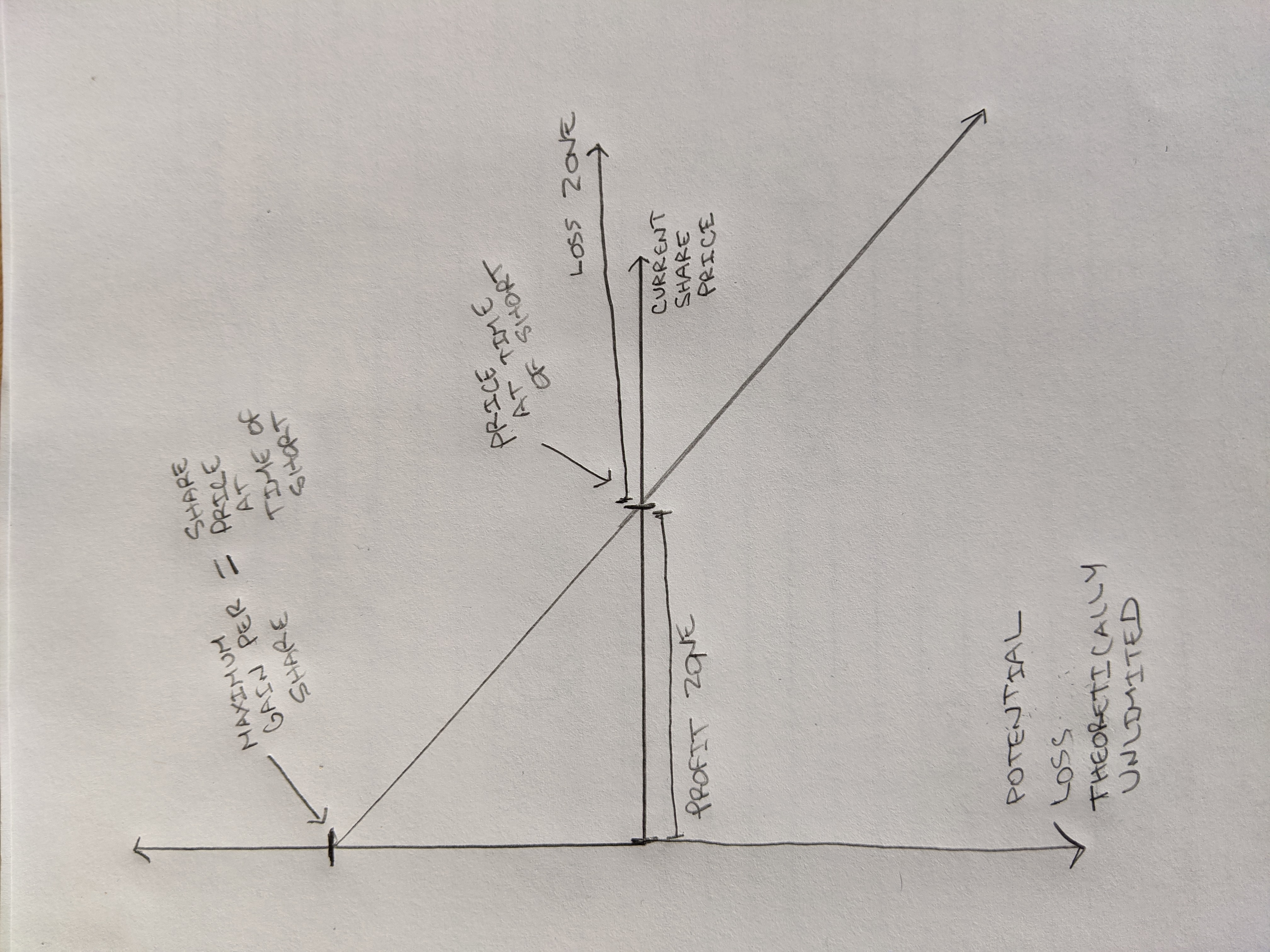

Mathematically, shorting has limited upside potential and almost unlimited downside risk. It is inherent in the mathematics that if you are going to short then you better be right. People who are shorting are "putting their money where their mouth is".

When these guys win they win big, but when they lose they lose even bigger. When you are shorting you are sailing into a headwind. Why would anybody do this? The high risk in shorting gives a strong incentive for short sellers to be accurate in their assessment that the company they are shorting is indeed a "bad" company. This risk profile creates market discipline in the shorting game. With gains capped, but losses uncapped--people don't just randomly short.

What I described above would be considered "normal" economic activity. The Game Stop situation is not "normal economic activity".

The Short Squeeze

Not all short squeezes are created equal. Shorting more than 100% of the shares is market manipulation and my stance on this is that it is immoral.

Creating a short squeeze scenario by using Reddit to the pump shitty stocks is also manipulation and does a lot of harm. There is no value being created for anybody in this scenario. Only value redistribution to the most effective market manipulators. That incentive structure is bad for everybody.

Markets that reward people for breaking it just encourage more people to break it. It also incentivizes honest people to exit the market or rotate toward sub optimally low risk profiles such as overweighting bonds.

Not all short squeezes are bad. The Tesla example is a positive example and I encourage people to do more research on it.

I don't agree with Elon taking a position on GameStop though because this situation is different from the Tesla situation. I think he is taking it personal because he wants to punish short sellers. However, sometimes short sellers are right and they are doing the market a positive service.

In the Tesla example short sellers got punished and normal main street people were rewarded and Tesla has a market cap that is approaching a trillion. This is a success story where the people who were wrong were punished and the people who were right made a lot of money. The market rewarded the people who were right and punished the people who were wrong. All is well.

Other influencers like Chamath are taking a philosophical positions in this debate and although I agree with him philosophically and I generally agree with most of his thoughts, the practical implications of what he is doing is going to lead to unintended consequences where normal everyday people are harmed.

You don't want influencers on the side lines pumping stocks that they don't hold positions in. A lot of people that actually have their real money in the game will be hurt by this and some of those people are normal main street people. What you should look for is that the influencer actually holds the stock and not something like call options where they are half in and half out--especially if you are all in.

Some of the winners of this short squeeze are hedge funds. Such as Michael Burry who holds a long position and he was famous for having a short position in the housing bubble of 08'. He has been reported to have made 1500% on this short squeeze.

Some Redditors will make money on this, but the ones that came late will be unable to sell after all of the shorts are covered and will be stuck overpaying for the stock with no sellers to sell to. These particular Redditors will lose a ton of money.

The neutrals who are not market manipulating will see crazy volatility and they will lose trust in the markets and may have to cut their losses. The average main street people who buy and hold may lose faith and rotate toward safety which is bad for the markets overall if the rotation is an overcorrection due to emotions rather than facts.

This is bad for the stock market as a whole and it needs to be fixed. The solutions are not simple, but the market will not fix themselves when people are doing this and Reddit will not fix it either.

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

The people that are doing this to hurt wall street suits need to realise that the longer this goes on, the more they're giving other suits chances to make more money. There were huge spikes in prices after hours meaning someone with a LOT of money bought in.

Posted Using LeoFinance Beta

You are correct and the higher that the reddit crowd tries to drive up GME stock prices the larger the incentive for hedge funds to come in and re-short the stock. Also if you go to the SEC website you will see that there is insider selling from Gamestop executives. I suspect that the Board of Directors have put a stop to this as there was insider selling from the 13-15th, but nothing after. A couple of Gamestop executives have already made out with a couple million dollars on this short squeeze. These are not main street people--these are suits with inside information doing things that are not illegal, but are not moral either.

The story is a lot deeper than people realize:

https://www.sec.gov/cgi-bin/own-disp?action=getissuer&CIK=0001326380

If somebody wants to do real journalism check out the link above and track the dates back to the historical stock prices on GME. You will find that the stock prices were up 50% on the close of day on Jan 13th.

This is most likely the beginning of the short squeeze and the insider selling starts on the 13th and goes through the 15th and it would have kept going if the company didn't impose internal restrictions. People think its crazy that Robinhood had suspended trading on the buy side, but GameStop themselves have probably suspending selling by executives to prevent them from participating in this Reddit driven short squeeze. Follow the money!

Posted Using LeoFinance Beta

Congratulations @therecantonlybe1! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

<table><tr><td><img src="https://images.hive.blog/60x70/http://hivebuzz.me/@therecantonlybe1/upvoted.png?202101280401" /><td>You received more than 500 upvotes. Your next target is to reach 600 upvotes. <p dir="auto"><sub><em>You can view your badges on <a href="https://hivebuzz.me/@therecantonlybe1" target="_blank" rel="noreferrer noopener" title="This link will take you away from hive.blog" class="external_link">your board and compare yourself to others in the <a href="https://hivebuzz.me/ranking" target="_blank" rel="noreferrer noopener" title="This link will take you away from hive.blog" class="external_link">Ranking<br /> <sub><em>If you no longer want to receive notifications, reply to this comment with the word <code>STOP <p dir="auto"><strong><span>Check out the last post from <a href="/@hivebuzz">@hivebuzz: <table><tr><td><a href="/hivebuzz/@hivebuzz/pud-202102"><img src="https://images.hive.blog/64x128/https://i.imgur.com/805FIIt.jpg" /><td><a href="/hivebuzz/@hivebuzz/pud-202102">Next Hive Power Up Day is February 1st 2021