This article is the result of a conversation with @blocktrades. It is being posted to get feedback from the community.

Source

Over the past few months we discussed different ideas regarding expanding Hive into the fixed income market. This is a crucial aspect of the investing world and one that is going to be vital in the evolution of Decentralized Finance (DeFi).

We already see the first layer established with the introduction of interest payments by utilizing the Hive savings account. At present, this has a 12% APR utilizing the Hive Backed Dollar (HBD). This is the premise we are going to build from.

Here we are going to delve into the issues with the stablecoin market as well as what we are proposing to develop on Hive.

The Problem

For now, the stablecoin market is paying a return of 12%-20%. This is the range that most projects fall into. This is, naturally, an outstanding return compared to the traditional market. When it comes to the hunt for yield, DeFi is excelling in this area.

That advantage to this, in addition to satisfying the need for a return, is that we see a great deal of liquidity. Money is available, for the most part, in a very short period of time.

Where the problem comes in is the design. Here is what we see tied to these projects.

Counter-risk because one is often dependent upon an application. We watched recent events exposing how this is the case with wallets and other applications.

The return is often in a token other than the stablecoin staked. This adds another level of risk which could affect the return.

The Solution - Hive Savings Bond

This is another layer added to the Hive savings program. Whereas that is a liquid account providing a return, the Hive Savings Bond is a time-locked account that offers incentive to lock up one's HBD.

We are looking at the first configuration at being a 1-year lock up, yielding a return of, say, 25%.

This is about double what the savings account pays, a price paid to sacrifice liquidity. Layer 2 solutions could be built in the future that allows for the trading/collateralization of these assets. For the moment though, we are dealing with a non-liquid asset.

It will work exactly the same as the savings account. Individuals would put HBD in and receive a return. That is set by the consensus of the witnesses. Whatever rate one deposits at, that is in place for the 365 day term. It is no different than buying a savings bond from the government.

Each month a claim could be made. Of course, we don't want the payouts automatically locked up so they would have to be directed either to liquid HBD or the savings account.

As we can see, another layer of fixed income options would be operating on Hive. People will have a choice of where to deposit their HBD. If one wants liquidity, then savings is the place. However, if the quest for yield is the main parameter, one can get a higher return if willing to forgo liquidity and lock the HBD up for a year. There is a trade-off yet both options are available.

Benefits

This could have an enormous impact upon the Hive ecosystem if successful. We can see a number of benefits that can be spawned from this one move.

- Hive Legitimate In The Fixed Income Market

We are dealing with a base-layer, algorithmic driven stablecoin with no counterparty risk. It is also tied to a decentralized blockchain with no foundation, company, or venture capital firm behind. With all the talk about regulation, this is removing that entirely.

This adheres to the "your keys, your crypto" that is one of the main tenets of this industry. Also, unlike what took place in Canada, the money is not at risk of seizure or banning. Nobody can take one's Hive account away.

- Payout In HBD

Put in HBD, get paid in HBD.

Sounds simple but it is so rare within the cryptocurrency world. This is eliminating the risk with another token involved in the transaction, thus removing a pitfall present in most stablecoin opportunities.

It also serves as a method to create a great deal more HBD. At present there are roughly 10M-12M outside the DHF. In the stablecoin world, this is not even a flea on a dog.

Look at some of the others:

Tether 80 billion

USDC 50 billion

BUSD 18 billion

UST 14 billion

In other words, Hive needs a lot more HBD if we are going to be a legitimate player in the stablecoin world. A lack of liquidity is also causing volatility in the token price, something that is counter to what is desired with a stablecoin.

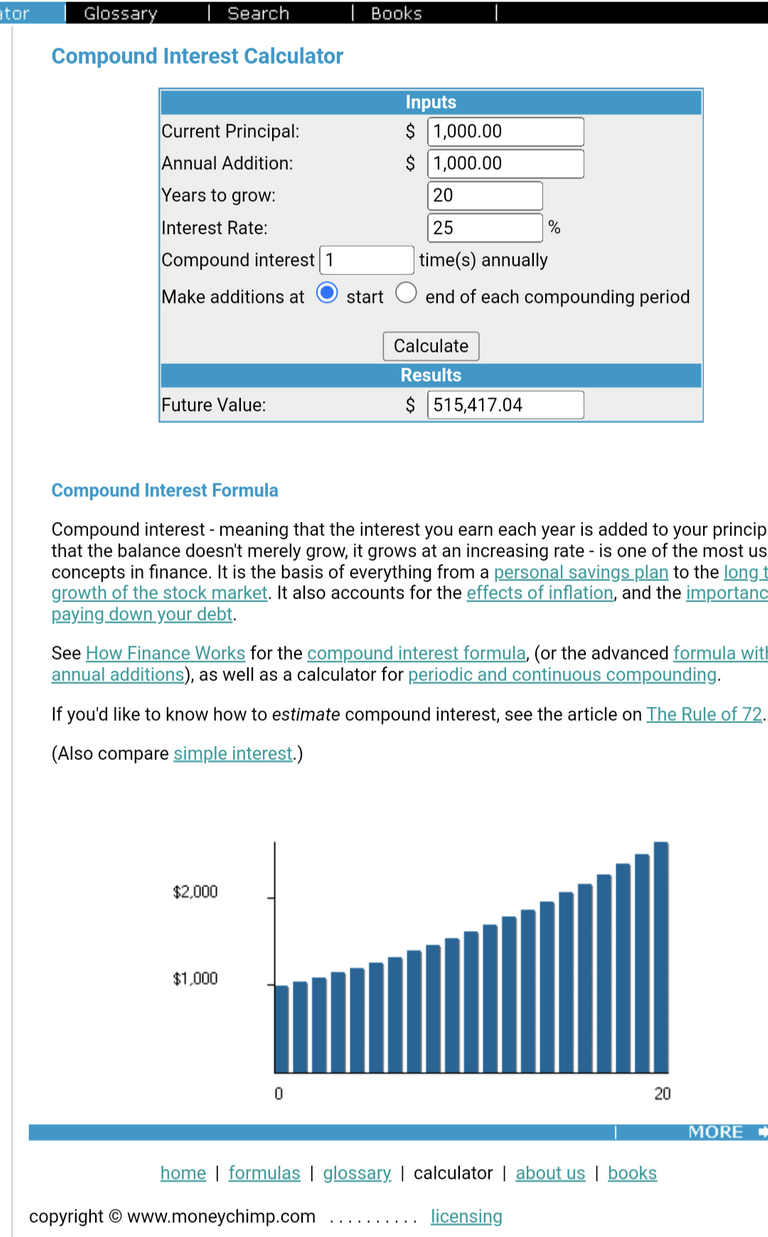

If we take the present HBD (outside the DHF) and extrapolate it out over 20 years at 25%, we get 1.04 billion.

Network Stability

The HIVE-HBD relationship brings up some interesting characteristics. One is that we have a supply that is truly driven by the community. Anyone can create either HIVE or HBD via the conversion mechanism. This means the market dictates whether one or the other is generated.

There is a risk to this. Since HBD is backed by $1.00 worth of HIVE, there is a potential threat by nefarious players to the system if they use market swings to create a lot of HBD and then convert it reverses. It is counterbalanced by the haircut rule which is bring moved to 30% in the next hard fork.

We see increased network stability through the use of the Hive Savings Bond. Since the HBD will be time locked, it is not a threat to the network since it cannot be converted to HIVE until released. With all the information is on chain, it is easy to tell what is being released over the next 30 days.

Hence, we have the opportunity to expand the supply of HBD while not putting the network at much greater risk.

Funding Mechanism

Most are going to look at the APR as a way to enhance our personal returns. However, this is equally applicable to the projects built on Hive.

For example, imagine you develop a game. In this case, one could take $10K and put it in the Hive Savings Bond. This would generate a little over 200 HBD per month. Here we see where the contests or leaderboard rewards could come from.

The same applies to a project in general. Let us suppose it raised $200K. Half of that could be put into the account and earn $25K per year. This would help to fund development, marketing, or whatever other tasks were needed.

We can see this really enhanced by the release of the Hive Application Framework (HAF) which will make development on Hive much simpler.

Pull In Money From The Outside

Having an APR of 25% in the crypto world might not sound like much. However, for those who understand compounding, it is huge. To contrast, Warren Buffett is known as the greatest investor in the world due to the fact he generated a 20% return over half a century.

Going into the 1980s, when interest rates were higher, the fixed income market was a legitimate avenue to pursue. People would buy bonds yielding 12%-14%. It was a way to develop a strong cashflow over time.

For those who are in their 30s or 40s, this could be a very powerful opportunity. If one looks at investing regularly into something like this, the 25% return would compound into a big number by the time one reaches his or her mid-60s. In the US, one can put in about $7K into an IRA. Doing something similar to that over 20 year, at 25%, will turn into millions.

Here we see not only the opportunity to appeal to those investing in stablecoins but also to pull money out of people's traditional accounts that are underperforming. It is easy to see how millions could end up pouring in as people learn about this opportunity.

Create A Demand For HIVE

If this project is mildly successful, it will not likely have much impact in this area. However, if it does take off, this could really alter things.

We see projects that are pooling billions. This is a fairly regular occurrence in the DeFi world. With this, we will not set our sites so high.

However, what happens if we start to move into the tens of millions? Where is all that HBD going to come from? The answer is through the conversion mechanism. Here is where we could see the demand for HIVE increase since people will need that to convert so as to enter the Hive Savings Bond.

This could actually further reduce the amount of HIVE outstanding.

Hive Accounts

Anyone who wants to partake will need a Hive account. This will help to expose more people to the ecosystem.

At the same time, there will be Resource Credits required. Here we could also see some increase in the demand for HIVE as people need to get some to power up in an effort to operate.

With increased transactions comes more need for those ever important Resources Credits. Someone has to create them by powering up.

Risks

There are risks to everything and we would be remiss if we did not cover them.

With this opportunity, we are looking at a very low risk ratio. In fact, it is as safe as one can get.

- No Longer Backed By $1 Worth Of HIVE

The Hive Backed Dollar is backed by $1 worth of HIVE. When the ratio of HBD to the USD value of HIVE goes to an extreme, this could be broken. It is the reason for the haircut rule which adds a layer of risk. Of course, that rule is in place to allow the system to self correct if it gets close to the limit. With the next hard fork, this is going to be raised, furthering reducing this risk.

- Hive Shuts Down

If the blockchain completely stops, there is nothing to access. While this is unlikely since it only requires one person, somewhere in the world, running the software, it is a risk. If Hive disappears, all that is one it goes away. The same is true for any other blockchain.

- HIVE Goes To Zero

The old saying of anything multiplied by zero is still zero.

If HIVE becomes worthless, than what it is backing, by definition, is also worthless. It is only possible to claim $1 worth of HIVE for each HBD if HIVE has some value.

Again, the likelihood of this happening is almost nil but it is out there in the realm of potentiality.

In Conclusion

Cryptocurrency is filled with people who are looking to get rich overnight. Everyone is looking for the "moon" token, one that will lead to Lambos and islands.

We saw another phase development where stablecoins emerged as a means of parking some of those profits. As risk-off took hold, many moved to stablecoins to preserve the gains. At the same time, some of the yield farming projects arose, providing some return.

However, few are fully focused upon the Decentralized Fixed Income Market. This is a place where Hive can easily set up camp. We have the basic infrastructure in place with the Hive Savings Program. Now it is just a matter of expanding it, adding another layer that includes the time-locked feature.

Essentially we are looking at a base-layer project with very low risk while offering a very strong return. It appeals to a different type of investor as compared to the one who is out there setting his or her hair on fire and throwing caution to the wind. While not as exciting, it does provide a solution for a larger portion of the investing public.

What are your thoughts on the matter? Give us feedback in the comment section.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I think this is another step in the right direction for the chain. This will allow to give more options to the users and improve the use of HBD. I definitely think this will increase the use of Hive as not just a social chain but an investment chain.

That is very true. The entire idea is to make Hive an option for people's money. That said, unlike a lot of DeFi, with Hive, we are dealing at the base layer. No applications, no outside wallets, not additional tokens.

Just what is resident at the base layer (HIVE and HBD). Plus it is powerful if Hive can get a footprint in the fixed income market.

Posted Using LeoFinance Beta

The Hive Savings Bond is an interesting idea. Since the funds (in this example) would be locked for a year it would be neat if there was a way that they could operate the same way Hive Power does or at least add to the Hive Power mechanism somehow. I have no idea how that could be achieved but it might be an interesting thought experiment.

Totally different utilities and user cases.

HP applies to governance and influence on the blockchain. HBD has nothing to do with that. Tying it is would only devalue one against the other.

With options comes choices. People will need to choose between getting the return in HBD versus having influence on chain by scooping up HIVE and powering it up.

We all have different motives and needs. Hence the more options will cater to a wider cross section.

It is just like the Hive savings versus the bond, liquidity or return: people get to make that choice but there is a trade off.

Posted Using LeoFinance Beta

Yup I am aware of this:

I am picturing (in this thought experiment) some of the interest from the bond being distributed as Hive Power.

I get where you are going with this. Say give an option like a post, but the option would be 50/50 HBD/HP or 100% HBD instead of a post where it’s the other way around.

Yeah something like that. Maybe even use the hbd.stabilizer during the conversion process.

I'm now looking for yield farming models that are shorter than the APR time horizon, would it be possible to take out the bonded HBD per month? I'm not touching my savings at all now cause there's the fear of losing out the amount that would be paid out for me after one year at around July, so I was happy there was a rise from 10% to 12% at least a bit, something

The interest claim would be monthly just like the savings. The principle, however, is locked up.

Once the interest is claimed, the individual has the choice to invest that back into the bond account, go to savings, or use the HBD to buy whatever.

Posted Using LeoFinance Beta

Could you see liquidity from this being tied into the SIP @taskmaster4450?

Why not stagger the return? A 3 month lock, a 6 month lock, a 12 month lock? The investor can withdraw at each lock point, but the return percentage is different. Also, if it's a 1 year lock, is there a penalty for withdrawing early? Like a CD penalty?

Adding different layers with different yields is something that can be looked at in the future. The key is to get one thing started and take it from there.

But you are right, there is no reason why other terms cannot be added. We can create an entire fixed income investment tree.

As of now, it is the commitment for the 365 days. Something could be added later or a second layer solution might actually be created to get these assets liquid. A few different ways that could go.

Posted Using LeoFinance Beta

Maybe the term can be assumable by someone else. For example, the remaining three months can be sold to someone else. As long as the remainder is purchased, the HBD stays locked up. The seller has liquidity and the buyer has a guarantee rate for a shorter term.

I think it's a valid option. Will we have something similar to the bond market where people can sell off bonds if they need to liquidate without waiting for the yield?

Posted Using LeoFinance Beta

At the base layer, no. This is a true lock up in return for higher return. If one wants liquidity, the savings option is the route to go.

That does not mean people will not set up second layer options. If this became very successful, I would imagine people will develop some type of collateralized system to put it to use. But that would be up to the innovation of some of the entrepreneurs.

Posted Using LeoFinance Beta

There's a whole bunch of stuff here that has a lot of appeal, but the one thing that increasingly ran through my mind as I read this is the reality that this starts looking more and more like a SECURITY, and that might suddenly start attracting the attention of regulatory bodies that will want to try to put up fences, restrictions, stumbling blocks and scrutiny we perhaps would rather not have.

Hence, I think the vast majority of what you are talking about here is very attractive, but I would leave it on the long-term burner — perhaps even developing it as far as being a "turnkey" project — while taking a step back to simply observe how the crypto-regulatory "cookie" is going to crumble, over the next few years.

Absolutely, "Hive is decentralized," but I don't think we can afford to be too smug and complacent about it and attract unwanted attention before attracting a lot more wanter attention.

In the meantime, maybe a "hybrid" system more along the lines of legacy banking CDs... there's a "spot (cash) interest rate," and a "one month" rate, and maybe a "6 month rate" and a "Year" and "five year" rate.

You can take your HBD out anytime you want, but you forego all incremental interest + some additional percentage as a penalty for early withdrawal. The accounts should still have a "live ticker" showing your current earnings, so people would know exactly they'd be losing if they took out their balances early.

=^..^=

Posted Using LeoFinance Beta

I think the point is that Hive is very hard to regulate. There isn't a central entity, no corporation etc. How can one regulate something that is essentially code? The only way I see is that it could be delisted on CEXs or be "banned"/blocked from the internet which is not really possible.

I am all for it and really do hope this gets rolled out soon. 20% or 25% is massive and doesn't really matter what age you are you cannot afford to not be involved in this. I have always said when Hive goes up in price I will convert Hive to HBD as this is a no brainer.

Posted Using LeoFinance Beta

I agree. To me, how can someone afford NOT to have this at part of their portfolio. Certainly one doesnt want to put all in this but having a bit in is a wise move.

I am not sure if most realize how much wealth can be generated by 25% APR over the period of 10 or 20 years. For those young enough, it is going to be a tremendous opportunity.

Posted Using LeoFinance Beta

Here are some nice examples of what can be earned from $1000 down + $1000\year..the 50 year scenario is close enough to buffet money for me...

It's a great idea, imo.

@klye promised us a second layer that could collateralize this, but hasn't delivered it, yet.

The Howey test doesn't seem to to be applicable.

An investment is a security if all 4 apply:

3 and 4 clearly don't apply.

I'm guessing the coding and testing would be minimal.

Any hope of it making this hardfork?

Don't push @klye, he's cool brAh

lol'd.

No need to defend my ass. But I appreciate the sentiment. <3

I got emotional, happens to the best!

This could be done in solidty once HSC goes live.

I'm off to my first round of physio tomorrow and few off HIVE prijects to round up then I can pivot back onto majority HIVE dev.

Wonderful, I think collateralizing the bonds would be a good thing, hp, maybe less so.

I am in full agreement with this and think it needs to be looked at by @blocktrades or any of the other main core devs as an upgrade option. This would really set Hive apart because it is all at core levels.

And the payout in HBD is the way!

Love all this!

I just wish there were more off ramps for HBD. But I pretty much have that covered through Tribaldex and #hive-engine where I go from HBD to BUSD then out through Binance.us. Actually the cheapest off ramp I have found. I really only lose a small percentage in the transfers. Much less than trying to go out through Coinbase.

Can always switch HBD to HIVE and then go through some of the channels too.

Posted Using LeoFinance Beta

I like going out through stablecoins... no capital gains to deal with, lol.

Just the right muse at the right time. Soon, we could think of Hive bank where one can lease HBD to fund projects.

Posted Using LeoFinance Beta

That could be something built on top if someone decided to. Collateralization could certainly be used as a second layer solution.

Posted Using LeoFinance Beta

The fact that the asset can be cross collateralized almost infinitely makes for a compelling proposition.

Of course the danger that comes with that is the same as what happened in 2007-8 with the housing market.

Cross collateralized assets from other tokens should be thoroughly examined before being accepted into the program thus avoiding lumping a pile of shit coins into the proposed hbd bond.

Other than that point I think the hbd bond is a brilliant idea. Well explained.👍

Wow, this is great! It would be a great addition to the Blockchain. It's high time for HBD to stand out there. We need it too. Plus this would help hive big time. Once Hbd becomes stable, I bet it will attract many big players .

Also, it could help disciplined savings, if it is totally locked. (Maybe for me actually).

Well people will have the choice. Do you want to lock the HBD up, or not. If one wants liquidity, then savings is the choice. This is contrast with yield hunting. If that is the option, then it exists too.

We give people choices and let them choose what fits them best.

Posted Using LeoFinance Beta

I definitely think there is a tremendous potential behind HBD that we are not utilizing. I think that if mass adoption and shift to cryptocurrencies is to occur, regular people will use and put their money in stablecoins.

As you say, we need far more HBD printed for this to happen.

One thing that concerns me with the bond proposal is that it creates complex mechanics where there can be a lot of gambling into the future that creates systemic risks for the entire network. We see this in economies. Huge amounts of capital locked up in assets that are seemingly very secure, but at one point it turns out they are not, so a domino effect happens. It bothers me that these scenarios can be brought into crypto, and especially into Hive which I would like to see as a far superior and more stable economy than the other ones out there. Gambling with buying and selling bonds (debt) for a year or many years into the future, which is where I think you are going with this, creates that speculation where everyone gets in on the high-paying asset and all of a sudden there is a huge amount of outstanding debt and this creates systemic risk.

With that said, I am all for the spirit of what you are going for here, I just don't think buying and selling debt will serve us well to get there. I think we can get there (print tens and hundreds of millions of HBD in the next 2-3 years) by using what we already have in place. I really like the system we have where witnesses can set the HBD interest rate at will. This creates a highly intelligent (far better than code) and responsive (in pretty much real-time) system. So, when the haircut rule is increased to e.g. 30%, might the witnesses not increase the HBD interest towards 20%? What about 30%? And go even higher, 50%. What would this accomplish? First, it will print more HBD. Then, it will increase demand for HBD, which will increase its price. As HBD's price goes up, the moment it reaches $1.05, it will start to make sense for people to convert Hive to HBD, which will begin to greatly increase the amount of HBD in existence. The higher the APR, the higher the demand, the more HBD gets printed. This will also create a large demand for Hive, increasing its price as well. And also, it will serve as a great marketing tool to make the name of Hive reverberate around the crypto sphere - who the hell gives a 50% APR on a stablecoin? It will also be a chance for us to point out the advantages of Hive, so many people who care about those core principles will discover what this place offers, besides having incentive to move capital here.

What's great about this is that the witnesses can keep increasing the APR gradually and seeing the effects of each increase. Are things going how we want? If so, keep increasing. If not, then revise. The goal would be to print hundreds of millions of HBD (or more), push Hive's price up a lot, and make Hive's name become very popular. Then the witnesses can start bringing down the APR when they see it is at a level that's not sustainable and that's not resulting in the additional printing of HBD.

Again, the goal of this would be to print a huge amount of HBD in the next 2-3 years. When accomplished, there will no longer be a need for such a high APR.

And then, we would have to ask ourselves - if there is this much HBD in existence, will it stay that way or will people convert back into Hive? I guess this depends a lot on what use cases for HBD there are. If there are good use cases, the HBD will stay there and be used. With a lot more HBD in existence, this will open up new use cases, for sure. The high APR and demand will create new exchange listings. So people will be highly incentivized to buy HBD and simply keep it in savings for a nice APR like 12%. Everyone with a lot of money will love this, and the popularity, stability and amount of HBD in existence (if we achieve it) will give them the confidence to put their money into HBD savings.

But this is just one idea, I'm sure there are other, better ones. The point is however that we aren't even scratching the surface of what we have - a decentralized system where the witnesses can specify, in real time, how the HBD system functions. I find this far superior than hardcoding any ruleset. We could easily increase the APR the more time a person keeps their funds into savings, or incentivize any other kind of behavior.

That is true that the witnesses can raise the APR on savings. They can do the same with the bond.

The difference is that HBD created through savings is still a threat to the system since it is basically liquid.

With the bond, there is a lock up, creating more HBD yet not having as a threat to the stability of Hive.

As for trading bonds, you might be right. That would be a layer 2 solution that would be technically outside of Hive. Would it drive more people to speculate and get involved, I dont know. Nevertheless, the base layer still operates the same with or without that step: lock up HBD and get an increased return.

All interesting ideas and there is the flexibility being built in. For example, the witnesses, if they desired, could push the bond to 50% and savings to 30% (or whatever numbers they choose) based upon the success of pulling money in versus not.

Posted Using LeoFinance Beta

Hmm, don't we want to create more liquid HBD instead of locked up HBD? What would the value of locked up HBD be? People can't use it to buy and sell things.

And why does more HBD pose a threat? If it does pose a threat, then locking up the threat just postpones it a year or more, so the threat is pushed into the future but the time will come when the HBD will become liquid, and then what would happen? I would be unsettled holding my money in a network that has huge future debt.

Maybe we can find a way to mitigate the threat (If there is one) in the present time instead of pushing it into the future.

The blockchain has the haircut rule which stops printing HBD once a debt threshold is reached, and to me this sounds like a good preventive mechanism - if we go above the haircut, no new HBD is printed, so the only way to print new HBD would be to increase the price of Hive or to reduce the HBD supply. From your proposal, though, I am guessing you don't think the haircut serves as enough of a protection against creating too much HBD that can't be paid back in Hive.

The haircut rule does provide the buffer. This actually enhances that since there is more HBD out there yet cannot be used as an attack vector since it cant immediately be converted.

That is true, if the dynamics stayed the same over time. However, since they change, we would not be in the same situation. For example, there demand for HIVE is likely to start increasing over time as more applications and games start to be developed here. Hence, the delayed period might have different ratios as compared the first time period.

Ultimately, you will end up creating more liquid HBD. As more people get involved, the amount in the "bond fund" will grow, throwing out more HBD. This will come out as liquid, which people than can decide what to do with after they receive it.

The biggest difference is what comes after the introduction of this. What innovation follows suit? There is still the liquid option in the savings (well 3 day lockup technically) and one that is longer term. The witnesses set the rates and can adjust them.

However, from an investment perspective, I cant lock in anything in savings. If it is 12% today and the witnesses move it to 10%, then as soon as I claim my rewards, I am at the new rate. With this, people can lock in their rate for a year.

Posted Using LeoFinance Beta

I of course also see a lot of increased demand for Hive in the future but to create huge oustanding debt, betting on a large increased demand is another thing altogether. There could be crypto winters, all sorts of impacts from regulation, geopolitical events, unknown security vulnerabilities discovered, who knows what. What if the bonds are very successful and we have e.g. $100 million or more in outstanding debt? People will expect the HBD to become liquid after 2-3-5 years (or however many), at which point it could be converted to Hive and sold, which would push Hive's price down. So we'd have a situation where the price of Hive is expected to potentially go down significantly as the HBD becomes liquid - not a stable situation, in my view. We need stability if many apps are to be built here.

Sure, if the bond interest rate is fixed and not changeable by the witnesses. But such a fixed rate will probably create another vulnerabilities. In addition, the savings locks up my money for 3 days only, so if witnesses move the interest rate down, I can just pull my money out and put it somewhere that suits me better. The bond locks up my money such that I can't reallocate it to great new opportunities, which there are many of in crypto.

Savings has all the advantages of the bonds but without the disadvantages. Am I missing something? The main disadvantage of savings you mentioned was that the HBD is locked only for 3 days so it can be taken out and potentially create instability if people rush to convert all that liquid HBD for Hive. So maybe we can look more carefully at the protection the haircut rule creates and whether we consider it sufficient. I guess you are going for enhancing the haircut rule by locking up the HBD for long. Maybe we can enhance it in some other way that doesn't have the abovementioned disadvantages.

I guess we are both talking about increasing the inflation of the virtual supply (Hive + HBD), which can result in a downward pressure on the price of Hive if people come in with capital, reap the interest and sell it. You want to counteract this tendency by locking up their capital for years, so there wouldn't be much downward price pressure on Hive except coming from the interest, and betting that in the future the demand for Hive will be greater so the unlocking of the HBD would not be a problem. Well, what if instead we thought of a way where people can put their capital here and reap a big interest, but as they do so they immediately help the ecosystem. In other words, instead of locking people's capital in order to prevent them from simply harvesting and selling the increased inflation, which creates a benefit for them at the expense of the network, how could we put their capital to work for the benefit of the network? This way there is a win-win instead of sucking value out of the network. Any existing financial instruments that create a substantial use case and benefit from people bringing in their capital?

yes, yes and yes! 25%, even the current 12% is amazing... I am all up for this innovation :)

To me, it is a good layer to the fixed income market forming on Hive.

It might appeal to people outside to draw in more people.

Posted Using LeoFinance Beta

exactly, and I think it has taken us this long to realize that with these kinds of incentives we can actually finally pull in more users which also solves the exposure problem of Hive

Very interesting. I was thinking that 25% seemed kind of low at first, but then I got thinking about Anchor and Luna an all of that and I think that seems like a really reasonable number. The problem for me would be holding HBD liquid long enough to put the desired amount in there. Usually I always succumb to the temptation of just throwing it into the savings.

Posted Using LeoFinance Beta

Yes it might be too low but there is always the possibility to add other layers at a later date.

For example, can go to 30% for a 2 or 3 year commitment, something like that.

Posted Using LeoFinance Beta

Yeah, that makes sense. Things move so fast in this space that I was thinking 25% would be more of a six month lock up. Then bump it up for a year or more. It is all fluid. If they decide to move forward with it I am sure they will find that sweet spot.

Posted Using LeoFinance Beta

This is essentially a CD with a 25% yield and only a 1 year lock!

This is an insane opportunity for the chain and for the users.

I'm liking the sound of this. Tradable bonds on a second layer might be an interesting option but with a 25% yield secured by the first layer we have an offer unparalleled in crypto or legacy finance so far as i know.

Make it so!

I agree 100%. It is a tremendous opportunity.

A layer 2 solution to trade could be very interesting indeed. That would provide liquidity, albeit off chain, and could create a market for them.

The possibilities to keep adding are amazing.

We also could end up adding other layers; longer lock up for higher rates if we see the need for HBD increasing.

Posted Using LeoFinance Beta

Hive Savings Bond sounds like a good strategy. If it becomes something of trade golden ticket, which would make more companies and the enterprise attracted towards the stablecoin. I hope blocktrades also allows HBD to Binance USD stablecoin swap in it's interface, it would make buying CUB easier.

That would one to direct at the BT team. Not sure but in the US there are all kinds of headaches with Binance.

Posted Using LeoFinance Beta

Hbd is awesome. I know you mentioned that it can go to zero if hive is not worth anything. Crypto is risky so best thing is to stick to what you know. At least with hive there's been a ton of improvement and really amazing team behind it. There been so much transparent behind it. There's much potential !

It is always worthy to mention the risks.

With this, I view it as very small.

Posted Using LeoFinance Beta

It all sounds like a bloody good start to me. I see a lot of potential for HBD, Hive too, but Hive itself is already on the right path in my eyes. HBD though, I think it deserves a bit more love and attention.

This new idea about the Bond does make things a bit more interesting. And if both the current flexible Savings option and the Bond option are available to the users, then I just see HBD getting more attention. More people coming in to invest in HBD, for both long and short term, which in my eyes is much needed.

Also, 25% APR is no joke, whether it be an ALT or a stable coin. Since HBD is backed by Hive and does tend to move up and down a bit, therefore 25% does sound quite good. Even I myself see some proper potential and wouldn't mind locking up some HBD for a year or two. And as you mentioned about compounding, if it is all done right and if Hive does keep on growing as it is now. Then there's surely some huge potential long-term for the ones investing in HBD.

From whatever amateur level knowledge I have about Hive and Crypto itself, that's probably all I can add to the topic, my 2 cents. Cheers 🥃

Thanks for your reply.

I am not sure if you get this point but the movement of HIVE, up or down, as it pertains to HBD is not relevant. If the price goes up, then less HIVE/HBD is given on conversion. When HIVE goes down, more is received for each HBD.

So the swing in price only affects the amount one receives in HIVE, not the value of the backing. That is where the stability is designed to come from.

I agree, it does make it more attractive to people both inside and outside of Hive.

25% is a strong return with little downside risk.

Posted Using LeoFinance Beta

Ahh, didn't know that, learning something new everyday haha.

25% is really good, whether it be just Crypto or out there in the "real world". Combined with compounding, it can give back some impressive returns.

25% will create a lot of wealth over time for those who know how to use it and seek to compound.

Posted Using LeoFinance Beta

YES SIRRR, absolutely no doubts there. 🥃

I am confident those chains which have a great number of benefits in stablecoins will end up succeeding. I am even more convinced if those stablecoins are algorithmic instead of backed by centralized entities. We can take a look at Terra and its UST main stablecoin getting its USD pegged out of an algorithm and adding the Anchor protocol offering almost a 20% APR paid in UST.

I see Hive has a potential opportunity there, our user base engagement is the strongest, things are growing strong with games such as Splinterlands and now with the expansion of Leo finance with Polycub and some other EVMs coming, and finally with SPK Network launching quite soon.

Adding a 25% APR product on a Stablecoin will bring us to the highest yield for a stablecoin, if we spend some effort communicating it, we may see some big whales adding some of their liquidity into Hive and helping grow and stabilize it.

All I can see is the benefits out of it with basically the same risks as any other blockchain. But considering the old Hive is, and how it has been growing, I think it is a great opportunity to consolidate the ecosystem growth.

It is true it will take promoting and talking to others about it. The first leg will be the community stepping up and moving some of their resources onchain. That is where the first wave needs to come from.

With a strong APR and little downside risk, it should be appealing to a lot of people.

Posted Using LeoFinance Beta

@taskmaster4450

Is it true the same for bitcoin:

If the blockchain completely stops, there is nothing to access. While this is unlikely since it only requires one person, somewhere in the world, running the software, it is a risk. If Hive disappears, all that is one it goes away. The same is true for any other blockchain.

If the electricity for the entire world goes off for let's say 2-3 hours, I mean 0 electricity at all...

That means it will delete all the crypto and blockchains there if I understand it well...

Is that right....?

Thank

The same would hold true for Bitcoin, if one person runs the software, the chain keeps going albeit not very secure at that point.

It wont delete it but the chains would run. But then again, neither would the banks, supermarkets, or most other parts of life.

If all electricity went down, bigger problems than cryptocurrency.

Posted Using LeoFinance Beta

@taskmaster4450le

Yep aggree :)

There are bigger problems if that happens...

So if something of that type happens, that means once we have the electricity back on the blockchain will continue running as normal?

If it's stored at the same time at the node of each miner...

It will continue running from the block before the electricity goes down...?

Thanks in advance...

Namaste :)

I think this is in principle a good idea, but there is another risk. At the moment HBD is not a major source of Hive inflation because HBD savings are a very small part of the overall supply. If these bonds got very popular, they could quickly become a major part of the supply, and substantially increase Hive inflation.

As such, yes I think it's good as long as -

That is true. However, the risk is minimized because a portion of the HBD will be locked up and hence not able to be converted.

And the haircut rule is still in effect.

Posted Using LeoFinance Beta

It's not locked up forever. After a year, if HBD bonds proved highly popular, you could end up with substantially faster growing virtual hive supply (which could become realized into real hive supply over time).

How can one person shutdown the chain ?

One person can. It only requires one person to run the software to keep the chain going.

Posted Using LeoFinance Beta

I thought the other way :) Thank you for the response.

Would be ideal if we had liquid hbd pairings on external exchanges other than bittrex. Ideally usdt/hbd, usdc/hbd, busd/hbd pairings.

I fully support high yields and locking funds for 3 month, 6 month, 1 year, 2 year with various APRs with ideally weekly or twice monthly distributions (for cashflow smoothness would be better than monthly)

25% over a long term would go a long long way towards financial freedom or relieving some financial anxiety for a lot of people. I'd definitely buy more hbd if 25% was available for locked in few months or longer

The highest stable coin percentage I've seen when looking was 16% so far on celo-Euro

Certainly we need to look at different ways of getting HIVE and HBD from external sources. However, those exchanges are based upon demand. Since the demand isnt high, they overlook it.

Creating some use cases could well up the demand, pushing some to accept it.

Posted Using LeoFinance Beta

YES! I would love this to become a feature!! Blog, claim rewards in 7 days and then add to savings all in one place.

Well you can do that already. There is the savings account paying 12% which can receive your blog rewards.

Posted Using LeoFinance Beta

I like the idea, it would really open the doors for new investors looking for a stable currency in which to obtain a return. On the other hand, the utility for this specific addition, would be excellent, there are many ways to use this personally or for a project. I agree with this.

I have a feeling people will get creative with it. This is something that we can really promote too.

Like anything, one person gets innovative with the use case and then others copy it.

Posted Using LeoFinance Beta

Exactly, if we think about the usefulness and use cases, there can be many, but in general, I agree with this implementation.

12% is great but double that would be wonderful and would attract a lot of

investors as well from outside of Hive. Great idea hope this idea takes off.

I would think so. Hard to beat a low risk, 25% return.

In fact, we could be involved and laugh at people who really dont know about it. Think to ourselves "if they only knew".

Posted Using LeoFinance Beta

Lots to think about here but I generally like it. A year seems long but goes by sooooo fast. I especially like your reference to games and how they can generate a return.

Since I have so little at risk or to risk, I would put in $1 a day so I'd unlock every day. But I imagine that wouldn't be an option if this idea really came into fruition.

Posted Using LeoFinance Beta

The idea is that your HBD is locked up for 365 days. So if you put in 1 HBD a day, it would release one a day to you after the 365 days went by. So then you would be on a steady stream of unlocking if that is what you would be after.

Posted Using LeoFinance Beta

Yeah, I understand that but is that fair to the system and be considered trying to game it? Or is that a legit strategy.

Posted Using LeoFinance Beta

I would definitely buy the HBD bonds if they existed. I have no hurry to collect my principal, I intend to live only of the dividends. Having the bonds would allow me to have a steady income every month at a very appealing rate!

Yeah. Depositing HBD and then collecting 25% APR is not the worst thing in the world. I have a feeling it would generate a lot of activity and excite people.

Posted Using LeoFinance Beta

YES!

But I would like the community to push for more listings for both HIVE and especialy HBD.

HIVE with more exchange liatings is still to much centralized with Upbit. At this point the only counter to that would be Coinbase listing.

Without a doubt that needs to be done. I still look at it as the chicken or the egg. Sadly, until we make some noise, we will not get the listings. Of course, to do that, we need the people to access the tokens.

So we just have to keep pushing in all the different ways. It is a slow process but getting some money staked could really help a great deal. Then we can promote that too.

Posted Using LeoFinance Beta

At the general level I agree with this proposal and I believe it's a needed step forward in making HBD truly powerful.

There are a few details I'd like to address.

Locked HBD benefits of fixed yield for 365 days or that can fluctuate if witnesses change the interest rate?

The second situation. One locks up small amounts of HBD regularly (like daily). In 365 days before the first one expires, we would have 365 time-locked HBD contracts to manage for that account. That could be significant. So, some edge cases need to be considered.

Yes that is part of the deal. The rate at the time of deposit of HBD would carry through all 365. It will not fluctuate.

That info is available on the blockchain so the front ends would be the ones to sort that. Perhaps some drop down menu that allows one to look at a calendar. Maybe Hivestats could do something.

The point is it is all on chain so it is just a matter of someone building out something that reads is for the users.

Posted Using LeoFinance Beta

You just never know what will be developed on Hive next, the potential here is amazing vast. I feel we are going to look back at this time in the future and recall being part of the growth we will be enjoying in the future.

Put all this into action and imagine the success of Hive, also imaging the sink it will have on HIVE...

Posted Using LeoFinance Beta

It is an idea to try and position Hive to take advantage of the fixed income market. We need a lot of HBD to truly become a legit stablecoin and have it used for commercial purposes so lets create it in a way that actually stabalizes the blockchain.

So far, the response is favorable.

Posted Using LeoFinance Beta

Hive Savings Bond- Is it proposed feature or ready for everyone to use?If it's ready for use (production) - How do I create a Hive Savings Bond?

~~~ embed:1501947678648717314 twitter metadata:ZWR3aW5nMzU3fHxodHRwczovL3R3aXR0ZXIuY29tL2Vkd2luZzM1Ny9zdGF0dXMvMTUwMTk0NzY3ODY0ODcxNzMxNHw= ~~~

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Love the premise of this plan. Seems to me very similar to what Terra is doing with their Terra & UST tokens and their different protocols like mirror and anchor. AS an American investor, the only thing I'm slightly concerned about is the lockup period, as there are some differing tax implications when you are in an open-ended savings instrument vs. a fixed-time savings instrument. Looking forward to more details about this implementation, and I feel like this is a great avenue to entice outside investors into the Hive ecosystem/blockchain, as well as incentivize current devs teams to work with Hive.

I had my payout 50% HBD, 50% Hive, and I just changed it to 100% Hive to build up my power about a week ago. But if I could lock up my HBD for a year for 25%, I would change my payouts back to 50/50. This change would probably change the entire structure of how I invest. Because I don't know much about a lot of projects, I would probably be looking into moving a lot of what I have in other projects over to HBD to lock it down. I love the idea of knowing for sure I can get 25% in a project that I'm familiar with.

This is true of anything no matter whether it's in the real world, web2, or web3. It's always a possibility that something of value could change direction to no value at all. Which is why it is always a good reminder that something only has value if it both exists and we all agree it has value. Thanks for another thought-provoking post. Cheers!

💪🏻 Amazing idea @taskmaster4450 and a really well balanced article with chances AND risks. If that works out, I think I have to accumulate some HBD then though my plan was to convert everything I get into Hive.

View or trade

BEER.I like it!

I believe it's the Perfect Idea!

👍🏼😊💸👍🏼💸😊👍🏼

LOL Well I am not sure it is a perfect idea but it does seem sound.

But thanks for the compliment.

Posted Using LeoFinance Beta

Well, I think You covered it quite well, and it really should get the interest thing going!

👍🏼👍🏼👍🏼

I would think so. It is something that seems like a good idea and a nice way to expand the Hive ecosystem.

Posted Using LeoFinance Beta

Absolutely!

👍🏼👋🏼👍🏼👋🏼👍🏼

I am 💯 percent behind this.

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I think this is a wonderful idea. I believe you posted some thoughts about this idea before and I said much the same. I really like it and think it could bring a lot more attention to Hive. I'd even go further and say we should add multiple yield lengths. 6 months for 20%, one yeah for 25%, 3 years for 35%. I'd like to see this become a reality.

!PIZZA

PIZZA Holders sent $PIZZA tips in this post's comments:

(1/5)

dbooster tipped taskmaster4450 (x1) @thinkrdotexe tipped @taskmaster4450 (x1)

You can now send $PIZZA tips in Discord via tip.cc!

Yes, totally agree with this move. The main issue we need to resolve if we are to get adoption around HBD is to get it on more exchanges and stablize the peg. Once we have a genuine peg, HBD could really take off.

The problem with exchanges is the lack of demand for both HIVE and HBD. This could help to change that.

Of course, with more DeFi options, the need for exchanges (centralized) is diminishing. That said, to pull in big money, CEX accessibility is vital.

We will see if something like this stimulates things on that end.

Posted Using LeoFinance Beta

This would be a tall order on the current chain.. On an EVM based chain though..? 100% doable, I've got some solidity code sitting somewhere that would facilitate this. Only problem is until BT make his contracts or I can get HSC launched and running it's not greatly feasibe.

Hell of an idea though. I'd gladly toss code at this to see the outcome.

The basic premise on the Hive is already in place. We are basically adding a time lock feature to the existing savings account and a different APR. This is not different than what is in place: 3 day lock up in wallet and the witness determined rate.

But yes, to get more expansive will require a second layer solution; things such as collateralization and other aspects. But from the foundation we could build a host of applications to expand the capabilities.

Posted Using LeoFinance Beta

Ah, yes. This is a nice way of explaining the whole thing. Admittedly I parsed the idea wrongly. Thank you for clearing it up for me captain!

Implementation of this on the first layer is likely totally doable, albeit I'm not strong enough at C style languages to attempt this quite yet.

The second layer / network enhancement via side chaining is likely our best bet. My stuff is still in the works, I'm way behind schedule though.

100% support your idea here though. Any useful financial tool / vehicle that can be implemented to make the network, and its sidechains more attractive.. the better.

It's my thought that the current HIVE chain will end up as our "blog" chain.. WIth the sidechains effectively acting as our bridge to other chains / catching us up with the standard.

I agree on the importance of the HBD bonding idea. I think it will have a positive impact on Hive price.

When I look at the HBD bonding concept from an investor's point of view, 1 year seems like a very long term. If there are options such as 20% return for 1 year, 18% return for 3 months, 15% return for 1 month, it can appeal to a wider investor group. Thus, the total average cost of the funding would decrease.

A Hive Savings Bond is a viable project taking into consideration the reasons stated. Certain risks need to be taken in order to gain a better position against other stablecoins. The risk that you run is the same that you get when participating with any blockchain. Therefore I would have no problem saving my HBD for better performance. This would give us better stability in the market

Posted Using LeoFinance Beta