Balaji Srinivasan is a well known technology innvoator, being the former CTO of Coinbase and part of the venture capital firm Andreeson Horowitz.

He has a lot of foresight regarding the technology world. For this reason, it is worthy to consider when he make a proclamation about where he sees things going.

Recently, he posted about the path of AI and Bitcoin. The conclusions were drawn using a couple of different comparisons.

The most important tidbit is he sees hyperbolic moves with both. This is what we will dig into with this article.

Hyperbolic Moves In Bitcoin And AI

Bitcoin, in spite of the most recent pullback went on a great run. Throughout 2024, the leading asset moved up nicely. A larger portion of this could be attributed to the approval of the Bitcoin Spot ETF. We are approaching one year and that is a raging success.

This is one of the factors that Balaji uses to determine where things are going. His metric is gold, something that many utilize since it is in line with the "digital gold" narrative.

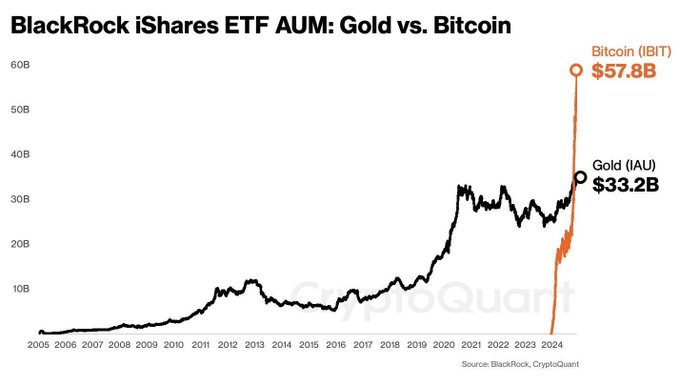

Since Blackrock is the largest player in this field, it makes sense to compare both the Bitcoin and Gold ETFs.

As we can see, the Bitcoin went basically straight up. Certainly, starting at a zero point helped but that is only part of the story. We see a $24 billion difference in the total, in under a year. While gold has a strong move, it is nothing compred to BTC.

With the discussions taking place about making Bitcoin part of the reserve, the inflows are likely to continue.

The big question is what will this chart look like in 2 or 3 years?

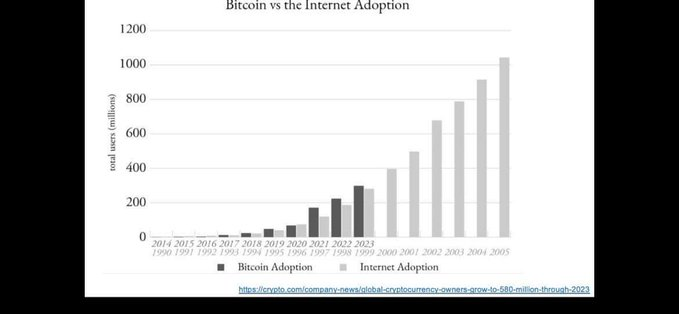

Another way of looking at it is by comparing to Internet users. This is something many did over the years and here is what we see.

It is safe to say that, as an economic engine, the Internet is the greatest innovation over the last 30 years. Yet, we see Bitcoin (I presume wallets) outpacing the growth of the 1990s.

Of course, if we factor all of crypto in, this is likely even a faster adoption rate.

AI: The Golden Goose

With Bitcoin, I still feel we are dealing mostly with a market based asset that is nothing more than price activity. The utility is not going to be great in comparison to other networks.

This pales in comparison to what AI. Whatever the impact of the Internet, and software applications built on it, we are going to see an order of magnitude greater size due to AI.

In fact, some are forecasting that AI agents will 10x the total SaaS market.

OpenAi is considered the leader in the LLM field. There was a recent release which provides a large boost to the overall potential.

Yesterday, Dec. 20, 2024, OpenAI's much-anticipated o3 model set a new record, hitting 87.5% on ARC-AGI public data set. As demonstrated by Balaji Srinivasan, this is a 10x more powerful result compared to GPT-4o, the strongest of ChatGPT's mainstream models today.

In turn, GPT-4o performs 500% better than GPT-3, the model that kickstarted the AI euphoria in 2023.

This is key when it comes to AI.

With most things, we talk about growth rates ranging from 2%-40%. Rarely did we encounter something that exceeds 30% or 40% growth for long. Startups can do this but they usually settle down in a few years.

With AI, we discuss this based upon the number of x. Here we are looking at a 10x. With total AI compute, we see a 4x annually.

Economic Singularity

It is interesting that Balagji charted both AI and Bitcoin. Here we see the union of technology and finance.

While I do not think Bitcoin is going to be a large part of this, AI and cryptocurrency are linked. AI agents will operate utilize cryptocurrency as the medium of exchange. We will also see business structures developed where crypto is the stake (ownership) mechanism.

That said, the Bitcoin moves along with the projected path reveal what we discussed regarding the economic singularity. There will be incredible wealth generated by AI. We are going to see hundreds of trillions in economy productivity added over the next decade.

This leads into the idea of us moving towards an economy singularity. This is where we see growth rates 10x (there it is again) that of what we are accustomed to producing. For most of the last century, this was 2%-3%.

What we are referring to is an annual growth rate looking at the 20%-30% range. Consider the implication of that and how at a global GDP chart would look like. It would reflect the charts Balaji posted for AI and Bitcoin.

This is how it all ties together. Hyperbolic moves are going to happen in many areas. People simply need to sift through the noise to drill down to the basics.

We can be the range someone like Balaji is well aware of what is taking place.

Posted Using InLeo Alpha

I'm ready for my bags to make some hyperbolic moves too!

2025 is the year I finally take some profits and buy some land!

Discord Server.This post has been manually curated by @steemflow from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited.

Great piece. I love Balaji, he is one of my original eye-openers, I remember my views about life and world before and after ppl like Balaji, Naval and others... Incredible leap.