Yesterday I met some of my friends and we started drinking and talking about the things that are going on on the world right now of course the state of Europe was the main subject , but what was the most exciting one to talk about was about Investing I argued with one of my friends because we are having different point of view about stocks ( He is into stocks and invests only in the US stock market).

Dividends

Our discussion kicked off with one of the most hotly debated topics in the investing, dividends. My friend was adamant that dividends are an essential part of investing, a view held by many. According to him, dividends represent an immediate return on investment, which can be a reliable income stream for certain types of investors—particularly retirees. He used Coca-Cola as an example, citing how its consistent dividend payouts are crucial for individuals who depend on regular income from their investments. "People love the steady income," he said. "It’s a reward for holding the stock, especially for those not looking to sell."

I argued that dividends reduce the amount of cash a company can reinvest in its own growth, which can be detrimental to long-term value creation. Take Amazon, for instance, They don’t pay dividends, and instead, they reinvest all their earnings into growing the business. That’s why Amazon has become the behemoth it is today. To me, dividends might offer short-term gratification, but reinvesting earnings can lead to far greater long-term gains, especially in companies still in their growth phase.

We eventually agreed that the value of dividends largely depends on the type of company and the investor’s objectives. Established, mature companies like Johnson & Johnson or Coca-Cola may be better off paying dividends, while companies with more room to grow, like Amazon or Alphabet (Google), should focus on reinvestment.

Cash Management

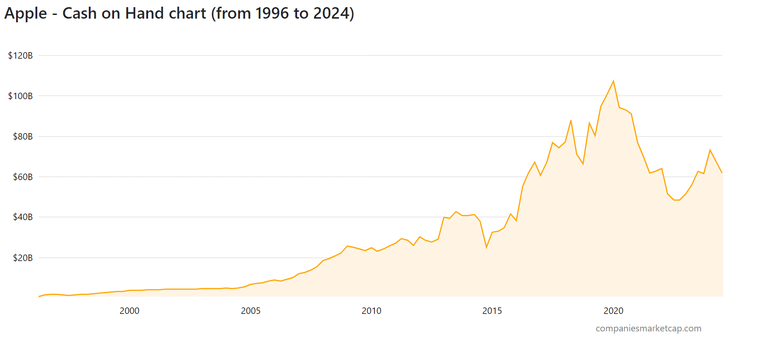

As the conversation evolved, we touched on how cash reserves impact a company’s value. My friend was in favor of companies returning excess cash to shareholders through dividends or buybacks, particularly when they don’t have immediate reinvestment opportunities. He pointed out that Apple, despite its massive cash pile, has been criticized for hoarding cash when it could be giving it back to investors.

On the other hand, I argued that holding cash isn't always a bad thing. Apple’s cash reserves gave them the flexibility to invest in new technologies like augmented reality and AI, I said. They can afford to take risks and innovate, which ultimately increases the company’s long-term value. Companies with strong cash positions, I suggested, have the ability to weather economic downturns and seize strategic opportunities, like acquisitions, when they arise.

We both agreed that the key is balance—too much cash can seem wasteful, but companies also need enough liquidity to remain agile in changing market conditions.

Stock Picking vs. ETFs

The next part of our conversation delved into investment strategies, specifically the age-old debate between stock picking and ETFs. My friend is a firm believer in the ETF strategy, arguing that for most investors, especially those without the time or expertise to research individual stocks, ETFs offer diversification and reduced risk. Look at the S&P 500 ETF, he said. You get exposure to the 500 biggest companies in the U.S. without having to worry about picking the right stocks. Over the long term, it performs well without all the stress.

While I agreed that ETFs are a solid choice for many, I argued that stock picking can lead to extraordinary gains for those who do their homework. If you’d bought Tesla or Apple years ago, you’d be sitting on massive returns right now, I pointed out. Sure, it’s riskier, but there’s also potential for much higher rewards if you pick the right stocks. Stock picking allows you to target high-growth companies that may not yet be reflected in broader indexes, though it does require more research and market knowledge.

Both approaches have merit, depending on your risk tolerance and goals. Those who prefer a hands-off approach with lower risk might lean towards ETFs, while more active investors looking for higher returns might prefer to pick individual stocks.

Managing Risk

Of course, no conversation about investing would be complete without addressing risk management. Both of us agreed that diversification is crucial to reducing risk. A diversified portfolio is your best defense against market volatility, my friend said. He explained how spreading investments across different asset classes—stocks, bonds, real estate, and even cryptocurrencies—can help protect against significant losses in any one area. The 2008 financial crisis was a perfect example: those who had all their money in real estate or related assets took heavy losses, while those who diversified across industries fared much better.

I added to this by highlighting the usefulness of stop-loss orders. Setting a stop-loss can save you from devastating losses. Let’s say you own Microsoft stock—you could set a stop-loss at 10% below your purchase price, so if the stock tanks, you’re out before losing more. It’s a simple tool, but effective in markets prone to sharp swings.

Insider Trading and Transparency

One area we both felt strongly about was the problem of insider trading and the lack of market transparency. My friend pointed out that insiders—like corporate executives—often have access to privileged information that regular investors simply don’t. Look at how Elon Musk’s tweets affect Tesla’s stock price. He can move markets with a few words, while the average investor is left to react after the fact.

I agreed, emphasizing the need for greater transparency in the markets to level the playing field. But we both acknowledged that achieving perfect fairness in markets is difficult, given the advantages some insiders naturally have.

Investor Psychology and Market Trends

Our conversation wrapped up with a discussion on investor psychology and how it often derails even the best-laid investment plans. People panic during market downturns and sell off their investments at a loss, my friend said. He pointed to the dot-com bubble, where fear of missing out drove people to invest in overpriced tech stocks, only for those stocks to crash when the bubble burst.

Adding that emotions like fear and greed can lead to poor decisions. People get greedy during bull markets and pile into speculative investments, then panic-sell when things turn south. It’s all about maintaining discipline and sticking to a well-thought-out strategy, even when market conditions get tough.

The night was concluded with some shots and hugs.

Posted Using InLeo Alpha

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

@tipu curate

Upvoted 👌 (Mana: 47/57) Liquid rewards.