Warning: This is not an investment advice. We will never repeat it enough: Only invest the money you are willing to lose.

Join us on Human-History and @human-history

Help me by filling out a survey. It will only take you a few minutes and it will really help me. Go here

Compte français: @statorcrime

Hello everyone,

We meet again today for my first article on my investments in the stock market

My investment supports

The first one is the life insurance in unit-linked contracts.

Thanks to this banking product, you can invest in several fields like REITs or shares.

Life insurance allows you to benefit from tax advantages after 8 years of ownership, notably an allowance of 4600€ (or 9200€ for couples) per year and a capital gains tax of 7.5% compared to 15% between the 4th and 8th year and 35% before the 4th year.

The second support is the Equity Savings Plan (ESP or in French PEA for Plan d'Epargne en Action).

This product allows you to invest in European companies and is also tax-efficient.

In case of withdrawal before 5 years, the capital gains are taxed at 30% (17.2% social security contributions and 12.8% income tax) and the account is closed.

And after 5 years, the capital gains are taxed at 17.2% for social security contributions and the ESP is not closed.

It is possible to invest up to 150K€ on the PEA excluding capital gains.

Life insurance

I'm going to start by talking to you about unit-linked contracts life insurance, which is the first investment support I used.

My parents opened my life insurance in 1998 when I was only 3 years old. They invested money throughout my childhood and adolescence (especially birthday and Christmas money). This money was invested in life insurance in Euro-denominated funds. That is, with guaranteed capital.

At the beginning of 2018, I really started looking for a way to make my money grow for my future. After some research, I turned to this product.

So I decided to move part of my money from the Euro-denominated funds to the unit-linked contracts in a fund managed by my bank.

Thus, I invested my first 3000 € on June 7, 2018.

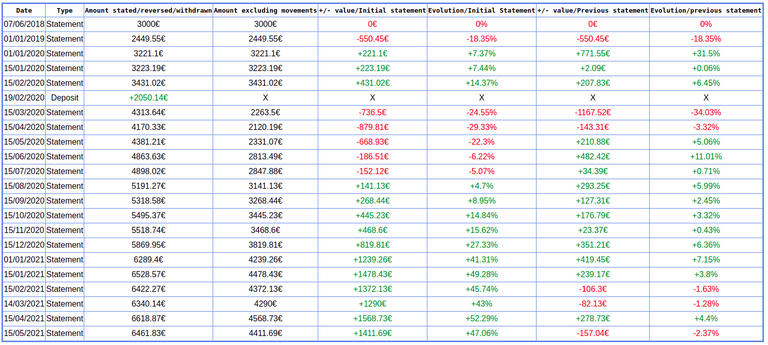

The end of 2018 was not the best. I ended up at 2450€ on January 1, 2019. That is to say a fall of 18,35 %.

As for 2019, it was much more interesting given that I went to 3220€, +31.5% on 2019.

Following this increase, I decided to put back 2050€ on this support in February 2020. So I reach about 5500€ on February 19, 2020.

Of course, you know the rest, health crisis, fall of the markets, ...

A fall so important that I find myself again in the negative at 4170€ in April 2020 for 5050€ invested.

Today, the investment has recovered well. Indeed, on May 15, 2021, the value of my portfolio was 6460€, that is to say a capital gain of 1410€.

I propose you a summary table of my life insurance :

At the time of writing, my internal rate of return is 12.53% and my return on investment is 32.21%.

When my ESP will be 5 years old and I will be able to withdraw money without it being closed, I wish to withdraw the 4600€ which give the right to an allowance on my life insurance in euro fund to move it to my other investments and put the rest on the unit-linked contracts.

In the meantime, I will not make any other movement on this product.

My Equity Savings Plan

I opened my ESP in my bank in October 2019 and I deposited 150€. I bought my first shares:

- Total : The n°1 oil company in France

- Engie : An electricity supplier

- A fund belonging to my bank.

I quickly realized that using a traditional bank as a broker was not interesting at all. Indeed, for each purchase, I paid more than 15% of brokerage fees !

So I turned to an online broker in December 2019 and deposited 1000€ there.

From 2020, by reading books, articles and watching videos, I decided to follow a strategy based on ETF (Trackers)

I invested about 450€ each month and then, on March 12, 2020, shortly after the markets fell, I reinvested 2000€ to take advantage of the crisis.

I went up to 500€ per month at the end of June 2020 and I put back 2000€ in October 2020 in case of a new fall of the markets, which didn't happen.

Since 2021, I lowered the amount deposited and I pay 300€ each month.

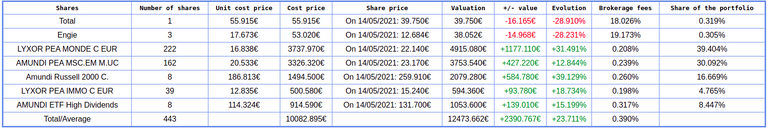

My strategy is quite simple. I chose a list of capitalizing ETFs in order to take advantage of compound interest and I invest in a way that the share of each one suits me. Here is a table with my objectives:

| ETF | Desired portfolio share |

|---|---|

| Lyxor PEA World | 40% |

| Lyxor PEA Emerging | 30% |

| Amundi Russell 2000 | 15% |

| Lyxor PEA Real Estate | 5% |

| Amundi High Dividends | 10% |

I also have cash in my portfolio which will allow me to invest quickly in case of market downturn.

I propose you a table representing my current positions

The purchase price of my shares is 10080€ for a valuation on May 14, 2021 of 12470€, that is to say a capital gain of about 2390€.

At the time of writing, my internal rate of return is 26.24% and my return on investment is 28.47%.

I will write an article on the stock market every quarter so that you can follow the evolution of my supports regularly.

Do you have any questions? Feel free to leave a comment

Did you like the article? A share would make me happy

You don't want to miss the next articles ? Follow me

You like browser games? Join us on Human-History and @human-history

That's all for today. Thanks for reading and have a nice day

Congratulations @statorcrime-en! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

<table><tr><td><img src="https://images.hive.blog/60x70/http://hivebuzz.me/@statorcrime-en/upvoted.png?202106141204" /><td>You received more than 50 upvotes.<br />Your next target is to reach 100 upvotes. <p dir="auto"><sub><em>You can view your badges on <a href="https://hivebuzz.me/@statorcrime-en" target="_blank" rel="noreferrer noopener" title="This link will take you away from hive.blog" class="external_link">your board and compare yourself to others in the <a href="https://hivebuzz.me/ranking" target="_blank" rel="noreferrer noopener" title="This link will take you away from hive.blog" class="external_link">Ranking<br /> <sub><em>If you no longer want to receive notifications, reply to this comment with the word <code>STOPStock Market planning is good to boost your money