Bitcoin fell sharply by 7.8% last week, falling to $60,000, but recovered over the weekend following positive jobs data in the U.S., approaching $64,000. In addition, while institutional investors’ interest in Bitcoin is increasing day by day, the amount of Bitcoin on centralized crypto exchanges continues to decrease. Market data looks quite positive for Bitcoin, which could signal an impending bull run.

Bitcoin is currently trading at $63,568. It's up about 1.5% today and up about 4.5% since Friday. Today, it tested above $64,000 but failed because the selling pressure around $64,000 is increasing significantly, but I think it will test it again in the coming sessions and if it can meet the sales around $64,000, it can move towards $66,000. Bitcoin’s macro outlook looks favorable for a possible price rally, but there is a strong resistance at $65,800 in particular, and if it can break this resistance, it could bounce towards $70,000.

Bitcoin Dominance (BTC.D) continues to rise and is currently at 58.10%. It clearly shows the confidence in Bitcoin in the crypto market. In particular, institutional investors seem to have great confidence in Bitcoin and continue to invest in it steadily.

According to data shared by Glassnode’s X account, Bitcoin exchange-traded funds (ETFs) now hold 911K BTC (roughly $58 billion), which is around 4.6% of Bitcoin’s circulating supply, clearly indicating strong demand for Bitcoin. Bitcoin’s overall macro momentum also looks quite favorable for a possible price rally, and if institutional demand remains strong and selling pressure eases, Bitcoin could bounce to $70,000 or even six-figure prices. However, for this to happen, it must first break the resistances at $64,000 and $65,800 and the investments made must increase even more.

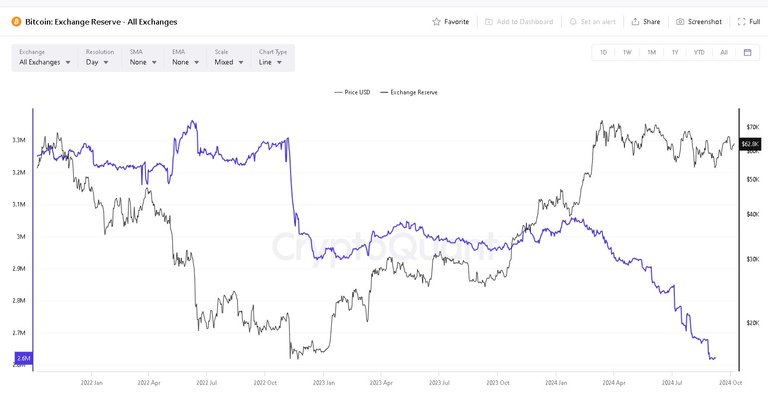

Bitcoin reserves on exchanges are decreasing day by day and according to Cryptoquant data, they currently hold only 2.6M BTC. I think that as the amount of BTC held by centralized exchanges decreases, Bitcoin will rise even more and especially the volatility will decrease even more. And after 2030, I think that the amount of BTC held especially by centralized exchanges will fall below 500K.

JPMorgan (JPM) stated in a research report that geopolitical tensions and the upcoming US presidential election will likely underpin the 'debasement trade', and this favors both Bitcoin (BTC) and gold. The report also stated that Bitcoin and gold will benefit from growing geopolitical tensions and the US elections. Click for source and more.

The US monthly jobs report was released on Friday and showed 254,000 jobs were added in September, well above estimates. In addition, recent data has increased expectations that the Fed could cut interest rates again in November, and if the Fed does, inflows into Bitcoin may increase further.

The data looks quite favorable for Bitcoin to move higher, and if the ongoing institutional demand continues to grow, Bitcoin could make a big bounce in the coming days, but on the other hand, the decrease in institutional demand and the increase in selling pressure could push Bitcoin price down. Frankly, I am very optimistic and believe that Bitcoin can hit a new ATH and even hit six figures by the end of the year. We'll wait and see.

Thank you for reading

@rtonline

This is not investment advice, I am just talking about current developments and only my personal opinions. As with all money markets, anything can happen in the crypto market at any time, so please do your own research before investing.

Posted Using InLeo Alpha

!HUG

!LOLZ

lolztoken.com

It is slowly coming back to me.

Credit: reddit

$LOLZ on behalf of tin.aung.soe

(2/10)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ@rtonline, I sent you an