Greetings to all members of this community, I'm pleased to be here again to share with you on the Theoretical aspect on Order Block in trading the financial market.

We all know that trading the financial market involves a lot of risk and this market can make you rich or make you poor. This is because of the high risk involved in trading the market.

Since two years now, i have been struggling to trade the forex and crypto market just by using indicators but i discovered that i was not making any profit rather made lots of losses within this periods. Based on my pass experience, i had to go back to the drawing board for further studies on how the market are been move by big financial institutions as well as the Central bank.

This is what has made me to learn more and i discovered that having an extensive knowledge on Order Block can make my trading skill more better and can give me an edge in the market. Today i will be dealing with the theory aspect of Order block while in my second publication, i will bring in the full practical for what i will discuss here to be seen practically by making use of charts.

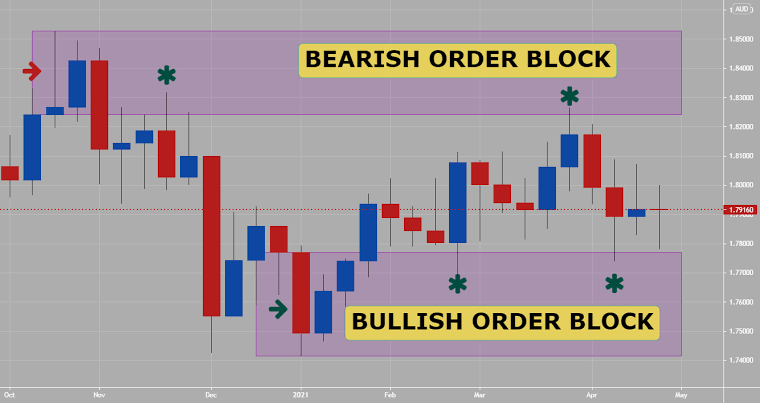

I believe as a trader, you should know what is a support and resistance level in the Crypto or forex market. Now an order block represent a down candle or up candle close to support or resistance levels immediately the upward/downward movement in the market. The very last bullish candle before a downward trend, is known as a bearish Order Block while the last bearish candle before a bullish movement in the market, is known as a bullish Order Block.

The market makers are responsible in moving the price up and down in the market and this is how they make their money. Here, there must be sell orders opened in the market to pair up the buy orders. Note, when the sell orders are not enough to pair up the buy orders, this is where an imbalance/liquidity void in the market occurs. However, it's the responsibility of the market makers to bring price back to the Order Block as to reduce risk in the market. Note, this is also known as where the market bought or sell from.

This movement deceive retail traders to join the market while setting their stop loss (SL) just above the order block while the market makers will manipulate the price down or upward below/above the order block to hit the SL set thereby closing their opened positions in the market. Immediately after this SL has been taken, the market will reverse and continue in the right direction.

HINT

An imbalance must have some valid test before it can be considered approved on the Oder Block. that is; from the breakout zone, you want to see a candle stick that is 3:1 or 2:1 before we consider that order block valid.

Movement Zone

Whenever you see the resistance area in the market becoming support, that is a good point to buy or go long the market.

Now for you to buy at any given support, you should see a liquidity void as explained above. You have to check the candle stick strength that breaks the support area before locating the order block.

Note, zones which has been tested many times, is where the market makers always come to reduce their risk. This is equally known as significant support and resistance as this is the zone where we ally set our stop loss as retail traders while the market makers drop the market lower and take out out SL, while they reverse the market upward.

So you only have to wait patiently for the market to take out liquidity in the market near support or resistance level and at reversal, you can set a buy order or a sell order to enter the market. The reasons for using this orders is because if the market could not come to that point, your buy order will not be triggered and this will safe you unnecessary losses in the market.

In conclusion, having a full knowledge on order block can change your trading to a better one that generates profits to you. Remember all the points that makes a valid block and the analyses should be in a higher time frame while we carry out our trades in lower time frame.

Thank you very much for reading through my blog. Please if you have materials that will enable me to understand more on order block or trading as a whole, please kindly share with me.

Do well to drop your comment on what you think is a valid order block. I remain your guy @justiceanietie.