Hello everyone welcome to my blog where you get improved as you read along, i still remain your lovely host @lordwealth, giving you the juice with words.

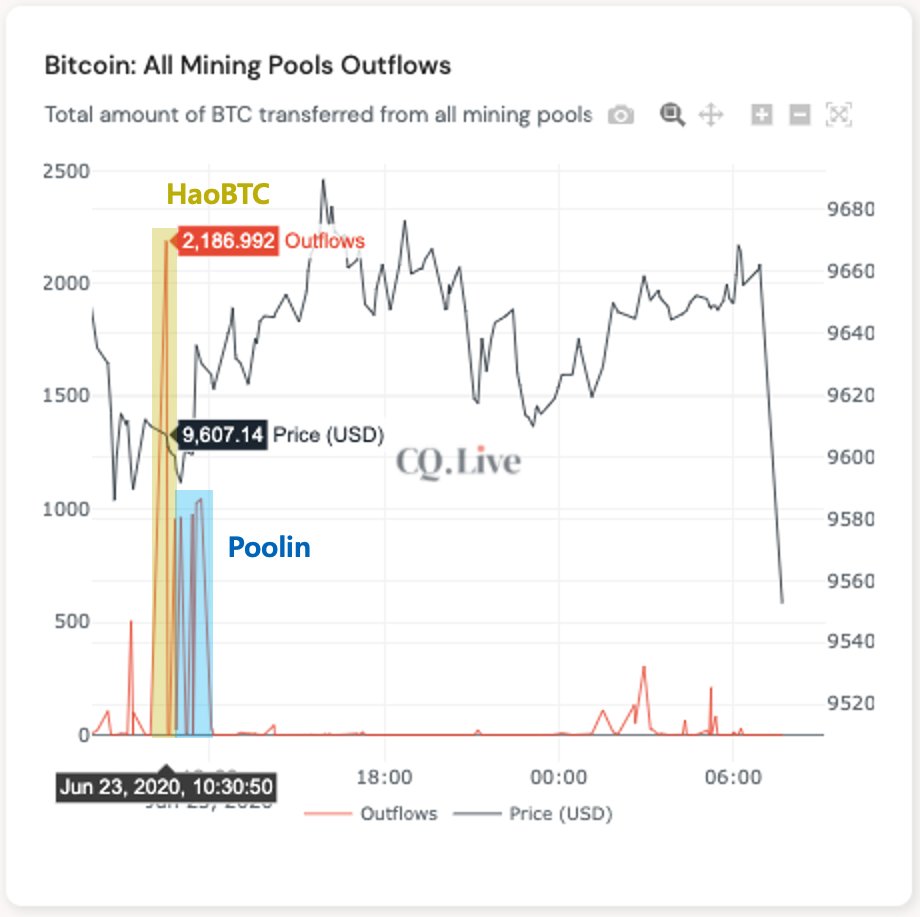

Days after Poolin and HaoBTC have seen their average daily outflow reached an almost record high, with a total of 7,153 BTC($68.1 million) flowed outward from both.

The move unlike what was expected didn't see a similar increase in exchange balances, but could still be traded using other methods like OTC and other stuffs.

The source of this data comes from the on-chain monitoring resource CryptoQuant, which was available to us a day ago via tweet prior to the price action we saw that occurred bringing the price of BTC/USD to its present price of $9281.17 as at the time of writing.

Miners selling as seen in the article referenced has been on the decline since the spike the market witnessed just prior to the halving of block subsidies and as explained, CryptoQuant's data has been able to identify correlation between increased miner selling and bitcoin price bottoms.

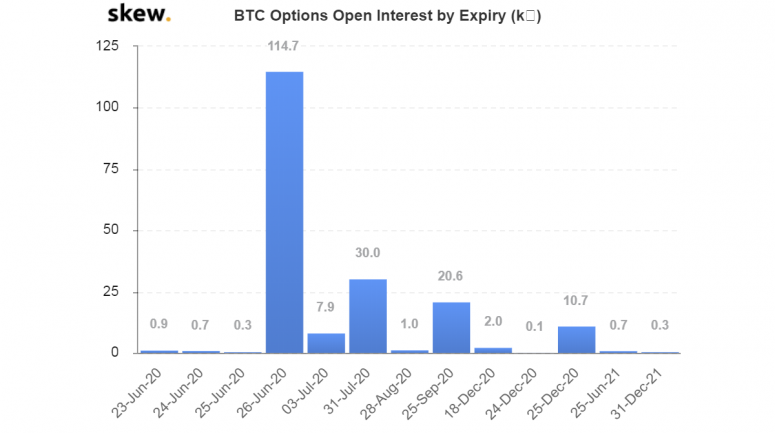

The yet fragile Bitcoin market is also hit with the news waves of the impending BTC options contracts set to expire on June 26 with 114.7 BTC (notional value of over $1 billion) across major exchanges - Deribit, CME, Bakkt, Okex, LedgerX - according to data provided by crypto derivatives research firm skew

As known all over the cryptosphere, this is definitely the largest BTC option expiry by a kabilion mile as options expiries can influence the market price action directionality via a process called pinning. Pinning process simply put is a fad in which option traders try to move the spot price to avoid sharp losses.

And this might just be the case post option expiry days, therefore its about to get bloody out there as the tug of war that will ensue with the big boys, we are all advised to stay vigilant and thread with caution.

The supposed sales behaviour of the miners has been accompanied by a drop in price. As in the last few hours more than 24 hours has seen BTC steadily dropped and trading BTC/USD at $9281.17 at the time of writing, a fall of about 2.46%.

This recent behaviour has seen a sharp change in market direction from the expected bullish trend optimism following rumours that the fintech giant PayPal would integrate cryptocurrency support, and also news of the fintech giant seeking out blockchain and crypto engineers for mass employment. Following the rumours and short term uptrend, Michael Van de Poppe and others from cointelegraph expressed optimism eyeing the price to spike to more than $10000 or to an impressive maximum of $12000 for BTC.

Also as earlier discussed, the fate of BTC prices also hinges on the massive BTC options expiry, although some experts have the view that it will have little influence on price action due to its size compared to the total BTC market capitalization. We all wait for what will ensue as the big player have major roles here.

At the moment BTC lacks direction and many have said we are in the kangaroo(lolzzzz) market and as such its susceptible to a quick directional change in any direction post option expiry.

DYOR

Thank you for reading, hope you got improved, stay tuned to my blog for more educational contents, i love you, #staysafe

Disclaimer : This article is not a financial advised, but published to serve as an educational tool. All resources were properly referenced.

Twitter --- @matthewanietie

Facebook --- Anietie M Matthew

Posted Using LeoFinance

you have really spent some good time to write this article. When BTC options will expire it will be an interesting time to see where the price will go

We all have to keep our fingers crossed