Short-term price action was bearish this last week. Broader economic issues remain with COVID-19 making a come back in the US. Doubtless, the FED et al will respond with further ‘stimulus measures’.Whether this bearishness turns into a full-blown retracement remains to be seen. Nonetheless, the conditions could scarcely be better for the long term value proposition that is BTC. Comment

Picks of the Week

Above all - Ray Dalio on the building blocks of an economy. This podcast discussing why BTC’s moment has arrived. While you are at it - this podcast outlining the inevitable and serious monetary debasement of current central bank policies. If you only have two minutes - this short explanation of why BTC matters as a vehicle of freedom. Finally, don’t miss this Jeff Booth interview on tech, deflation and Bitcoin.

Could there be a guiding trend here? (recommended):

https://twitter.com/100trillionUSD/status/1273597320500830209

This ‘recovery’ differs fundamentally from previous economic cycles:

https://twitter.com/krugermacro/status/1273805850012979201

The fulfillment of a ‘sly hope’ - BTC:

https://twitter.com/matthewryancase/status/1275522087738675200

Dismissing BTC doesn’t have a great track record:

https://twitter.com/btccultmember/status/1275482508377931777

A roundabout but compelling BTC thread (highly recommended):

https://twitter.com/hemre_j/status/1275555148450971655

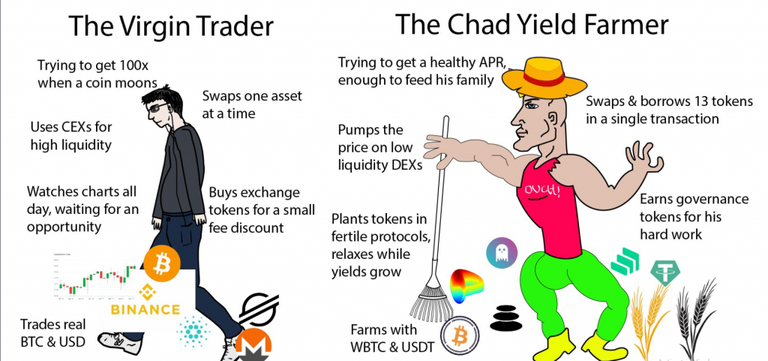

A thought before you go chasing DeFi projects/yield (recommended):

https://twitter.com/GordonBuckley3/status/1273562384267796480

Yield farming - details matter:

https://twitter.com/BlockEnthusiast/status/1275552820469653513

Articles

BTC - hated by corrupt regimes the world over (highly recommended)

https://www.forbes.com/sites/tatianakoffman/2020/06/13/why-bitcoin-is-a-silent-protest-against-corrupt-governments-everywhere/#1bec3eb83542

Blockchain analysis insights (highly recommended):

https://blog.chainalysis.com/reports/bitcoin-market-data-exchanges-trading

Making a contribution to BTC core - a journey (recommended):

https://medium.com/@rajarshi149/from-hello-world-to-bitcoin-core-dd233ce99f72

Arguing that layer two will take much of the friction from using BTC:

https://cointelegraph.com/news/layer-2-will-make-bitcoin-as-easy-to-use-as-the-dollar-says-kraken-ceo

The global economy needs BTC:

https://medium.com/in-bitcoin-we-trust/hard-money-like-bitcoin-is-essential-to-stabilize-the-world-economy

Yield farming and liquidity (recommended):

https://tonysheng.substack.com/p/beware-illiquid-markets-lessons-from

Crypto options market looks set to continue to grow:

https://insights.deribit.com/market-research/why-crypto-options-explaining-growth-and-anticipating-trillions/

Same old same old - more printing:

https://mises.org/wire/why-new-economics-just-boils-down-printing-more-money

Podcasts

A wide-ranging discussion on BTC’s value proposition (highly recommended):

An analysis of current monetary debasement practices and the likely outcome of such policies (highly recommended):

YouTube

BTC matters for human rights - two minutes (highly recommended):

https://twitter.com/gladstein/status/1275901917579763712

A useful intro to Bitcoin for your nocoiner friends/relatives:

Jeff Booth on technology/deflation and BTC (highly recommended):

DeFi - a basic explanation:

A bullish take on Ethereum (recommended):

Comparing EOS to Eth 2.0:

First principles -Ray Dalio on the economy - 6 years old and just as relevant today (highly recommended):

https://www.wix.com/dashboard/fcab5df7-1b1a-41fc-a81c-a8c2f099b73b/home

Infographics

Indeed:

https://twitter.com/BTCSchellingPt/status/1273559801054654465/photo/1

Now you know:

https://twitter.com/dmihal/status/1274322585182965762/photo/1

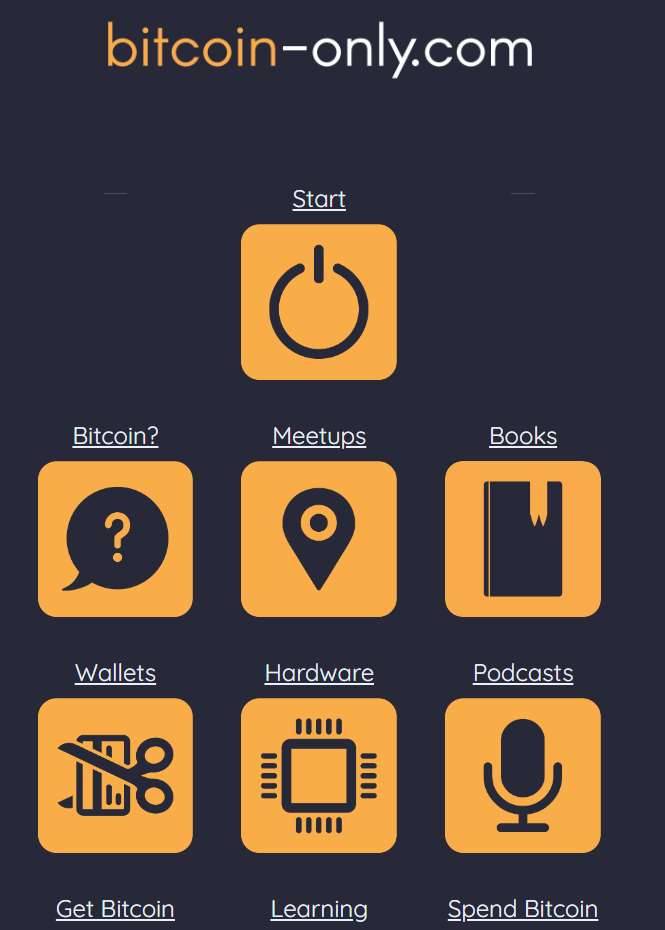

Website / Utility

An excellent Bitcoin resource - covering a wide -range of mediums/formats (highly recommended):

I learned a lot this week - funny thing - I learned a lot the week before too. Until next week. As always looking forward to your comments and suggestions.