I don't have much time available; so this one will be real fast. Three things to mention:

- TVL in presales keeps increasing, we added 2 more projects this week.

- SEED is getting very unstable in the pool. How we should proceed?

- Price disparity & Refunds.

First with the stats.

We added 2 new projects, DARK and HE. We're still waiting for the listing of HE which should happen soon.

DARK is the first token which I'm not selling instantly, as the project feels amazing and I want to hold it a bit more. It's another x10 on the board as we purchased our 6000 tokens for 375$ ( 0,0625$ /DARK). Trading currently at +0,5$.

Soon our portfolio will be filled with small allocations yielding outsized returns with TVL increasing progressively :)

SWAP.HIVE/SEED Pool getting unstable [opinions, please?]

When I started with the 'yield farming program' for SEED on this post my #1 intention has been to bring a bit more of that needed liquidity for SEED holders. I added around 10K$ of liquidity and started paying a pretty decent APR of +50%.

So far my modus operandi (not daily, but once every 2-3 days) with the BeeSwap has been the following:

- Reduce progressively my liquidity (46% atm) to increase the %APR for other users of the pool.

- Pump (or dump) Hive/Seed to keep the price aligned (''canceling'' effectively IL for LP's).

And even with that I'm seeing people:

- Still dumping SEED on the 'normal' HE market 'losing' a lot of money.

I bought SEED at around 1 HIVE... which means someone 'dumped' on me at LESS than 1$/SEED. Why would anyone do that? It's ignorance or what I'm missing? It's Ok that HIVE pumped +100% overnight and I understand that some people market sold everything at Hive Engine... but... but I can't still understand.

In the end, maintaining liquidity in the pool + yielding rewards has a cost. If holders don't pretend to use it and just want their SEED to sit quietly in the wallet I'll end up terminating the pool.

For that reason, I'm asking for your opinion.

What do you like/dislike about the hive/seed pool? What would you change? What you're missing?

Friendly Reminder about the SEED Buyback Promise.

The BeeSwap pool has the function to allow people in/out (in small amounts atm) as long as the pool keeps pegged in HIVE terms.

I'm also setting up periodic buy/sell walls on Hive Engine because I noticed that price there can alter the 'visualization' price of the pool.

Apart from that, a buyback promise stands in place.

that means you can reach to me and sell your SEED for a 'fair' value based on the ACTUAL backing value of SEED (minus a fee).

That means if you need to sell, and the 'real' price is 1,5$, you can contact me through Telegram/discord (I'll never send a message first) and then we'll arrange the sale for a 2-5% fee or something around that).

So,

NO NEED TO DUMP SEED ON HIVE ENGINE.

let's go with the last stats.

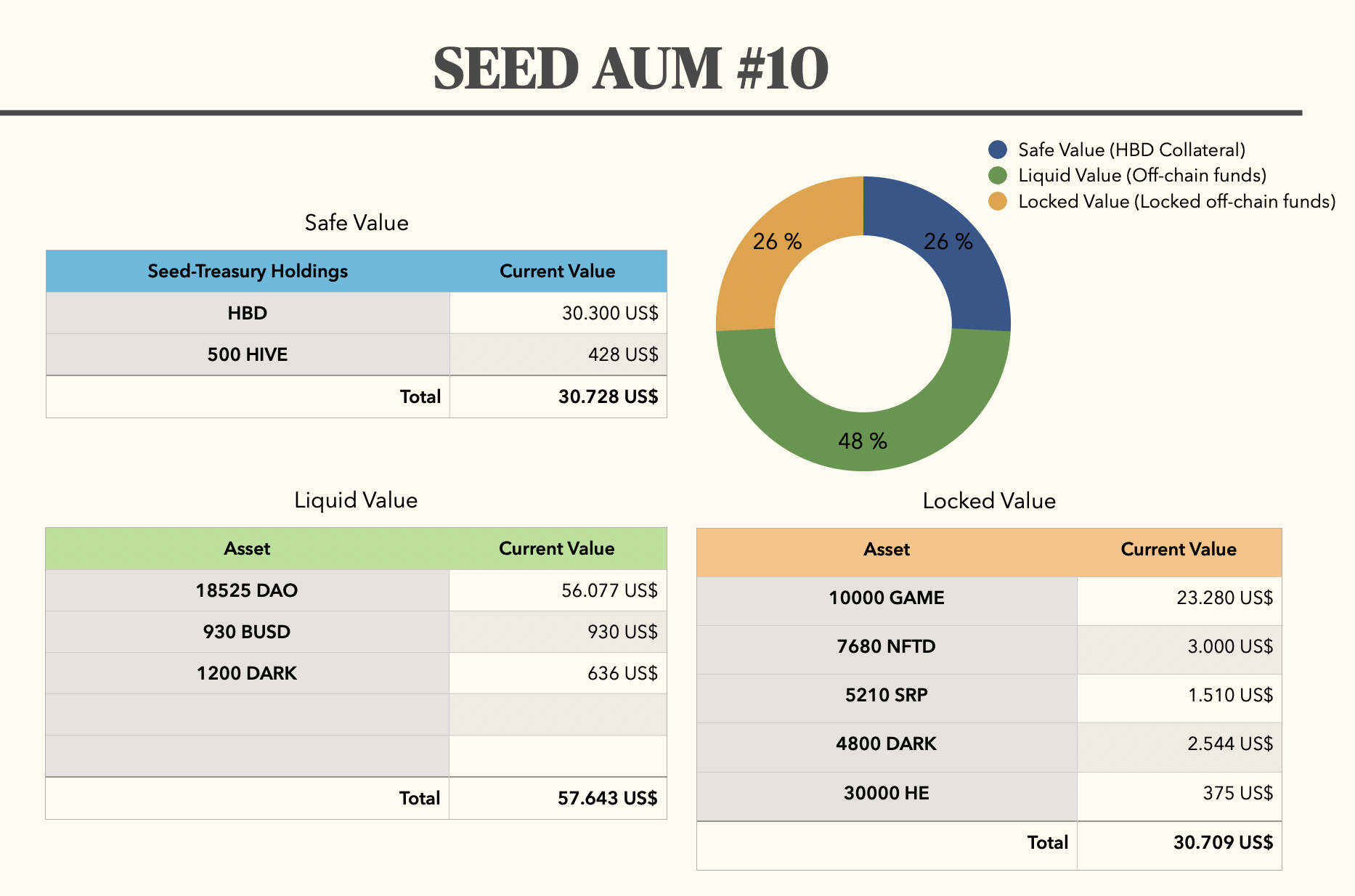

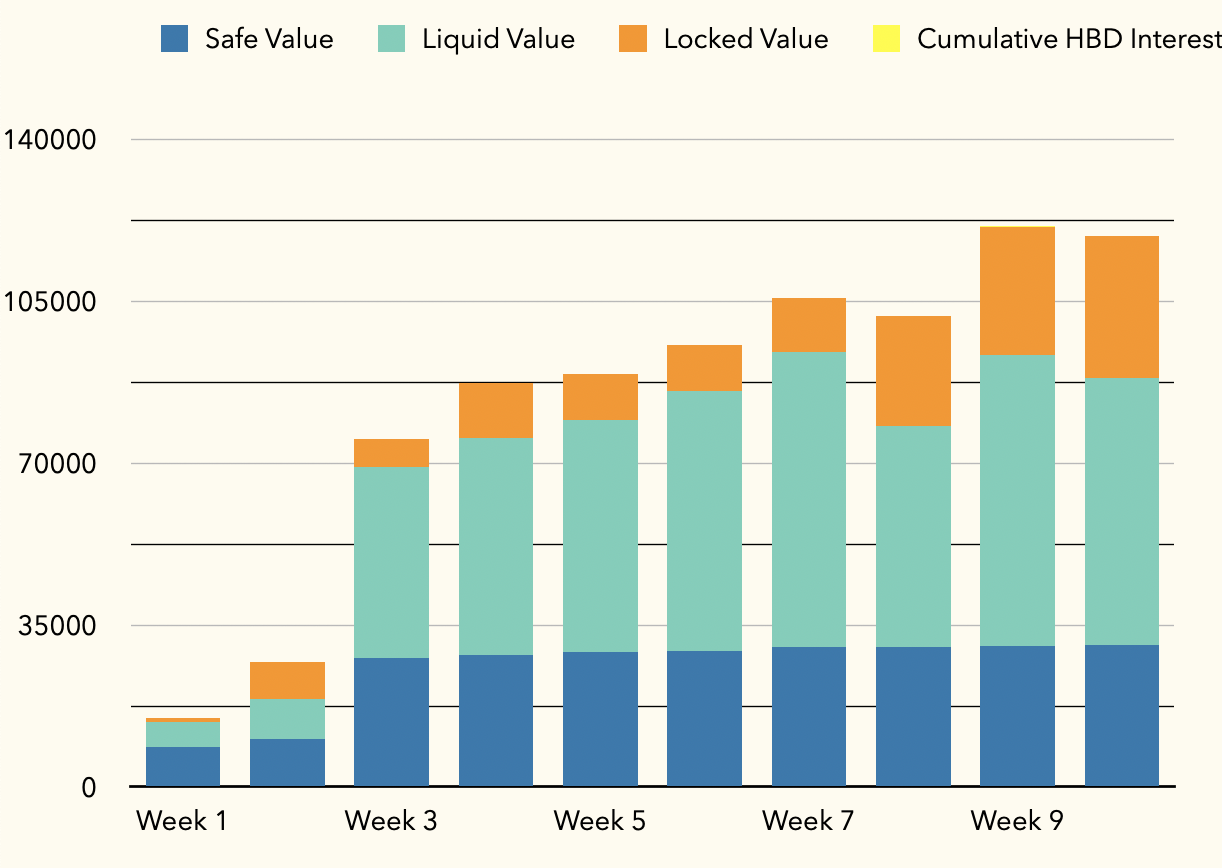

Current SEED Stats:

Circulating Supply: 75,000 tokens.

Total Supply; 100.000 tokens (25K unissued).

AUM Value (All assets): 119.080$

SEED TOTAL Value: 119080/75000 = 1,58$ /SEED (+58% since the beginning).

58/2 = 29% MoM profit

It's Friday again. Enjoy.

100% of blogging rewards paid to @seed-treasury. Remember you can follow the portfolio in real-time here:

https://cointracking.info/portfolio/seedtreasury

You can join us on Telegram and follow me on Twitter.

Posted Using LeoFinance Beta

I think it's the degens who dont know what SEED is and just ape blindly into a 'high APY pool', they're dumping their earnings.

Anyway, if it's too hard/useless to run the pool -- let's shut it down then.

Posted Using LeoFinance Beta

I'll keep it up for now (at least the 3 first promised months of rewards), we'll see later then (as I still have to internally decide a model for providing a sustainable yield).

Not sure if there's any sense in explaining irrational behaviour of market participants (there will be numerous reasons from bots to idiots). Let them do whatever and smarter actors should bring price back to reality. In the AMM pool though, with a volatile asset like HIVE paired against SEED, IL may be inevitable for the LPs.

Definitely +1 for keeping liquidity and pool available.

Thank you for this comment, my friendly reminder again would be ''don't accept the IL as empo will come and rebalance the pool''.

+1 on your take on irrational behavior.

I saw that my SEED holdings in the pool dropped nearly 25% last night. I had seen them increase over the last couple days before that and had pulled some out. Now I have my initial investment plus a little more setting in my HE wallet and a small amount in the pool. Considering the volatility and my limited understanding of how the pool works, I can't see myself risking much more in the pool even with the fantastic APR's.

Posted Using LeoFinance Beta

Was never intended to put all in, but it's 'safe' and the yield is pretty attractive IMHO.

I'm definitely going to keep some in there because like you say "the yield is pretty attractive". I just need to dial back my contribution enthusiasm a bit. 😀

After some thinking I decided not to enter, so I'm going to sit this one out and let those who are in decide.

Posted Using LeoFinance Beta

Obviously some of the people invested not thinking of the long game which is super dumb. I am in this and nothing has changed in my thinking and wish I could have more. If they sell let them as we can try and buy it up. 58% is nothing and is the tip of the iceberg as we know what you can do. What you are offering as a buy back is more than fair and nothing should be hitting the market. Maybe you can offer those to some of us if people sell.

Posted Using LeoFinance Beta

A buyback has been cooking in the oven for some time now, but still can't figure it out to implement it.

Soon, though.

I prefer to HODL and not risk IL on the diesel pool. As for people selling off SEED for less than the actual value, I think it's because they don't understand. They may of just entered following someone else without even keeping track of what is going on in the project.

Posted Using LeoFinance Beta

Probably... but even with that... dumb behaviour, dunno

I just left my stuff in the pool and kind of forgot about it. No point in messing around with it too much. Thanks for this update! I hope you get some good ideas to sort things out.

Posted Using LeoFinance Beta

Thx bozz!

My tip for people inside the pool would be: ''don't panic if you see an irrational IL vs HIVE'', as I'll come back soon or later and rebalance (cancelling the IL for everyone inside and returning SEED to its fair value).

Sounds good!

The pool is interesting, but I think since we are up against HIVE instead of a stable token we are going to see these problems. I made a post about SEED being cheap, and then hive pumped and it turned out SEED was expensive. 🤦♀

This is the reality of a swap.pool against an unstable token.

In terms of the market - dumpers going to dump so I wouldn't worry too much about that - cheap seed is always a bonus! But let's try to pinpoint exactly what value is being brought by the liquidity pool and if it is worth the costs.

I always appreciate a lot your comments eco, I also learned a lot about dcity from you.

Hive will keep hive things though :)

Someone donates to you :) Why not :P

Bring us to the moon!!!

I chalk my non-participation up to not following the SEED project at all. If you could shade some links where you cover it, I’d like to see them. I may participate if I see a chance for me. I really liked your plug to Secrets of Crypto and your mention of the power down helped me time a neat sum. I know you’re not giving advice and I’m not taking it, but the direction of your conversations moves forward. I like it.

I recommend following @seed-treasury and read its first posts.

I'll compile them soon on a single one, but that's not ready yet.

Glad to see that you find my post helpful :)

On HE orders, could existing orders left unchecked through the Hive pump be the cause of this? Or someone who, in the heat of the moment, thinks it's a great trade? All/most HE tokens go deep into red during a Hive pump. Hive was at the highest over $1.5 during this pump.

Personally I like the diesel pool and hope more will start using it.

As I'm seeing, price feeds on tribaldex/beeswap get their prices from the 'normal orderbook' of Hive engine (dunno how to explain this).

That means that If for whatever reason someone buys 1 SEED at 20$ and nobody dumps after (things that happen with very illiquid markets), the visualization price on the diesel pool will give an incorrect value. (hive at 1$ and seed at 20$, but still a 2:1 proportion of seed vs Hive), which leads to the aforementioned confusion and consequent 'dumb dump'.

Ok, I see what the problem is. And yes, that can create confusion on tribaldex because of the illiquidity on HE. Maybe a bot on HE would help?

It's the same with other tokens like SPI or LBI, ppl are selling them for less than the guaranteed value.

Mhhh there is kind of an arbitrage opportunity here, buy Seed for 1 hive and sell them directly to you and repeat until the prices are more or less the same.

I like the pool because I am earning more Seed and also it offers an easy way to even buy more. I missed the chance to buy 1000 token when it started but because of the pool and ppl selling their tokens for less than $1 I can reach my goal of 1k Seed xD

Hope you can reach it soon! :)

To be honest, though I like the idea of DeFI, pools and farms, most peeps seem to want to profit from it, without taking any risk. Hence so many pools and farms are trending to zero. For a project like SEED, I am not in favour of Pools and Farms. I look at SEED as an investment project, like a Fund in which we go in/out through a more centralised organisation based on the value of the investments in the portfolio. I personally think the somewhat strange behaviours by users, causing high volatility, is not helping the aim for SEED... as well it de-focussed you from the investment part of SEED.

Posted Using LeoFinance Beta

Thx for the input.

It's true that most users want o profit from defi without risk, but in our case with SEED it's different.

post.The supply is 100% fixed and at the moment the yield rewards are coming from my own budget (let's call it a ''marketing budget''). This feature is also in a testing phase for three months as stated in this https://peakd.com/hive-167922/@empoderat/pre-yield-farming-rewards-for-seed-are-live

After this period I'll re-evaluate and decide what we do and if we really it's worth it and all that stuff.

SEED is volatile in the HE markets.. but internally it's not:

Therefore all that happens in terms of HE prices is 'noise'... and we could even profit from that (not my ideal solution, though).