Is that right?

I've never lost a deposit in this way.

Have you?

Everyone knows why they shouldn't hold crypto on exchanges.

They do it anyway.

That's the entire point.

Is that right?

I've never lost a deposit in this way.

Have you?

Everyone knows why they shouldn't hold crypto on exchanges.

They do it anyway.

That's the entire point.

Coinsbank for one and VaultOro. Suddenly my BTC balance reads zero. There was no explanation. You can see long lists of people basically depositing and then losing access to their account: https://www.trustpilot.com/review/vaultoro.com

It's pretty wide spread. People deposit for actual trade or perhaps interest and it only has to happen once for you to lose your principal. Exchanges are fractional reserve banks but far less honest than banks. Bank employees are probably the most honest people. I don't think it is the same over at most exchanges.

What I do to protect myself is firstly, to use decentralized exchanges as much as possible. This means Thorchain. Uniswap is something I don't often use because I am not interested in EVM chain tokens or coins. When using a CEx, trade less than $50.00 USD at a time. That means I may deposit 50 HBD, buy whatever and then withdraw. If the minimum deposit exceeds that $50, I just don't use the exchange.

I also tend to just leave value in each blockchain and perhaps spend within that blockchain for services rather than trading it. I feel comfortable trading within the Hive blockchain because it is always through a DEx.

Obviously that is all good advice. It very much is a fuck around and find out situation with exchanges. It only takes getting burned one time to have a lasting effect.

At the same time the spirit of the original post doesn't care about what you or I think or do. This is a global discussion about incentives and how users are going to act on aggregate.

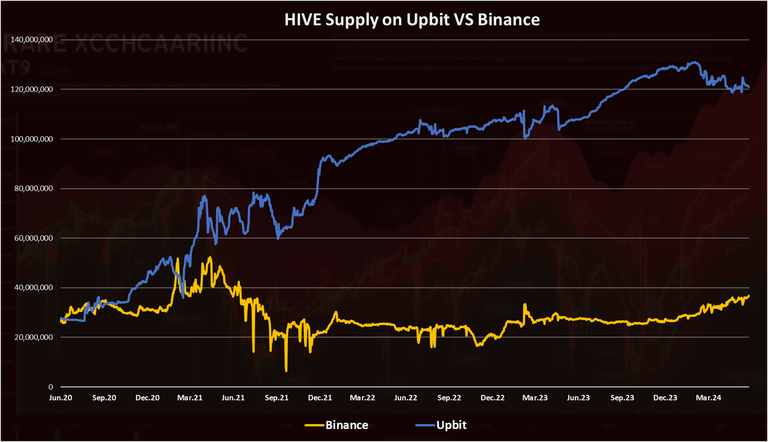

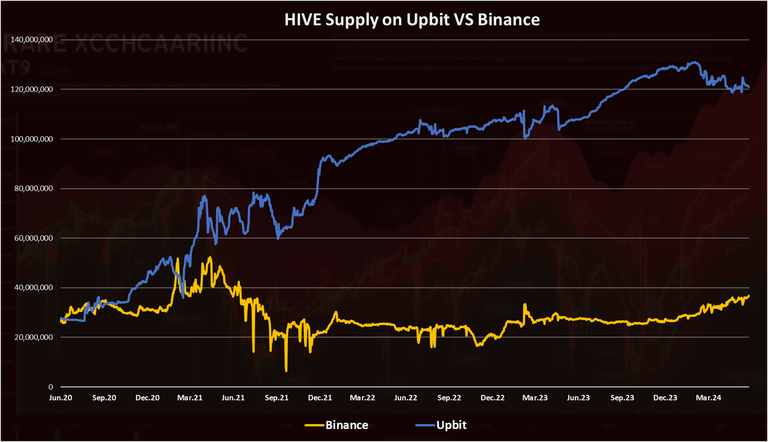

Right now Hive gets a huge inflation benefit in that all this money sitting on exchanges can't earn yield and just gets constantly diluted by our inflation rate. The problem is that they have the power to not only change this but also provide instant powerdowns with there liquidity and lure all the tokens to their platform. Not that Upbit needs more than 120M tokens, that's already enough to hijack all 20 witnesses.

If I set my account to powerdown to Binance and then get a bunch of liquid hive, why can't I withdraw and then cancel the powerdown? Its a shady thing to do, of course. The point is, that it ought to be a concern with providing instant power-downs to users.

Huh? You can't cancel the powerdown because Binance controls the powerdown.

It's a by proxy situation where the exchange offers yield on the token like FTX or Coinbase.

Okay, I get it. The scenario is that they control the stake. Another problem is the SEC is only American and CExes may start this for non-Americans even without challenging the SEC.