2021 was the year of the rise of new smart contract layer one L1 blockchains. A lot of them Ethereum compatible blockchains, or EVM compatible (Ethereum Virtual Machine), but some with a tech of their own like Solana and Terra.

There is now at least ten blockchains that have established them self in 2021.

Let’s take a look at them and compare them with some key metrics.

We will be looking into the following blockchains:

- Ethereum

- BSC

- Solana

- Terra

- Avalanche

- Polygon

- Fantom

The data that we will be looking at:

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

The period that we will be looking is the latest data from April 2022.

The data for the chains will be extracted from their blockexplorers or some other data providers.

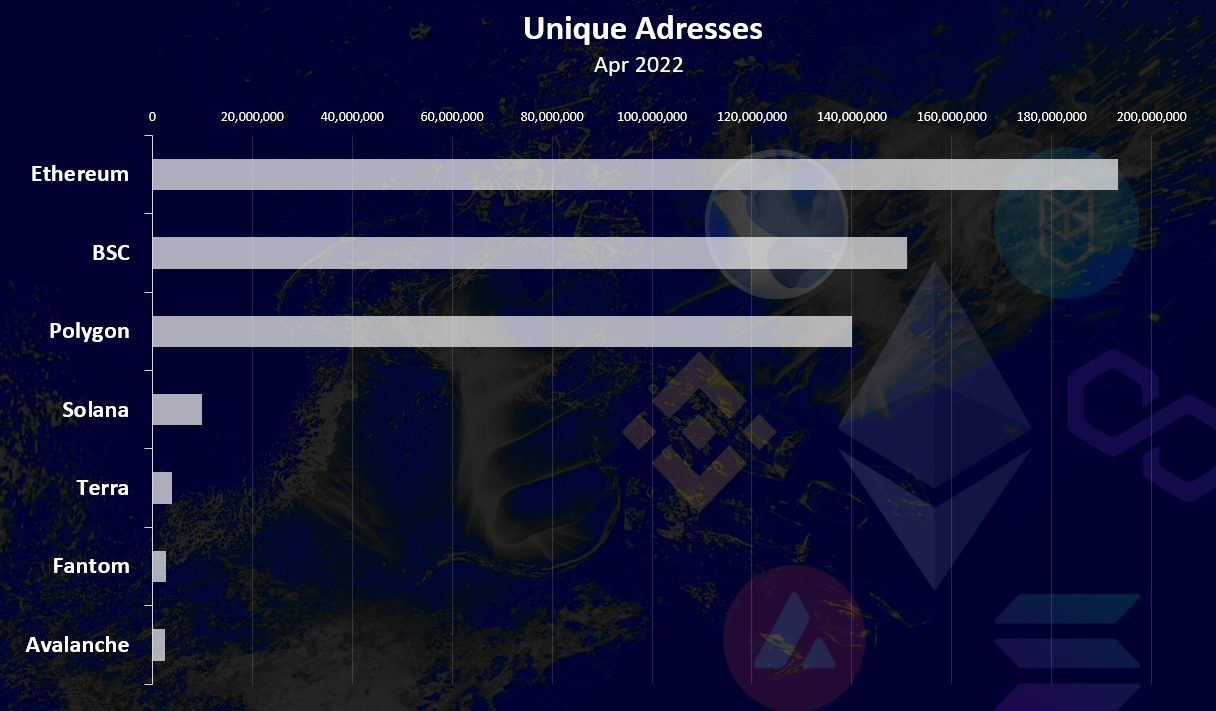

Number Of Addresses

One of the key metrics for crypto projects is the number of wallets.

Here is the chart.

Ethereum is on the first spot here with 193M wallets. Closing on 200M now.

The Binance Smart Chain BSC is on the second spot with 150M wallets. Polygon is third with 140M wallets. All the other blockchains have less then 10M wallets. Avalanche is on the bottom spot here.

Note that the Solana data is approximate.

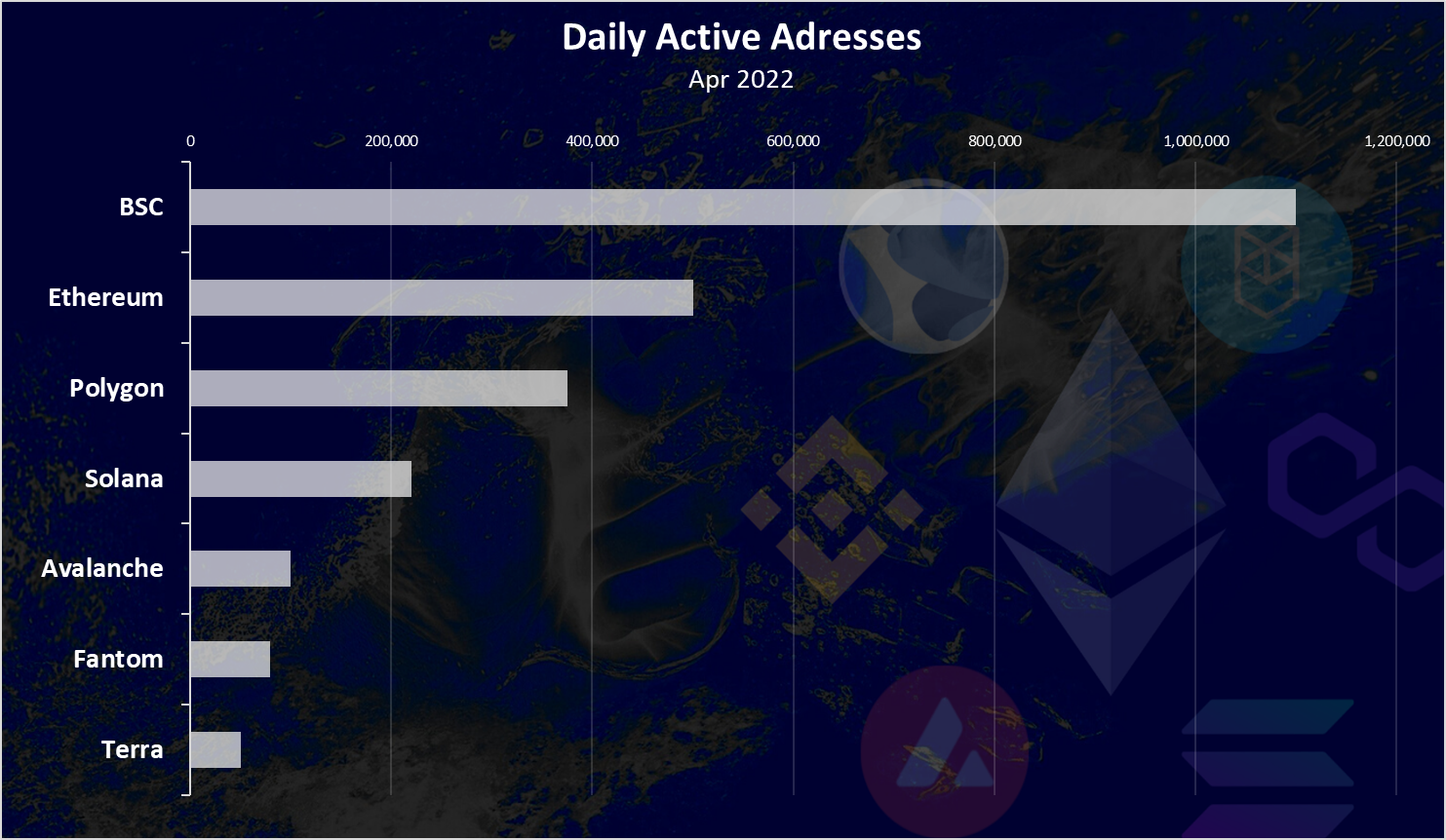

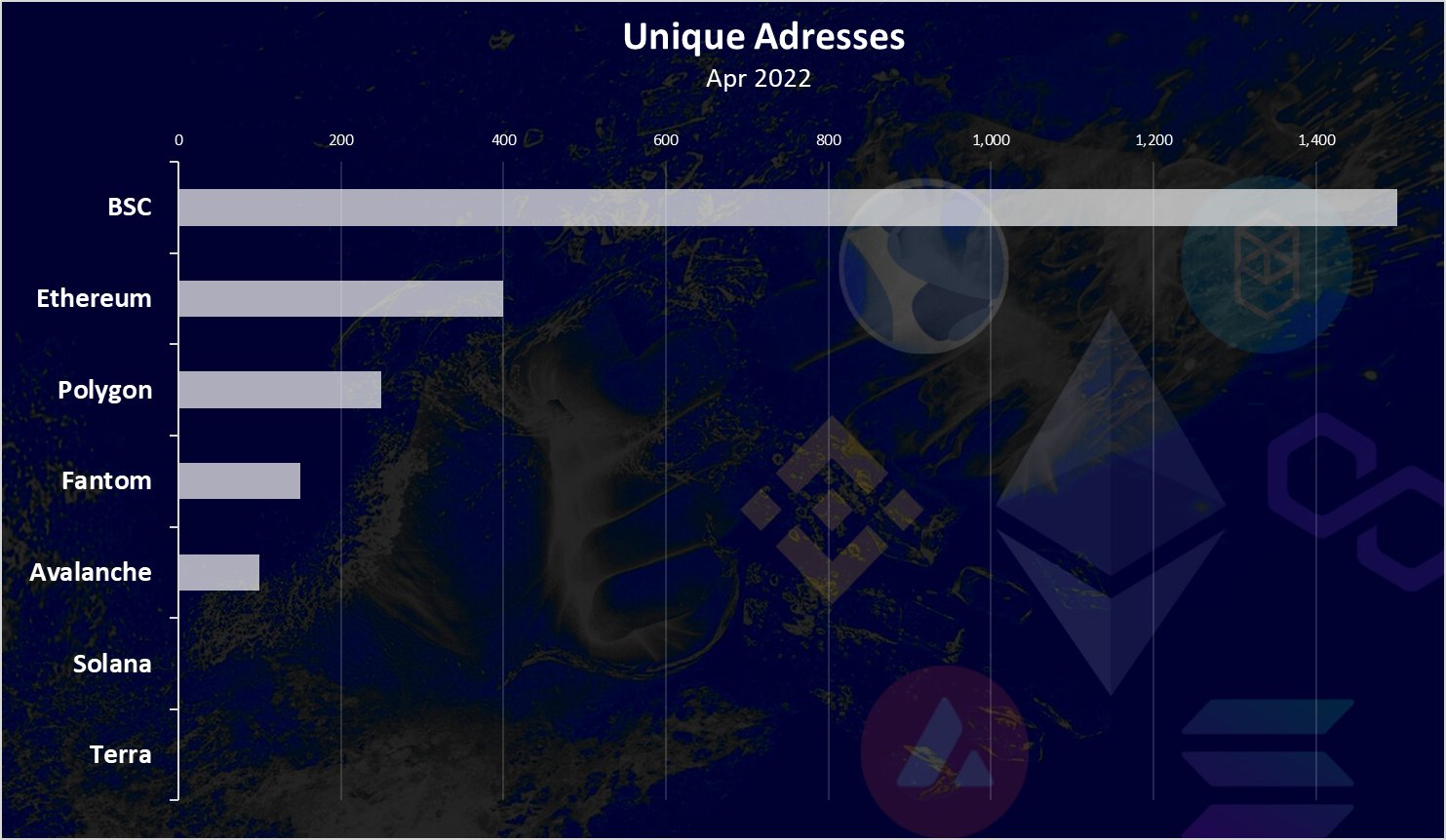

Active Addresses

What’s more interesting in times like this is how many wallets are transacting. How many of those addresses are actually active?

BSC is on the top here with more then 1M active daily wallets.

Ethereum comes second with around 500k DAUs in the last period, followed by Polygon. Terra is last according to this ranking.

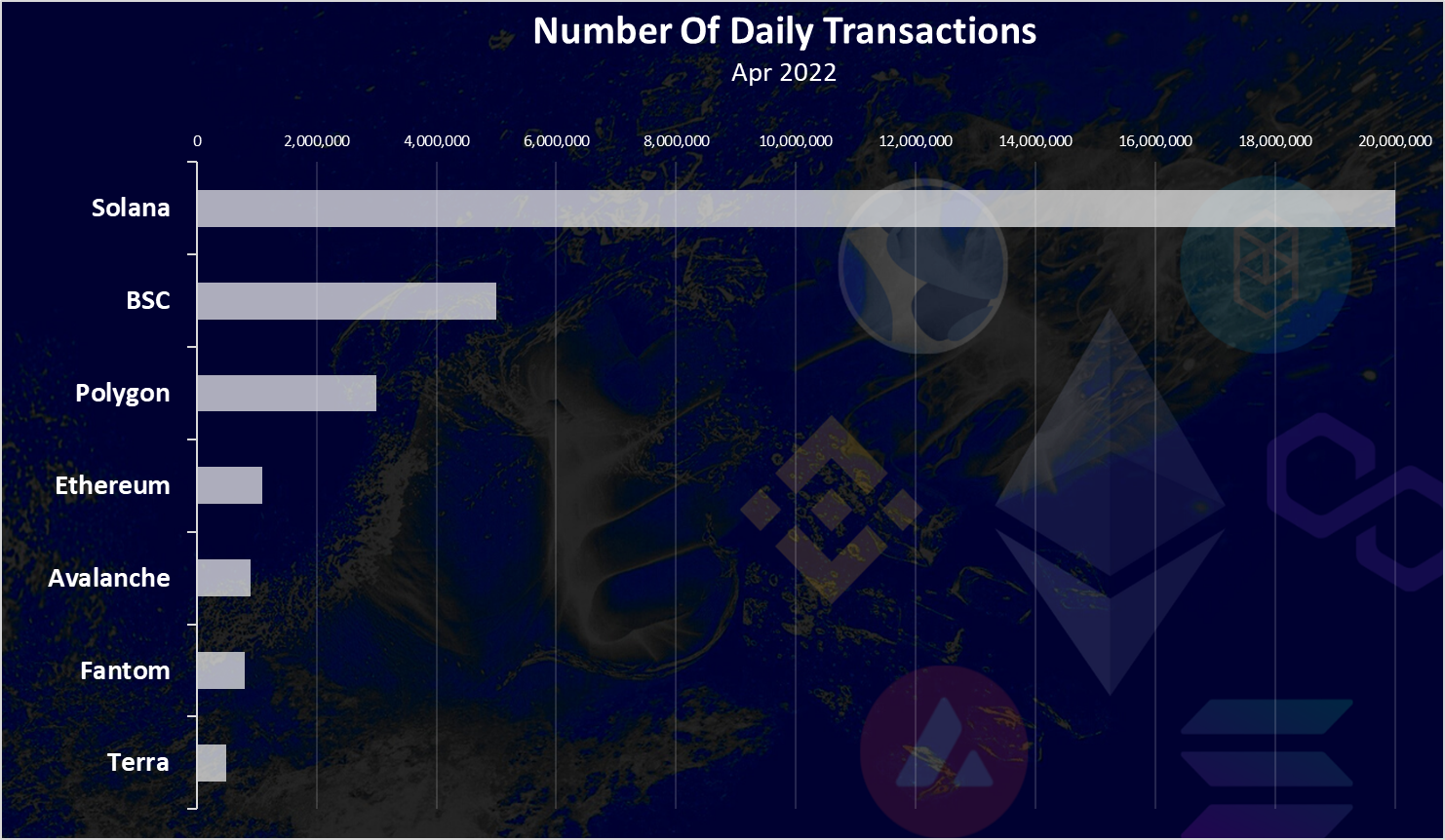

Daily Transactions

The activity on the networks is mostly represented by the number of daily transactions. Here is the chart.

Solana is holding the number one spot by far here. That is what the blockchain is know for. Its speed.

BSC is on the second spot with around 5M transactions, followed by Polygon. Terra is last here as well.

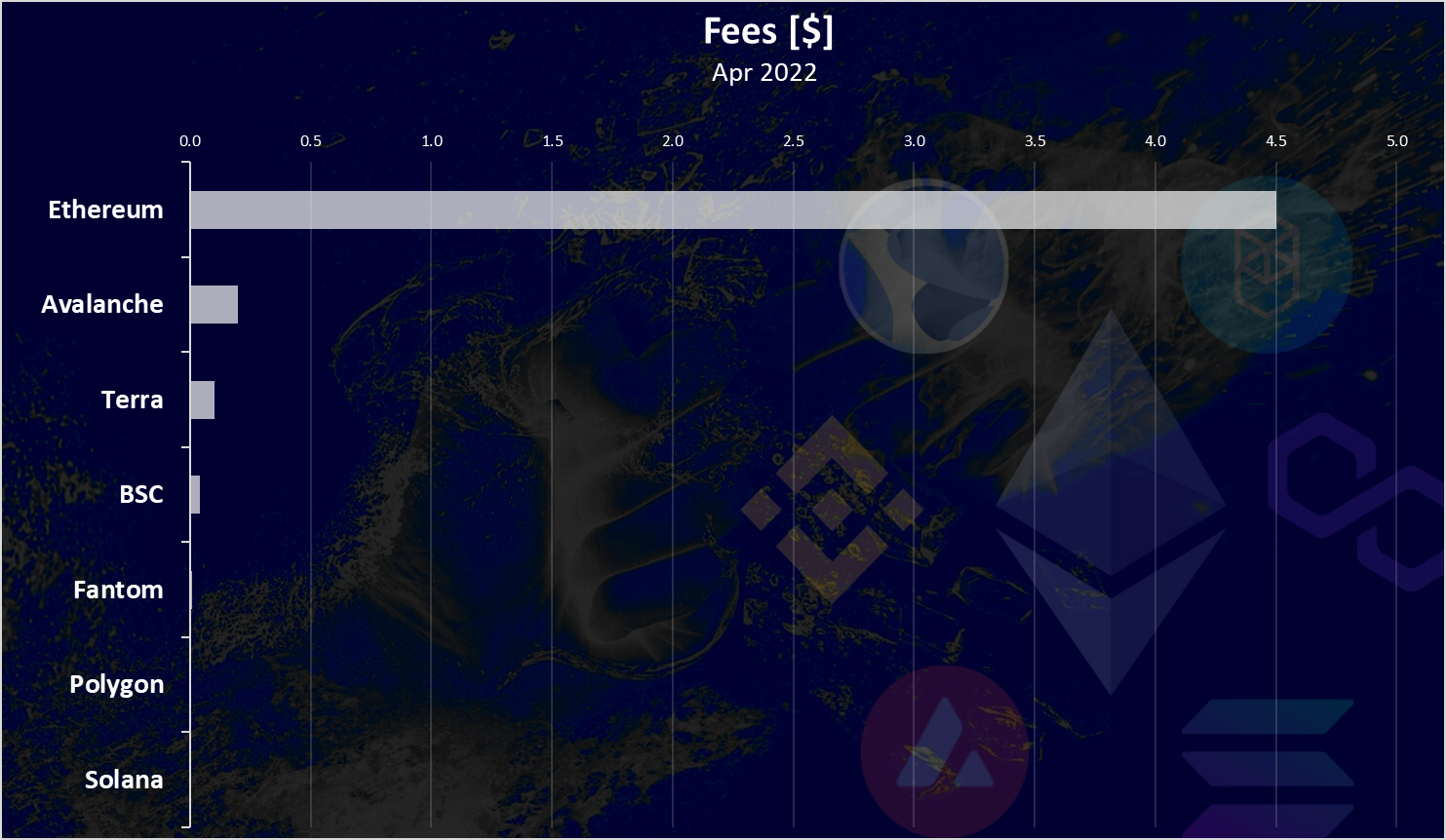

Fees

Fees are quite the unpopular topic and one of the main reasons for the new EVM chains, as users are trying to find a way to escape ETH high fees.

Here is the chart.

The fees here are in dollars.

Ethereum is by far the most expensive chain in terms of fees. The average fees according to cointool are around 4.5$. These are actually quite low fees for Ethereum. The fees have been as high as in the few hundreds dollars. It also depends on a lot of what type of transaction is made, is it a simple transfer of funds, or maybe swapping that are usually more expensive. Avaalnche is on the second spot with 0.2$ followed by Terra.

Polygon and Solana are the cheapest blockchains in terms of fees.

Contracts

These three are smart contract platforms so here is the chart for verified contracts per day.

BSC is on the top here with 1500 contracts per day. Ethereum is on the second spot with 400, followed by Polygon.

There is no data for Solana and Terra to compare against.

When we summarize the above, we get this:

- Wallets – Ethereum

- Active Wallets – BSC

- Transactions – Solana

- Cheapest Fees – Solana

- Contracts – BSC

This is the current situation, and it has been changing from time to time.

In terms of marketcap Ethereum is still the king here, but obviously there is a lot of competition now, from EVM chains but from other smart contract chains like Solana and Terra.

All the best

@dalz

Posted Using LeoFinance Beta

WOW! Solana with the daily transactions. Wasn't expecting that lead.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment !STOP below

View or trade

BEER.Just highlights the fact that all people want is a product that works.

NOT decentralisation.

Hive needs to take lessons here and stop marketing Hive as a blockchain and start marketing dApps built on Hive that just work.

Posted Using LeoFinance Beta

I think we are one top class app away from mass adoption.

Just a simple, fast, clean UI app with easy signups.

I thought bsc would be top with active addresses. Ethereum has the most but not active. What is interesting, that Solana has the highest daily transaction of 20 million. Yet the wallet count is just over 200,000. I think it means that each Solana wallet has 100 transactions a day. That's so big !

For some reason I believe that Solana transactions are highly centralized by a handful of whale VCs. I may just be buying into the headlines on that one. Though I’m still waiting to be proven wrong on it

BSC is absolutely crushing the EVM market. I had no idea that they were leading by such a big margin

Posted Using LeoFinance Beta

I had no idea about their success either. IIRC, BSC was the first chain to take EVM, centralize it and offer better user experience via lower fees. There is no point of having great software if it only help the whales to play around.

When POLYCUB launched I got out almost everything I had on Ethereum and invested into CUB and POLYCUB.

!PIZZA

Posted Using LeoFinance Beta

i think so too solana has a lot of fake transactions.

https://hive.blog/hive-167922/@holger80/eos-fakes-their-blocktivity-stats-by-massively-sending-batched-transactions-with-a-value-of-0-0001-eos

Reminds me of this

You are right. There is 65 wallet addresses that hold one million SOL tokens, worth $31 billion. 48% of the total tokens are owned by companies and VC. No doubt this can lead to severe market manipulation !

Polygon is not in the summary but looking at the chart is always in average which is not bad, I believe bsc is the best

Posted Using LeoFinance Beta

Polygon had the most tx and the lowest fees few months ago ... not anymore

Posted Using LeoFinance Beta

Do you think poly is strong enough in terms of security

Posted Using LeoFinance Beta

Wow great analysis.. I had no idea BSC was crushing the EVM market by this big of a margin.

I have a feeling that BSC has massive network effects already playing out in its favor. New EVM chains may not swallow up their market cap but simply add to the exposure of it

Posted Using LeoFinance Beta

Yep, BSC has established itself quite well!

Posted Using LeoFinance Beta

Just as I predicted before reading the post, when it comes to active users I expect more from BSC.

I used Solana in a DEX Wallet the other and I was impressed with the fees. It’s truly a low just like they say.

Nice statistics you have here

Posted Using LeoFinance Beta

Thanks!

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

vimukthi tipped khaleelkazi (x1)

(2/5) @vimukthi tipped @dalz (x1)

Learn more at https://hive.pizza.

Next time it would be great to see these numbers against their respective marketcaps. For an example, Avalanche has more than double the marketcap of Polygon and yet the activity numbers are a fraction of what Polygon has to offer.

I'm expecting to see better things for Fantom. They have taken a lot of inspiration from Hashgraph (which is one of my favorite projects).

!PIZZA

!LUV

Posted Using LeoFinance Beta

(1/1) gave you LUV. H-E tools | discord | community | <><

@vimukthi

H-E tools | discord | community | <><

@vimukthi

this post is beautiful. This confirmed what I think of Solana and opened my eyes to Polygon. Thanks!!! upvote 100% (for what little my power is)

Solana is holding the number one spot by far here. That is what the blockchain is know for. Its speed— It’s no surprise Solana tops the chart when it comes to the aspect of daily transactions.

Despite several hacking and breaches attempts and other online attacks, the protocol has maintained its prominence as one of the leading cryptocurrencies in the market.