CUB has been slowly and steadily grinding up in price alongside the rest of the market. The liquidity for bHIVE and bHBD has never been as deep as it is right now - sitting at $801k for Multi-Token Bridge liquidity.

All is well in the CUB-iverse.

The key to CUB's long-term success is a slow, steady and consistent rise in bHIVE & bHBD liquidity.

In my opinion, this is what we're seeing right now. The P/E ratio has also been improving as we see the Multi-Token Bridge revenue generated by the DAO continue to climb upwards.

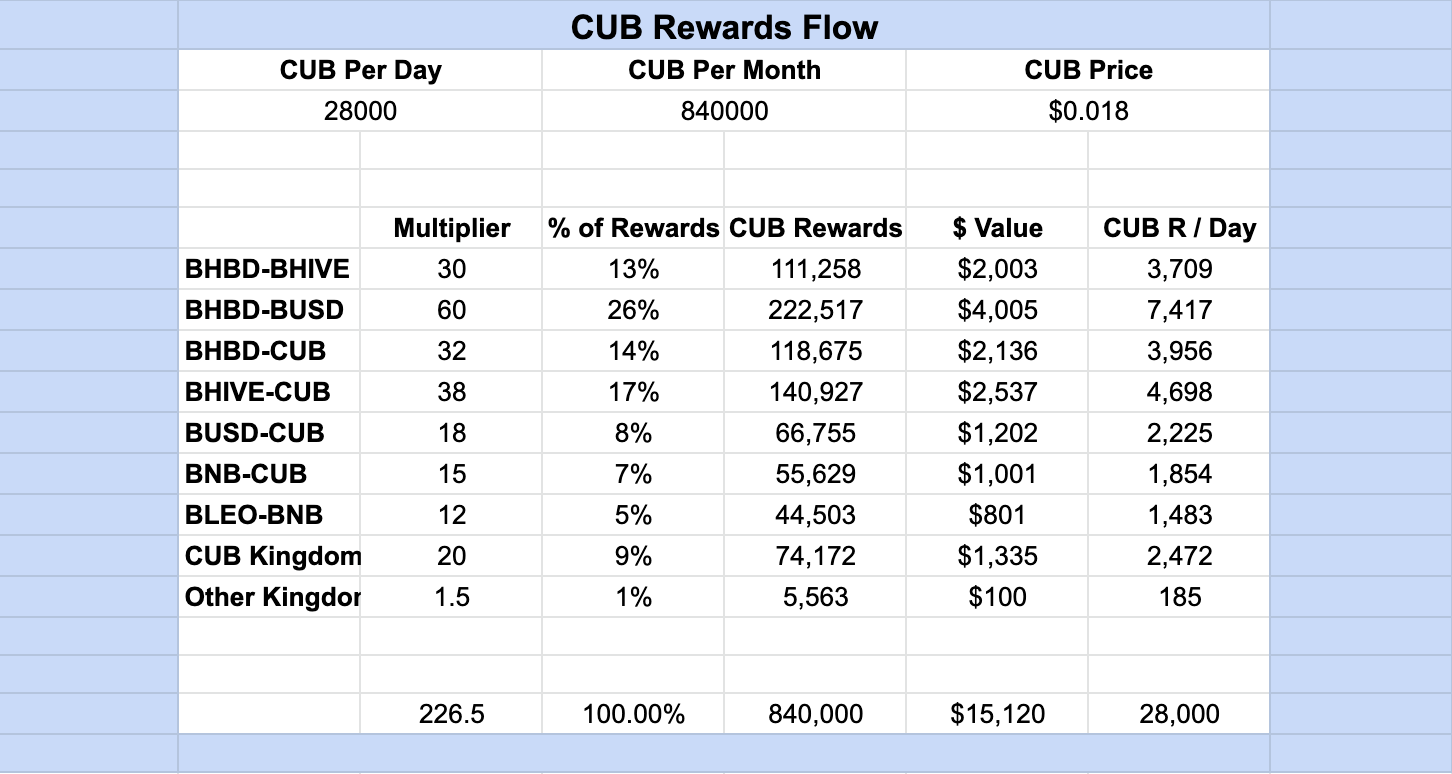

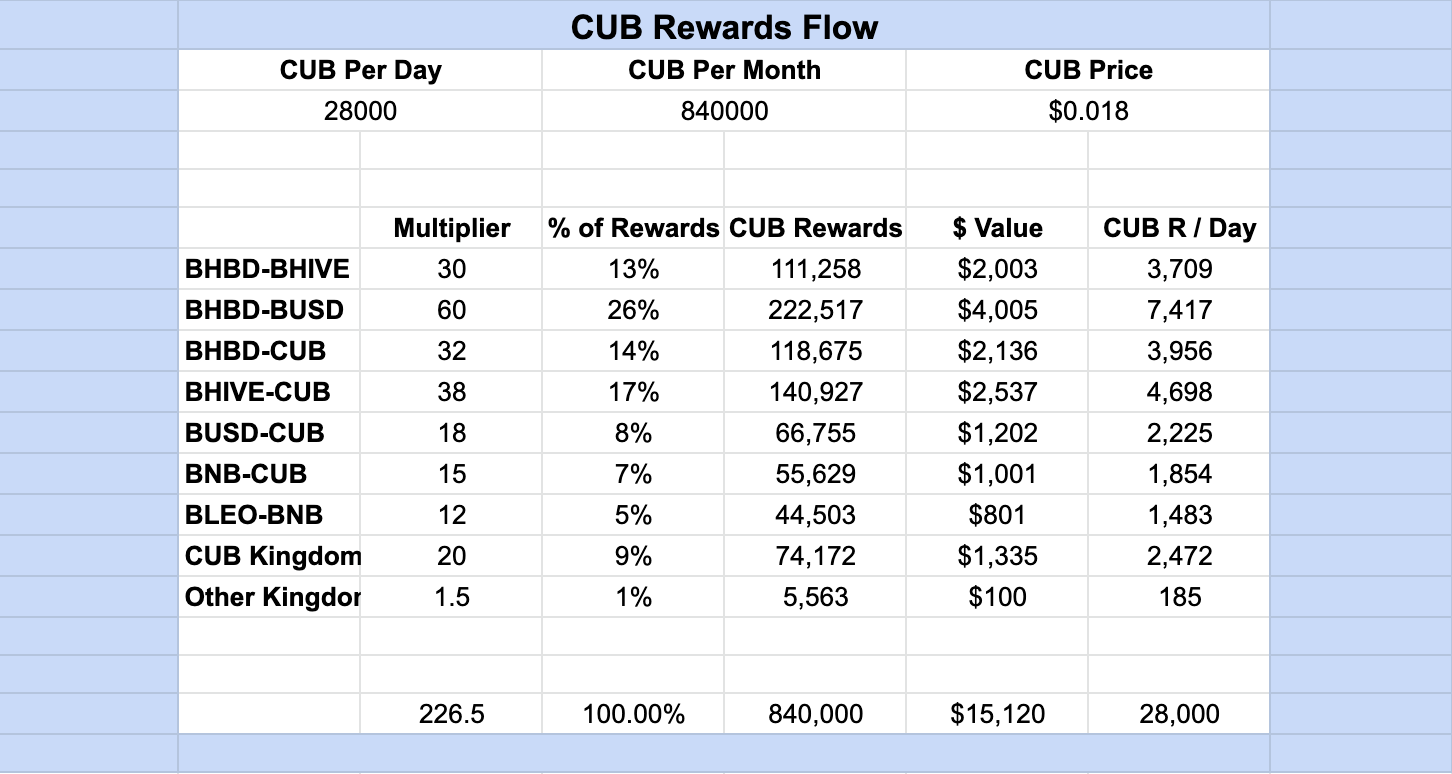

One thing I am keeping a close eye on now is the rewards flow of CUB Rewards on the platform.

You can see more details on this in the "CUB Rewards Flow" section of my reports. From there, we see how much CUB is flowing to each specific LP.

In my opinion, the team has a nice breakdown of where these rewards are going and we simply need to see this trend continue as LPs who bring the most value to the platform are rewarded.

The most utilized and profitable LP for the DAO is bHBD-BUSD. No wonder that it's getting 26% of all rewards on the platform!

Follow along as I report daily on @cubdaily 🙏🏽

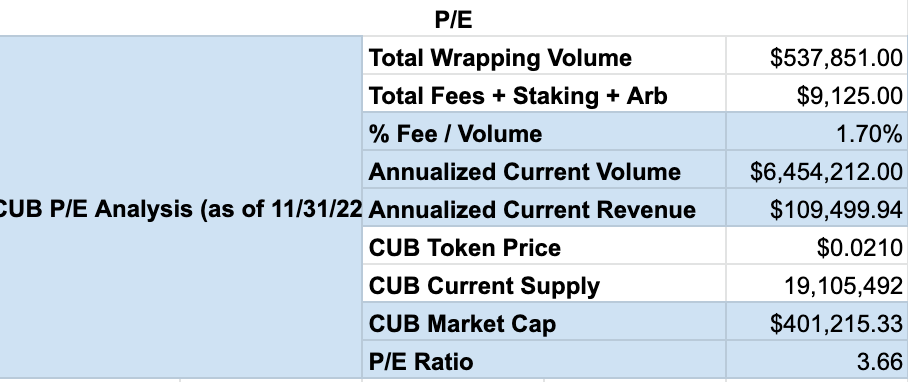

P/E Analysis of CUB

Here's a new section I'm trying out. I decided to run a P/E analysis of CUB using data from each Monthly Burn Report posted by @leofinance. Check out the second analysis I ran and leave a comment below with your thoughts.

Keep in mind that a low P/E ratio is good. It means that the revenue that CUB is generating each month is increasing faster than the CUB price is increasing (more revenues earned per share of CUB).

CUB Rewards Flow

*NEW

Here's another new section of my daily reports. This chart will be updated monthly. It accounts for the flow of CUB rewards.

"Over time, I'll start collecting data on how much each Liquidity Pool actually earns for the CUB Protocol (through wrapping revenue, arbitrage, etc.). Obviously, that's a lot of data to capture! This tells us something very important though: is the DAO effectively using its monthly funds (inflation) in paying LPs to build liquidity that ultimately generates revenue. Let's keep an eye on it and see how this progresses, maybe the team can even take this data and use it to migrate multipliers to more effectively build liquidity in the pools that are generating the most revenue."

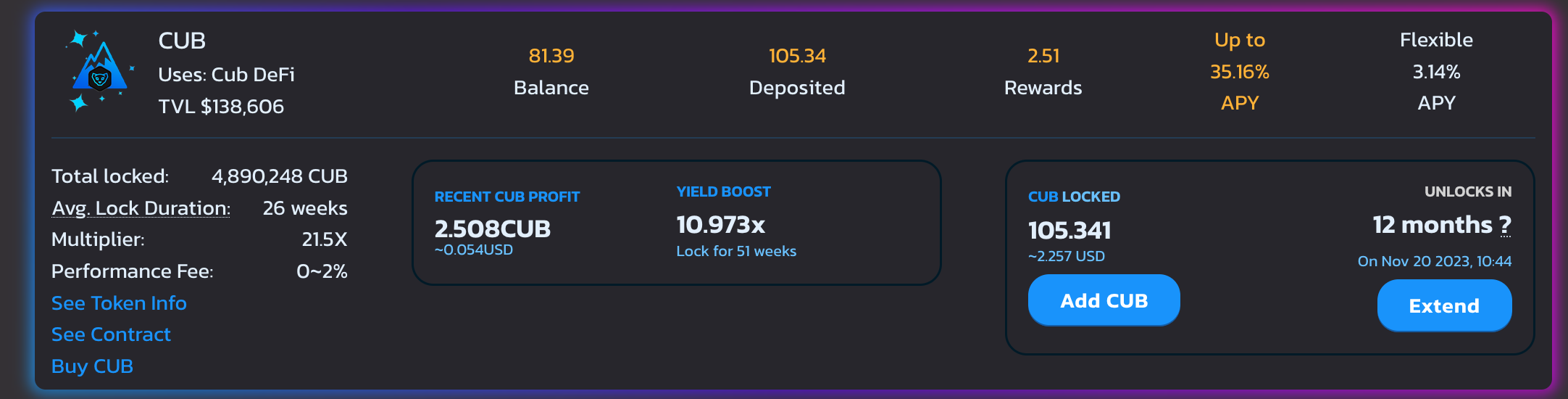

Locked CUB

A new section! The new CUB Kingdom is now live and we can track the amount of CUB locked and how long it is locked for.

- CUB Locked: 5,596,410

- Avg. Lock Duration: 33 Weeks

CUB Token

- Price: $0.02039

- Total CUB Supply: 20,420,731

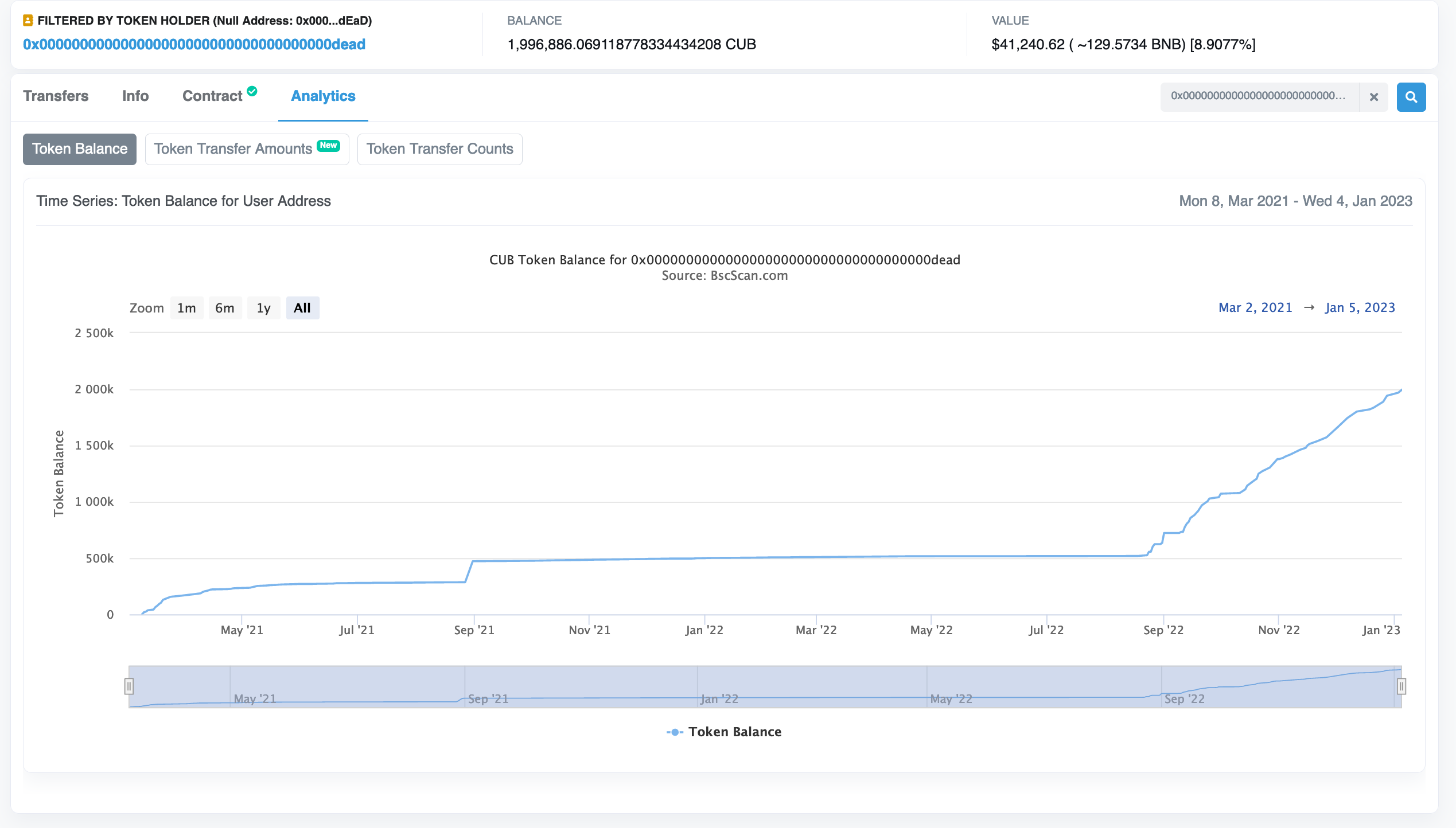

- Total CUB Burned: 1,996,886

- Total Market Cap: $415,694

- Total Value Locked: $1,403,279.38

Multi-Token Bridge Stats

- bHBD-bHIVE: $168k

- bHBD-BUSD: $318k

- bHBD-CUB: $142k

- bHIVE-CUB: $173k

- Total: $801k

TVL continues to grow! We just crossed $800k

CUB Burns

.png)

Further Reading:

- Latest Reports From this Account: @cubdaily

- Latest CUB Burn Report From the LeoTeam: https://leofinance.io/@leofinance/cub-monthly-report-or-november-2022-50-of-cub-inflation-bought-and-burned-tvl-continues-to-grow-and-arb-bot-2-0

About CubDaily

I'll be using this account to report on the CUB stats each and every morning. Together we'll track the growth of CUB under the completely revamped ecosystem that LeoTeam has built called the Multi-Token Bridge.

Posted Using LeoFinance Beta

!discovery 30

This post was shared and voted inside the discord by the curators team of discovery-it

Join our community! hive-193212

Discovery-it is also a Witness, vote for us here

Delegate to us for passive income. Check our 80% fee-back Program