Bitcoin: a long way to bull-run

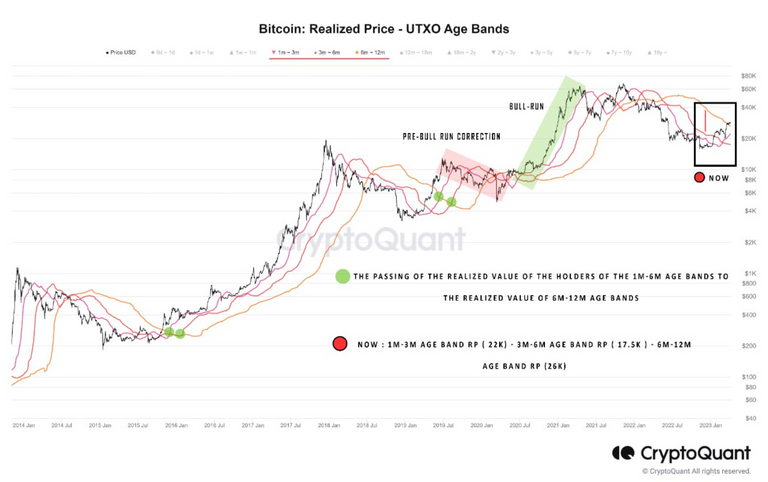

"Based on the Bitcoin price cycle in 2015-2016 and 2018-2019, when the 1m-6m age bands' realized price value passed the 6m-12m age bands realized price, after the pre-bull run price correction, the bull run began." - CryptoQuant

Here, the realized price crossovers of multiple monthly bands identified as either we are entering a new bull-run, pre-bull run or yet another long accumulation range play. I discussed in one of the previous posts the possibility of streched Wyckoff accumulation. If CryptoQuant analysis turns to be true, it is in sync with Wyckoff Accumulation as well as long-term Macro-factors.

Hier zeigen die realisierten Preisüberkreuzungen mehrerer monatlicher Bänder, dass wir entweder in einen neuen Bullenlauf, einen Pre-Bullenlauf oder eine weitere lange Akkumulationsphase eintreten. In einem der vorherigen Beiträge habe ich die Möglichkeit einer gestreckten Wyckoff-Akkumulation diskutiert. Wenn sich die CryptoQuant-Analyse als wahr erweist, ist sie im Einklang mit der Wyckoff-Akkumulation und den langfristigen Makro-Faktoren.

Best regards

Herzliche Grüße

@cryptopi314

The above content is for educational purposes only. It is not a financial advice.

Der obige Inhalt ist nur für Bildungszwecke. Es handelt sich nicht um eine Finanzberatung.

Source: Image

Additional reference:

- Is Wyckoff being played out on BTC weekly?

- NOSTR: Where does it stand?

- Is Gold profitable?

- Mindful and fruitful HIVE Meetup

- TradingView: Tools & Resources: TradingView

If you find the content useful, kindly consider to follow and re-blog! It is a great motivation 🤗

Wenn Sie den Inhalt nützlich finden, denken Sie bitte daran, zu folgen und zu rebloggen! Es ist eine große Motivation 🤗.

Can’t wait to get „moving“ again

imo it will take a little longer until FED solves the inflation problem 😊

I am patient 🤦🏻♀️

I don´t believe in TA for crypto. From the past course of the chart one can´t predict the future, there are too many other factors influencing (regulatory, macro economy, whales actions,...)

Was the bull run to 68K predicted? Was the following dump predicted by TA?

no indicator can predict future price correctly, otherwise there will be no market. TA helps in identifying high probability trades. There are various approaches to it, e.g. check order blocks (not same as order book or order flow). Some indicators mark cycle top or bottom, overbought or oversold, range play, trend play, etc. imo TA is the best tool we have to understand charts. if you know something else, am open to suggestions :)