In recent days Solana (SOL) has been nearing its all-time high of $259. It has also been beating records for transaction counts, active addresses, and TVL (total value locked). This is all great news for Solana investors and the community.

But taking into account its huge token distribution to insiders, intensive hardware requirements for validators, and centralized delegation program, is it sufficiently decentralized for sustainable long-term growth?

In this post, we point out some aspects of Solana that make it relatively centralized compared to other projects, and discuss whether or not it will affect the project's success long-term.

Bitcoin -> Ethereum -> Solana

Satoshi Nakamoto make a breakthrough when he invented an immutable and permissionless form of digital cash. Anyone, anywhere in the world was not only able to self-custody their own Bitcoin, but use their own personal computer (PC) to mine it as well.

Back in 2009 and 2010, when Bitcoin had just launched, a small laptop or PC would have sufficed to occasionally solve a block and earn 50 Bitcoins. Since then however, solo mining has become increasingly expensive, and mining pools have taken over the hashing power.

Most of these pools now require new users to go through a KYC process before mining, essentially making the network less permissionless. However, a Bitcoin node (which doesn't mine) can be setup quite easily with minimal hardware requirements.

Intensive Hardware Requirements

Ethereum lauched in 2015, and introduced smart contracts, which made things like DeFi, NFTs, and DAOs possible. Within two years the network was saturated with users, causing fees to skyrocket and transactions to slow to a crawl.

This proved that demand for decentralized apps was there, and that we needed a blockchain that scales well. As the Ethereum community started to work on its own layer 2 solutions, Solana began their work on a more scalable, smart contract enabled, monolithic blockchain.

The enhanced usability of Solana over Ethereum is fairly obvious if you've ever installed a wallet (like Phantom) and interacted with the network. Transactions are (usually) quickly confirmed, the fees are negligible, and the wallets are overall more user-friendly.

Compared to a Cardano or Hive node though, running a Solana validator is quite expensive. You need at least 24 CPU cores, 512GB of memory, and a 2TB SSD drive, which is going to put the little guy out of business if he doesn't get any help.

Solana Foundation Delegation Program

Unlike Bitcoin and (the original) Ethereum, Solana is a delegated proof-of-stake network, and the nodes that process transactions are called validators instead of miners. Therefore, in the case of Solana, stake concentration plays a major role in decentralization.

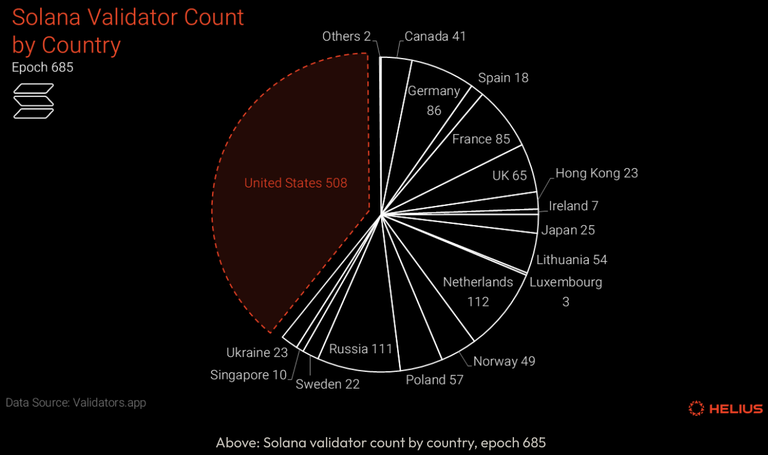

There are currently 1415 validators on the Solana network, and they each compete with one another to convince $SOL holders to stake with them. Reason being that the more SOL that is staked to their validator, the greater portion of Solana's inflation they will receive.

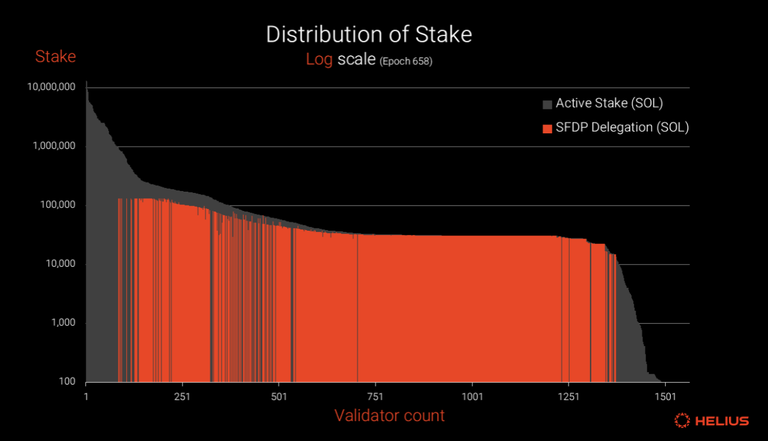

Since Solana's launch, the foundation has controlled a large swath of the SOL supply. Currently they wield about 51 million staked SOL tokens, allowing them to pick and choose new validators through their Solana Foundation Delegation Program (SFDP).

In order to be approved for the SFDP, validators must go through a KYC process, and continuously meet a number of criteria, otherwise their delegation will be outright rejected or revoked.

Approximately 72% of Solana validators are receiving a delegation from the SFDP, and that makes up about 19% of the total stake. This delegation program is essentially keeping a lot of Solana validators on life support. From the Helius report:

We estimate that if the SFDP were to be immediately discontinued, approximately 897 of the program’s participants—accounting for 57% of all Solana validators—would struggle to maintain profitable operations.

Therefore, although anyone is able to permissionlessly join the Solana network as a validator (with a minimum of 0.02 SOL staked), those who receive a delegation from the foundation will have an advantage over others, especially when it comes to paying their bills.

Distribution Of Tokens To Insiders

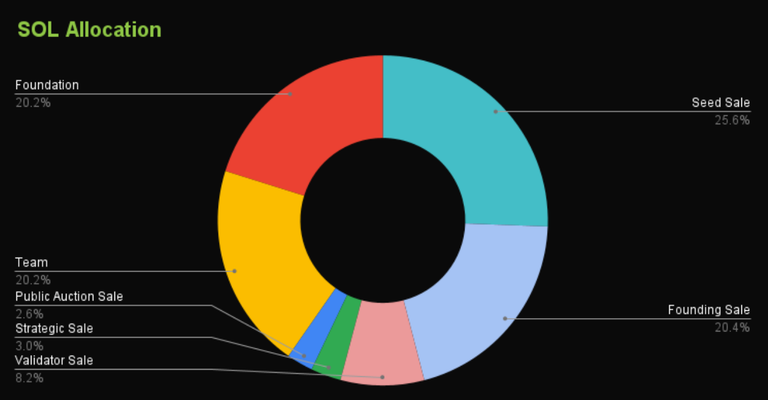

Solana's initial token distribution is also of concern.

Unlike Bitcoin, which was distributed gradually over time to the miners who safeguarded the network, a large portion of SOL was heavily allocated to the founders and investors from the outset.

This means very few people are are deciding which validators get stake, and makes it hard for newcomers to climb the ranks. This could also affect governance voting in the future, as the whales could easily veto the community.

All that said, the token supply could become more decentralized as venture capitalists (VCs), insiders, and whales sell into the upcoming bull-run, allowing (wealthy) newcomers to take a stake in the network.

Until next time...

Compared to Bitcoin and Ethereum, Solana is still a relatively new and experimental blockchain project. Although it suffered many outages throughout 2022 and 2023, it has since stabilized and made it to the #4 spot on Coingecko.

Despite its intial token distribution to VCs, intensive hardware requirements for validators, and centralized delegation program, it has managed to attract a number of promising DePIN projects, as well as memecoin traders, thanks to its low fees and high speed.

As its market cap continues to increase, we should see more decentralization of its token supply, but only time will tell if this innovative project is decentralized enough to withstand targeted attacks, and win over serious users in the long run.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Resources

Helius - Solana Decentralization [1]

Helius - Solana Foundation Delegation Program [2]

Solana Initial Token Distribution Coingecko [3]

Posted Using InLeo Alpha