As is now well known, on May 8 and 9, 2022, Bitcoin went from a value of $40,000 to $26,000. That was possible by exploiting the weakness of the UST stablecoin of the Terra-Luna ecosystem, based on an algorithmic stabilization.

I do not want to repeat what has been enormously expressed by thousands of people on the net, but to talk about why in classical finance such an attack would have produced no damage while in cryptocurrency it hit the mark and caused small and medium investors to lose billions of dollars. I point out how the economy is at the basis of the survival of human beings in our modern society and due to the attack suffered from Terra, 8 people have committed suicide.

Volatility auction

The volatility auction is a time-out if the trading price fluctuates outside of what the market is expecting that day, whether it goes up too much or it goes down too much. In the case where orders are still out of the market at the end of the auction, it is possible to repeat it up to block the trading for 24 hours.

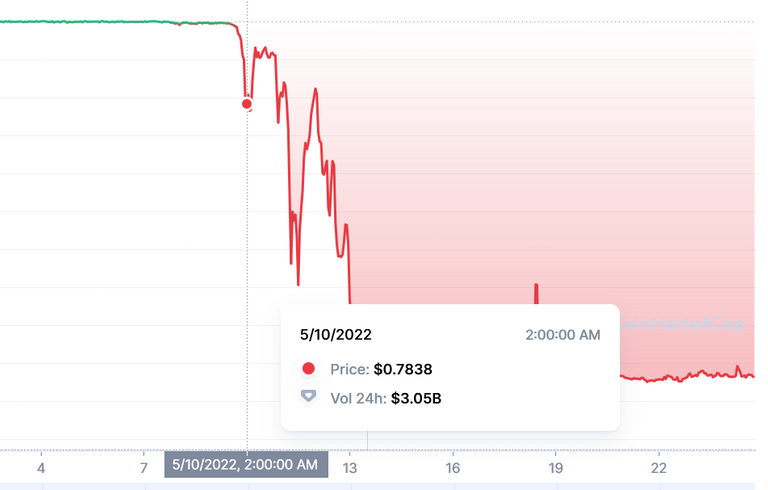

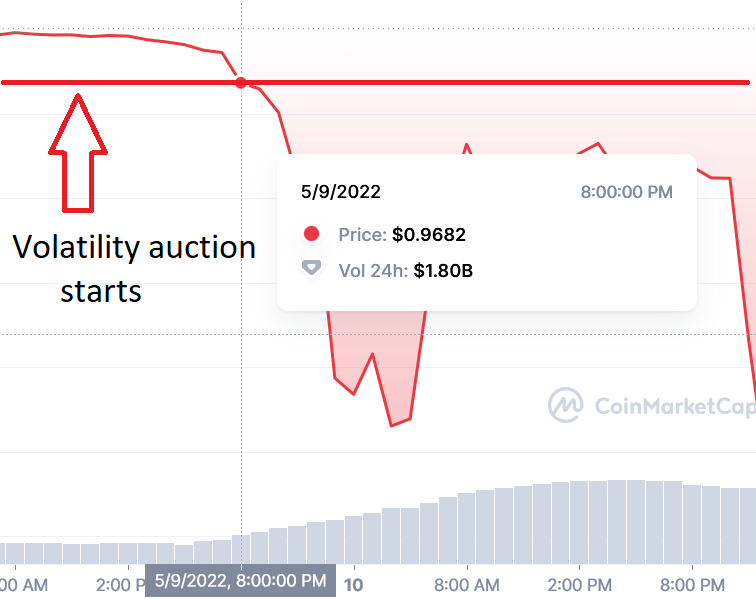

May 9th at 8pm (Italian time), UST passes from about $1 to $0.9682, that is, an oscillation greater than 3%.

Normal for crypto, right? Unfortunately yes because that we are used to. Yet at that 3% there are people who have put their savings 10 years of their lives, others have pointed Stake to pay the mortgage payment. The capital could be protected through an auction of volatility.

How does the volatility auction work?

The market fixes a maximum percentage by which the price can oscillate. If the price goes above this percentage or drops below this percentage, the trading stops for 2 minutes and a half, during which anyone can edit orders, insert new, but mostly eliminate them.

And it is the latter option that would allow Terra to survive in classical Finance instead of succumbing to crypto (you will understand how in the next paragraph). For example UST could have chosen 3% as swing, blocking the market when the price had fallen to $0.96. At the end of the volatility auction, selling the Bitcoins would have brought it back to $1. Thanks to this protection mechanism, the value of UST could never fall below $0.97 since every time the trading day would be interrupted. Moreover, in case of massive deletion of purchase orders, the market can be blocked for 24 hours.

What would happen on May 9 if the volatility auction had protected Bitcoin and Terra?

Suppose that everything happens in the same way.

The attacker sells 100,000 Bitcoin and the price goes down to $35,000.

Immediately after the attacker sells 350 million UST stablecoin forcing it to be worth $0.98.

The next day the attacker tries to sell 650 million UST but he fails, because as soon as its value becomes $0.96, a volatility auction starts and in 2 and a half minutes Earth sells a few thousand Bitcoins to rebalance the market. At the end of the auction, the attacker tries to sell the remaining UST failing again because another auction blocks him. At that moment it happens a very negative psychological event for the market called "Panic Selling": Terra controls the market seeing that at the end of the last volatility auction sales orders are many while a lot of buy orders are erased: the title is likely to go so down to lose the status of stablecoin or burn all the Bitcoin held in order to rebalance a market driven by fear rather than by reason. So does a very smart move: closes the trading day for 24 hours. At that time investors take a chamomile possibly with a couple of anticoagulant tablets inside, find rest with a couple of Twitter, sleep and come back to see how many money they have, discovering something fantastic: 24 hours after the UST price is still a dollar!

The news of the attack immediately appears and Terra announces the final outcome.

On May 9, the Terra platform would have sold about 10,000 Bitcoin instead of 80,000, UST would not get crazy and would maintain monetary stability. The attacker would have taken home $200 million but would not have destroyed the wealth of millions of investors and an ecosystem.

What is the volatility auction in classical finance for?

I make a very brief example: China holds in their banks 3 trillion of American assets. Without this protection mechanism, it could destroy the US economy in 10 minutes and the next day everyone would be forced to become Chinese.

ITA

Come è ormai ben noto, l'8 e il 9 maggio 2022 Bitcoin è passato da un valore di $40.000 a $26.000. Ciò è stato possibile sfruttando la vulnerabilità della stablecoin UST dell'ecosistema Terra-Luna, basato su una stabilizzazione algoritmica.

Non voglio ripetere ciò che è stato enormemente espresso da migliaia di persone in rete, bensì parlare del perché nella finanza classica un attacco del genere non avrebbe prodotto danni mentre nella criptovaluta è andato a segno e ha fatto perdere miliardi di dollari a piccoli e medi investitori. Faccio notare come l'economia sia alla base della sopravvivenza degli esseri umani nella nostra società moderna e a causa dell'attacco subito da Terra, si siano suicidate 8 persone.

Asta di volatilità

L'asta di volatilità è un time out alle contrattazioni se il prezzo oscilla al di fuori di quello che il mercato si aspetta in quel giorno, sia che salga troppo sia che scenda troppo. Nel caso in cui gli ordini siano ancora fuori mercato al termine dell'asta, è possibile ripeterla fino a bloccare le contrattazioni per 24 ore.

Il 9 maggio alle ore 20 (ora italiana) UST passa da circa $1 a $0.9682, cioè un'oscillazione superiore al 3%.

Normalissimo per la crypto, giusto? Purtroppo sì perché è questo a cui siamo abituati. Eppure in quel 3% ci sono persone che ci hanno messo i risparmi di 10 anni della loro vita, altri hanno messo in Stake per pagarsi la rata del mutuo. Il capitale avrebbe potuto essere protetto grazie all'asta di volatilità.

Come funziona l'asta di volatilità?

Il mercato fissa una percentuale massima in cui prezzo possa oscillare. Se il prezzo sale oltre questa percentuale o scende sotto questa percentuale, le contrattazioni si fermano per 2 minuti e mezzo, periodo in cui tutti possono modificare ordini, inserirne nuovi, ma soprattutto eliminarli.

Ed è proprio quest'ultima possibilità che avrebbe permesso a Terra di sopravvivere nella Finanza classica invece di soccombere nella crypto (capirai come nel prossimo paragrafo). Per esempio UST avrebbe potuto scegliere il 3% come oscillazione, bloccando il mercato quando il prezzo fosse caduto a $0.96. Al termine dell'asta di volatilità, la vendita dei Bitcoin lo avrebbe riportato a $1. Grazie a questo meccanismo di protezione, il valore di UST non sarebbe mai potuto scendere sotto $0.97 poiché ogni volta le contrattazioni si sarebbero interrotte. Inoltre, in caso di rimozione massiva degli ordini di acquisto, il mercato può essere bloccato per 24 ore.

Cosa sarebbe accaduto il 9 maggio se l'asta di volatilità avesse protetto Bitcoin e Terra?

Supponiamo che tutto avvenga nello stesso identico modo.

L'attaccante vende 100 mila Bitcoin e il prezzo si abbassa a $35.000.

Subito dopo l'attaccante vende 350 milioni di UST costringendo la stablecoin di Terra a valere $0.98.

Il giorno dopo l'attaccante tenta di vendere 650 milioni di UST senza riuscirci, perché appena il titolo arriva a $0.96 va in asta di volatilità e in 2 minuti e mezzo Terra vende qualche migliaio di Bitcoin per riequilibrare il mercato. Alla fine dell'asta, l'attaccante tenta di vendere gli UST rimanenti e ancora non riesce perché un'altra asta lo blocca. In quel momento accade un evento psicologico molto negativo per il mercato chiamato "Panic Selling": Terra controlla il mercato vedendo che alla fine della seconda asta di volatilità gli ordini di vendita sono tantissimi e quelli di acquisto cancellati: il titolo rischia di andare così in basso da perdere lo status di stablecoin oppure di bruciare tutti i Bitcoin posseduti al fine di riequilibrare un mercato mosso dalla paura invece che dalla ragione. Allora fa una mossa molto intelligente: chiude le contrattazioni per 24 ore. In quel tempo gli investitori prendono una camomilla possibilmente con un paio di pasticche anticoagulanti dentro, si rasserenano con un paio di Twitter, dormono e tornano a vedere quanti sono i loro soldi scoprendo una cosa fantastica: 24 ore dopo il prezzo di UST è ancora un dollaro!

Subito appare la notizia dell'attacco e Terra annuncia l'esito finale.

Il 9 maggio la piattaforma Terra avrebbe venduto circa 10.000 Bitcoin invece di 80.000, UST non sarebbe impazzito e avrebbe mantenuto la stabilità monetaria. L'attaccante avrebbe portato a casa 200 milioni di dollari ma non avrebbe raso al suolo il patrimonio di milioni di investitori e distrutto un ecosistema.

A cosa serve l'asta di volatilità nella finanza classica

Faccio un esempio brevissimo: la Cina detiene nelle proprie banche 3 triliardi di dollari di asset americani. Senza questo meccanismo di protezione, potrebbe distruggere l'economia degli Stati Uniti in 10 minuti e il giorno dopo sarebbero costretti tutti a diventare cinesi.

Sad that something so simple could have at least helped but look who was in charge.

Posted Using LeoFinance Beta

I think you hit the spot: whoever decides whether to protect crypto has chosen not to. And those who decide certainly have much more knowledge of simple school notions like the one I have described

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-0.00000001 BTC (SWWAP.BTC)

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

I wonder what happened that they allowed things to go how it did when something simple could have actually been placed to help.

Posted Using LeoFinance Beta

My opinion is that no one wants to protect crypto to allow those who know how to use the market to earn as much as possible, unfortunately to the detriment of non-professional investors

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-0.00000001 BTC (SWWAP.BTC)

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

That's sad and unfortunate indeed.

Posted using LeoFinance Mobile

You're only painting half the picture, if you place such rules in place you limit traders spreads on arbs, which is what kept the platform going, meaning less capital to top up the anchor protocol subsidy meaning the whole system is pointless.

Posted Using LeoFinance Beta

When it comes to an arbitrarily priced stock, everyone knows they are taking the investment risk. But when it comes to stablecoins, "trust" in the stabilization system comes into play. Without trust you will get less investment and less capital, so protecting stablecoins is essential to allow investments to continue

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-0.00000001 BTC (SWWAP.BTC)

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

If you have rules like that you effectively obliterated all trust, because you've got chain halt rules so why have a chain at all?

You're going to just push people to the chains that don't limit arb and your project dies from lack of liquidity.

The algo stablecoin is a project that has failed since 2015 and will continue to fail and your half-backed solution isn't changing dick. You really think people with near bilions in funding, research and backing would think of this and think of your proposal?

This is just shitcoin apology,

Algo coins will always continue to fail until they are protected as in classic finance. Creating billions of UST without thinking that a massive sale could bring down the price is insane! Applying my proposal would be a basic level of protection to be able to say: we made a mistake in printing money, we have to solve it in 24 hours.

People's trust is not only based on the chain, but also on the monetary stability of a stablecoin

then it's no longer an algo coin which is my point entirely you cannot use blockchain assets with a reference tool, no ones ever solved the oracle problem in computing. I could go through the litany of issues behind it but I've already put them up on my blog

You are right: if the algorithm fails it is no longer algo. The problem starts with the fact that we are human and we need to destabilize a value to make a profit. Whatever the algorithm, there will always be someone ready to attack it. If there were a calculation capable of predicting the trend of a market, finance would cease to exist since it would no longer make sense to negotiate

Anyway, the error has been made by humans. As long as balancing UST was the most profitable business, people focused on that. The mistake was to sell Bitcoin instead of leaving the rebalancing to investors, making it more profitable to play short. The volatility auction would protect against human errors by giving time to understand what they are and correct them while minimizing the damage

Yay! 🤗

Your content has been boosted with Ecency Points

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more, by @mchero.

The Hivebuzz proposal already got important support from the community. However, it lost its funding a few days ago and only needs a few more HP to get funded again.

May we ask you to support it so our team can continue its work this year?

You can do it on Peakd, ecency, or using HiveSigner.

Your support would be really helpful and you could make a difference.

Thank you!Dear @mchero, we need your help!