The Bitcoin balance on exchanges is a parameter that is closely monitored by the market participants. It can give a signal when a large amount of Bitcoin is moved in or out of exchanges causing the price to drop or rally. In the recent period it is also monitored as proof or reserves on exchanges. After the FTX collapse, exchanges started to be more opened and disclaimed their positions, with BTC in most cases being the number one.

As the latest development in the space, we now have the spot ETF approved from the US SEC, causing more BTC to be withdrawn from exchanges. Let’s take a look.

Here we will be looking at:

- Bitcoin balance on exchanges

- Historical share (%) of bitcoin balance on exchanges

- Bitcoin balance on exchanges VS supply

- Monthly Changes for BTC on exchanges

- BTC on Exchanges VS Price

- Top Exchanges holding BTC

The data is collected from sources like coinglass.com, macromicro.me, cryptoquant.com.

Bitcoin Balance on Exchanges

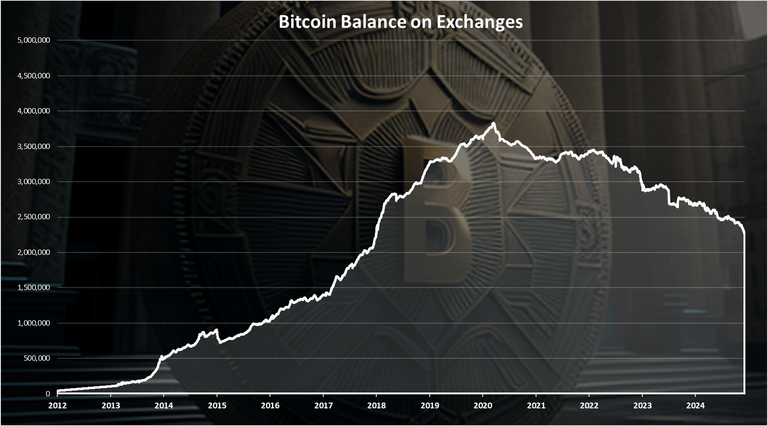

Here is the chart for the historical balance of bitcoin on exchanges.

This is a long term trend starting from 2012. As we can see prior to 2013 the amount of BTC on exchanges is almost nonexistent. After 2013 there is an increase in the amount of BTC on exchanges, reaching more than 600k at the end of 2014. In 2015 there is a small drop and after that a continuous growth up to March 2020, when an ATH for BTC balance on exchanges was reached more than 3.5M.

Since 2020, the balance on bitcoin on exchanges is in constant decrease and it has dropped even more in the recent period. At the moment there is around 2.2M BTC on exchanges. Quite the drop since the ATH.

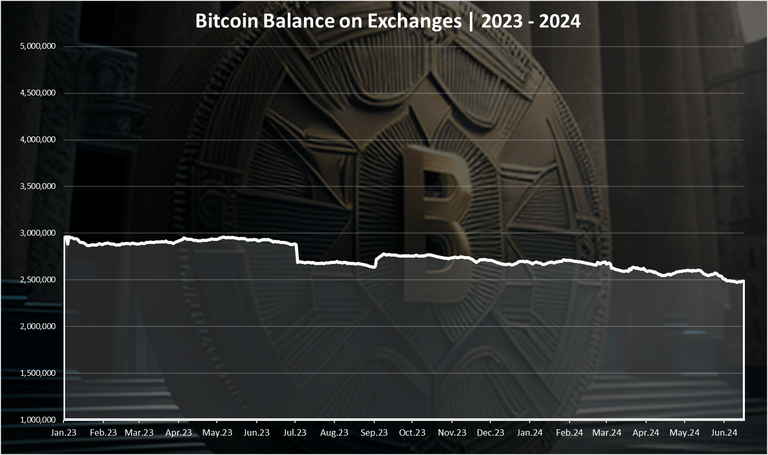

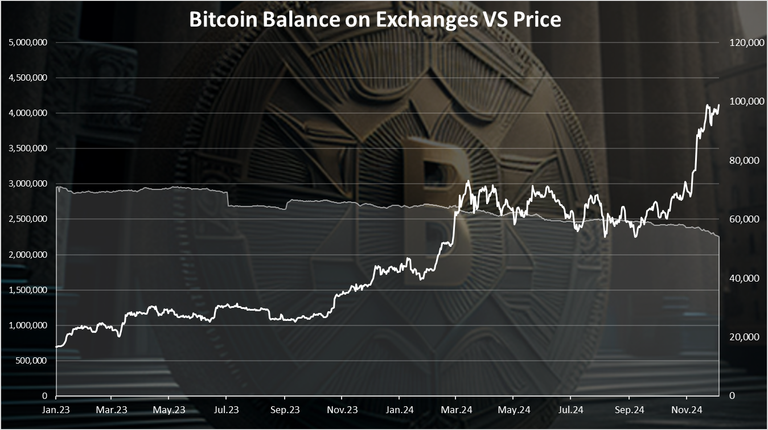

When we zoom in 2023-2024 we got this:

A continuous decline in the BTC balance on exchanges in the last years. At the beginning of 2023 there was around 3M, while the year ended at around 2.6M. A 0.4M reduction in 2023.

In 2024 there is a further drop in the balance of exchanges and now we are at around 2.2M. A further 0.4M drop in 2024.

Note that different source are reporting different data on the Bitcoin balance on exchanges and the current 2.4M might differ.

Bitcoin on Exchanges VS Supply

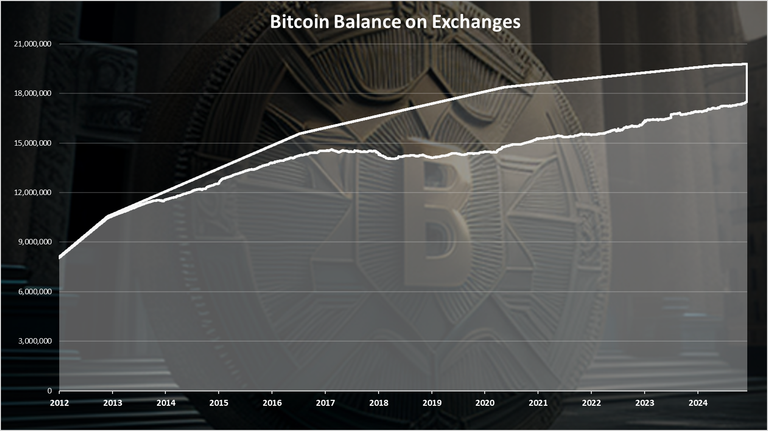

When we plot the balance on exchanges VS the overall supply, we get this:

We can notice the increase in the balance one exchanges up to 2020 here as well, and then a slow decrease. But still overall we can see how small this share is from the absolute supply when presented in the chart above.

Historical Share [%] of Bitcoin Balance on Exchanges

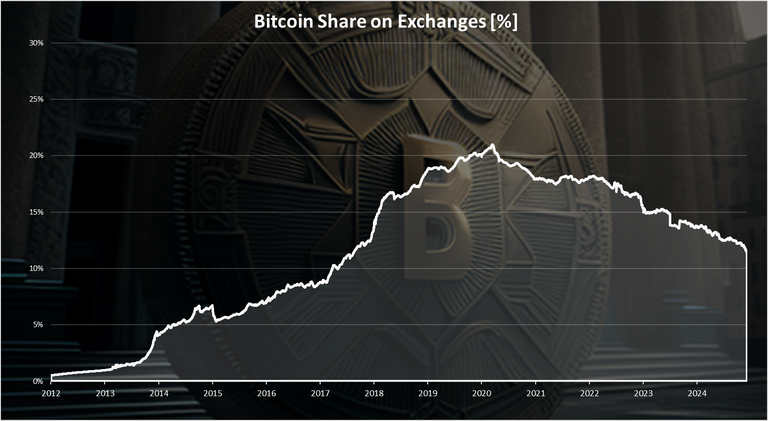

When we take a look at the Bitcoin balance in relative terms, as percent of the supply we get this:

This chart is similar to the absolute balance, but here we can see the share [%]. An all-time high of 20%, in 2020, and a drop since then to 11% where we are now. At the beginning of the year this percent was close to 14%.

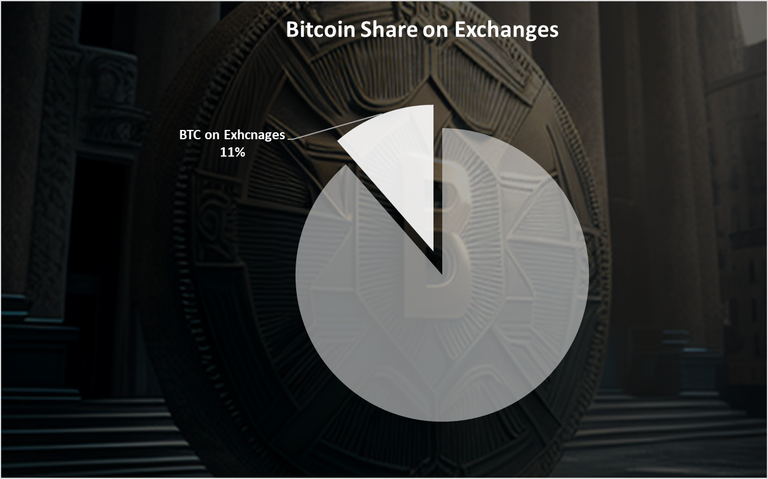

When presented as a pie chart the chart looks like this:

A 11% of the Bitcoin supply is currently on exchanges. This is a low amount of tokens on exchanges, especially bearing in mind that Bitcoin doesn’t have any type of staking rewards or similar incentives for users to withdraw their tokens of exchanges. The overall trend of self-custody has been growing.

Monthly Changes for BTC on Exchanges

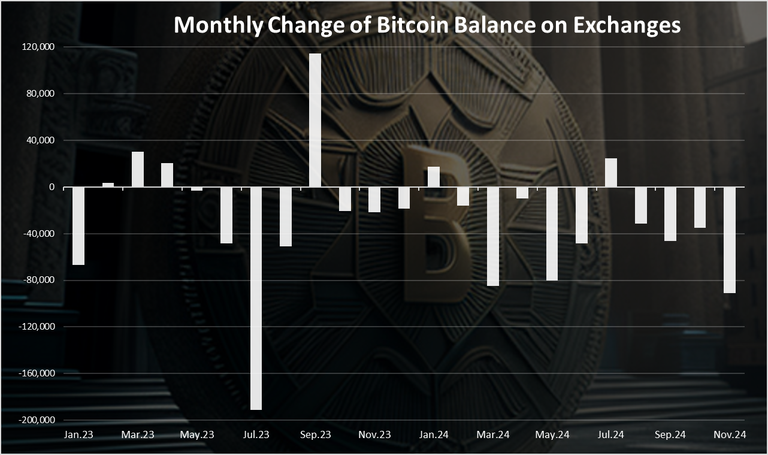

The change for the monthly balance on exchanges is as follows:

A positive bar is the inflow, negative outflow from exchanges.

We can see that last year July 2023 was the month with the most outflow from exchanges while September 2023 was the month with the most inflow on exchanges. Afterwards each month there was an outflow from exchanges.

In 2024 only January and July had a small inflow on exchanges, while all the other months we can see net outflow from exchanges with November 2024 being the highest in the year with close to 100k BTC withdrawn from exchanges.

Bitcoin Balance on Exchanges VS Price

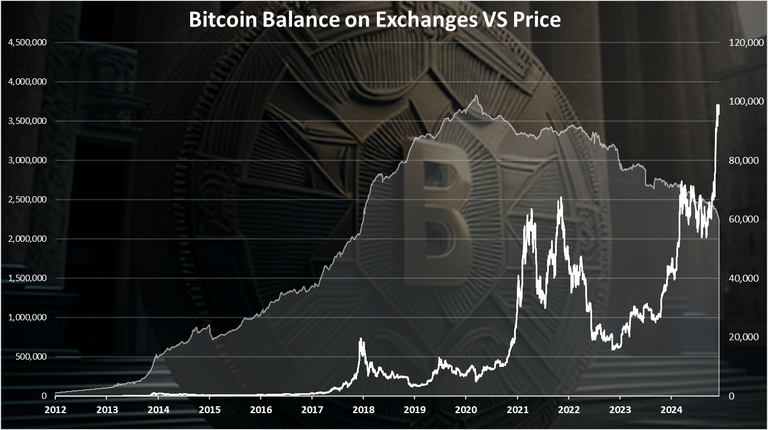

When we plot the BTC balance on exchanges vs the price we get this:

When we look at the long-term trend, we can notice that there has been a correlation back in 2017, when the price increased, that followed by a large amounts of BTC deposited on exchange, and this continued to grow even during the bear market of 2018 and 2019.

In the last bull market of 2021, there hasn’t been any significant increase in BTC on exchanges. There was only a slight increase towards the end of 2021, but then the trend for removing BTC from exchanges continued, no matter the price.

Will this trend be over soon, or it will continue in the future remains to be seen.

In the last years these two have been moving in the opposite direction. The amount of BTC on exchanges down, and the price up.

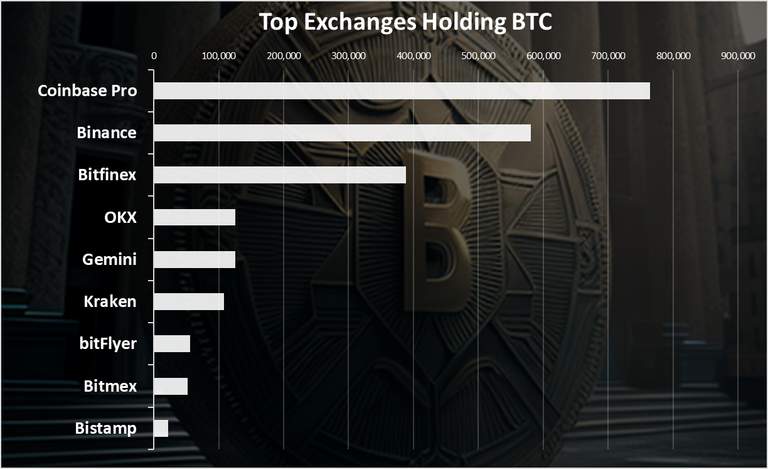

Top Exchanges Holding BTC

Which exchange holds the most BTC. Here is the chart.

The Coinbase Pro with close to 764k BTC is on the top here according to Coinglass. Not sure what is included in this amount, does Bitcoin that Coinbase custody for other entities, like maybe the ETFs. In the past this number was close to 900k.

Binance is in the second spot with close to 580k Bitcoins, followed by Bitfinex and OKX. Gemini and Kraken are the next exchanges that hold more than 100k Bitcoin, all the others are below this threshold and dropping fast.

All the best

@dalz

The Coinbase holds 764k BTC, a record amount of BTC. The price has increased even though BTC balances on exchanges have decreased. A lot of information that is very important for investors

I just saw on my Twitter (or X) feed that Coinbase is freezing users accounts for no reason, one guy had around 1,2 million stuck there.

I got my Coinbase account frozen around like 2021 or 2022, but luckily they left my account open for withdrawals for 30 days, so I could get my assets back.

I don't like them, but they are pretty much the most mainstream exchange there is. 😠

What about HIVE? It'll be interesting to look how changed numbers since your previous October post

Bitcoin is becoming scarce on exchanges. We'll see if they don't end up paying premiums.

At the moment the demand for bitcoin is very high and the exchange has it low so we can see a lot of increase in price which I think will be the top of the cycle for bitcoin. It will be from one lac 30 thousand to one and a half lac.

Exchanges might be trying and sell now at 100k

Congratulations @dalz! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

<table><tr><td><img src="https://images.hive.blog/60x70/https://hivebuzz.me/@dalz/upvoted.png?202412070124" /><td>You received more than 350000 upvotes.<br />Your next target is to reach 360000 upvotes. <p dir="auto"><sub><em>You can view your badges on <a href="https://hivebuzz.me/@dalz" target="_blank" rel="noreferrer noopener" title="This link will take you away from hive.blog" class="external_link">your board and compare yourself to others in the <a href="https://hivebuzz.me/ranking" target="_blank" rel="noreferrer noopener" title="This link will take you away from hive.blog" class="external_link">Ranking<br /> <sub><em>If you no longer want to receive notifications, reply to this comment with the word <code>STOP <p dir="auto"><strong>Check out our last posts: <table><tr><td><a href="/hive-122221/@hivebuzz/pum-202411-delegations"><img src="https://images.hive.blog/64x128/https://i.imgur.com/fg8QnBc.png" /><td><a href="/hive-122221/@hivebuzz/pum-202411-delegations">Our Hive Power Delegations to the November PUM Winners<tr><td><a href="/hive-122221/@hivebuzz/pud-202412-feedback"><img src="https://images.hive.blog/64x128/https://i.imgur.com/zHjYI1k.jpg" /><td><a href="/hive-122221/@hivebuzz/pud-202412-feedback">Feedback from the December Hive Power Up Day<tr><td><a href="/hive-122221/@hivebuzz/pum-202411-result"><img src="https://images.hive.blog/64x128/https://i.imgur.com/mzwqdSL.png" /><td><a href="/hive-122221/@hivebuzz/pum-202411-result">Hive Power Up Month Challenge - November 2024 Winners List