The Hive internal DEX is an amazing feature on the Hive blockchain. It is a layer one DEX that allows users to trade HIVE and HBD. Imagen if BTC or ETH had an on chain, layer one - no additional apps, KYC free, permissionless way to convert between a stablecoin and the asset. It’s quite the thing!

The DEX has been around since the beginning of the chain, and it is an integral part of it. However, it has always been underutilized and with low volume. But since the introduction of the two ways conversions and more HBD improvements, things have changed, especially in the last years. Much higher volumes and usability of the DEX. Also, now we have more than one interface for the DEX.

The introduction of the @hbdstabilizer and its trading activities on the DEX has also improved liquidity. In the last period though the stabilizer has scaled down its activities leaving room for other participants and market makers.

Here we will be looking at:

- Daily HBD volume on the internal Hive DEX

- Monthly HBD volume on the internal Hive DEX

- Number of trades made

- Number of accounts trading on the DEX

- Top liquidity providers on the DEX

- HBD Price

The period that we will be looking at is from 2021 till now. This is because in 2021 the two ways conversion for HBD was introduced and the stabilizer trading on the DEX. Prior to this the volume and the activity are very low.

Daily Trading Volume

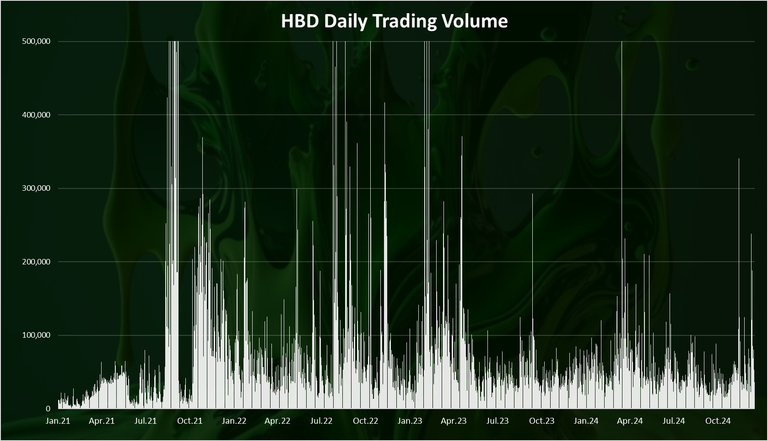

Here is the chart for the daily trading volume on the internal Hive DEX.

This is a longer timeframe starting from 2021, for context. As we can see back in the begging of 2021 the daily trading volume is quite low, usually under 5k. The stabilizer was introduced at the end of February 2021, and later we can notice the increase in the trading volume on the DEX. Furthermore, in June 2021, the HIVE to HBD conversions were implemented and we can see the explosion in the trading volume in August 2021. This is as a result of the increase in the price of HBD and all the arbitrage that has been undergoing.

We can notice the spikes in the trading volume on a daily basis. This usually happens when HBD is trading higher on external markets, usually on Upbit where HBD has one of its rare listings. When this spikes happen the trading volume on the internal DEX is higher than 1M HBD per day.

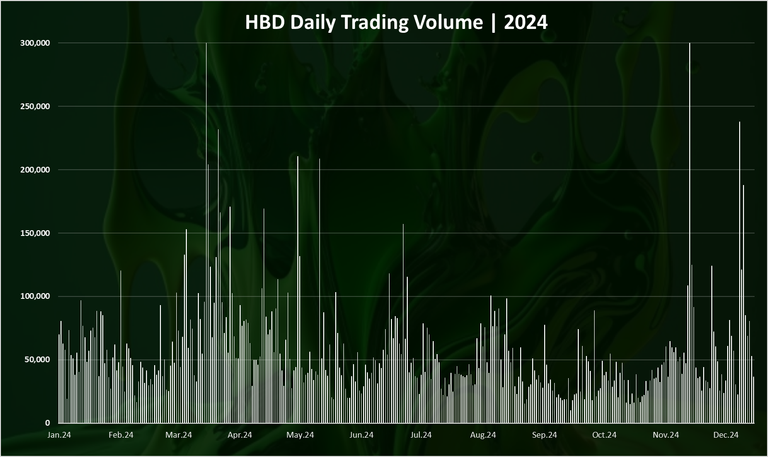

When we zoom in 2024 we get this:

In 2024 the daily trading volume on the internal DEX on average is between 50k t0 100k daily. There is a spike in March 2024, when there was more than 300k volume in a day. In the recent days there is also an increase to 200k daily volume.

All this volume is mostly from organic market participants since the stabilizer has now scaled down its operations by a lot.

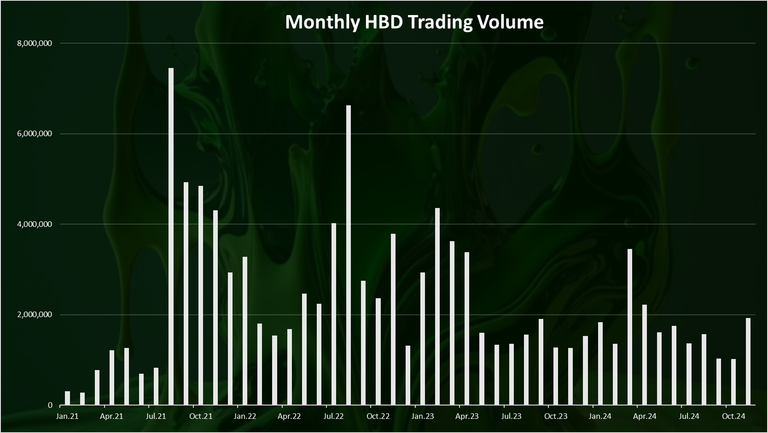

The monthly chart for the trading volume on the DEX looks like this:

Here we can see the spikes in the monthly volume chart. First in August 2021 up to 7.5M, then again a year later in August 2022 to 6.5M. In 2023 in the first months the trading volume was around 3.5M HBD up to May 2023 and the scaling back of the stabilizer, when it dropped in the range of 1.5M to 2M.

In 2024 the monthly trading volume remained in this range with a spike in March 2024 almost to 4M and a smaller spike in November.

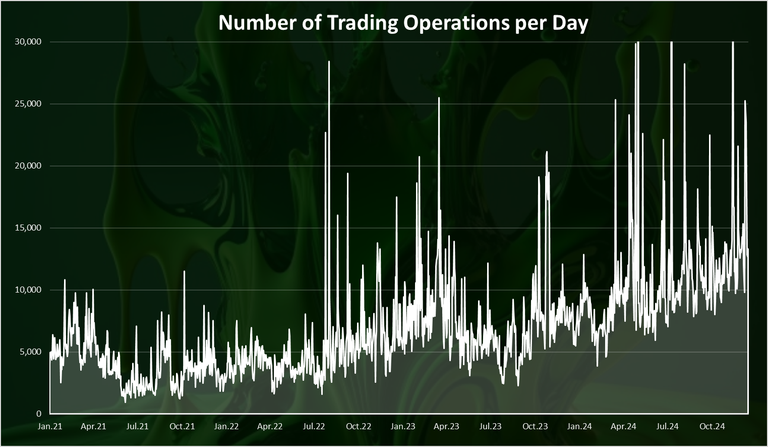

Number of Trading Operations

The above was the volume. What about number of operations/trades made on the DEX. Here is the chart:

In terms of number of operations we can see an almost continuous growth with some occasional spikes. Back in 2021 the number of daily operations was around 5k while now we are above 10k, with a lot of spikes in between pushing the numbers above 30k on occasions. On average in the last 30 days the number of daily operations on the internal market are close to 15k.

Note that these are only the operations made by users, meaning making or canceling orders. Furthermore there are virtual operations happening on the blockchain when the orders are getting filled but these operations are not made directly from users, ergo the name virtual operations.

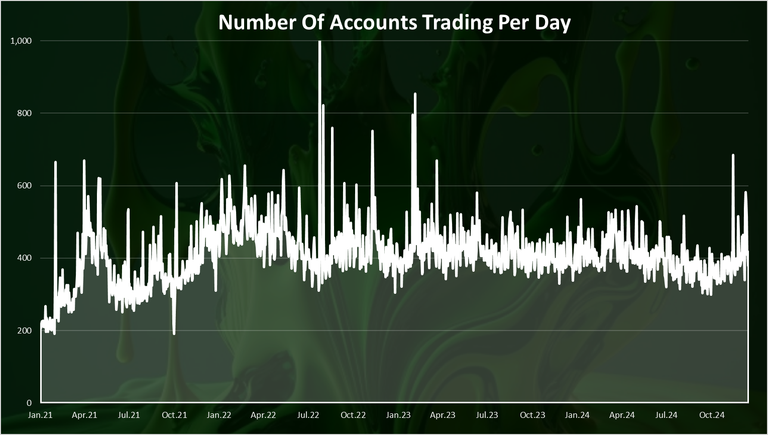

Number of Accounts Trading on the Hive DEX

What about the number of accounts? How many users are actually using the DEX? Here is the chart for the daily accounts.

The number of accounts trading on the internal DEX has been surprisingly constant on a daily basis in the period. Around 400 accounts making using the DEX on a daily basis. There is an increase in the last month up to 600 on some days.

What about the number of monthly accounts trading?

When it comes to trading not everyone is doing it daily, so the MAUs might be a better indicator. Here is the chart.

The monthly active accounts chart is also quite stable. Close to 3k accounts trading monthly on the internal DEX. This is quite higher from the DAUs, where the daily numbers are around 400.

Top Liquidity Providers on the Hive DEX

Who is doing most of the trading? Here is the chart for the top accounts that are buying HIVE (selling HBD) on the DEX in the last 30 days.

The @konvik-hbd account is on the top now with 1MHIVE bought in the last 30 days. @konvik is now the top market maker on the hive DEX.

On the second spot is @keychain-swap with 120k. The account from @keychain has build in function for swapping in the wallet and obviously users are taking advantage of this. @deathwing is also in the top.

What about selling HIVE (buying HBD)? Here is the chart:

@teamsmooth-mm is on the top here as well with more than 800k HIVE sold. Konvik on the second spot.

These accounts are buying HBD on the internal DEX, meaning they are giving support for the HBD price. We can notice that the @hbdstabilizer is not even in the top accounts in the list above.

In the past the stabilizer was on the top of this chart acting as a main liquidity provider for HBD, but not anymore. The stabilizer was in the previous chart for selling HBD, on the 3rd spot, meaning in the previous month it was selling more HBD then buying, giving support on the upside for HBD.

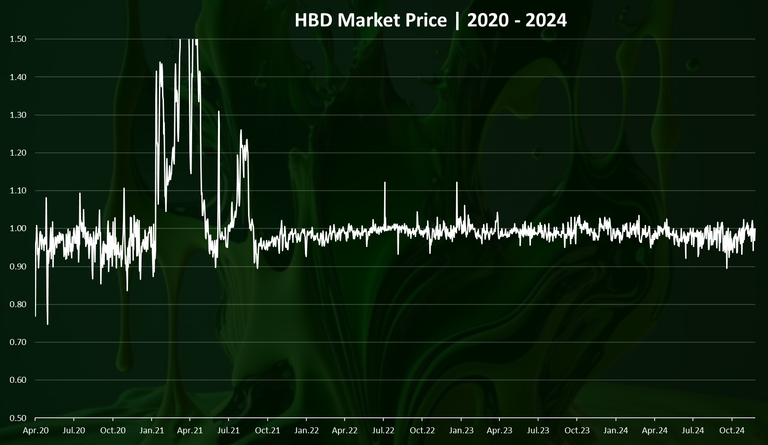

HBD Price on the External Markets

At the end the chart for the HBD price starting from 2020.

We can see that at first the price was oscillating a lot around one dollar. Then in the first half of 2021 it spiked and reached more than $2 on a few occasions.

After August 2021, the HBD price on the external markets is much more stable with a few small spikes above $1.1, and drops to around 0.95.

In the last period, after the scaling back of the @hbdstabilizer budget there has not been any significant movement in the HBD price. Other players are also participating in providing liquidity on the DEX, buying and selling HBD. This has basically removed the stabilizer as a single entity that is providing liquidity for HBD and made the system more decentralized, and user driven.

HBD now has more than four years of history acting as intended with its design. We can probably declare it as a successful design for a stablecoin.

All the best

@dalz

I think you probably made a mistake somewhere when calculating the buy/sell volume of accounts. @konvik-hbd and @teamsmooth-mm should have buy and sell volume similar to each other :) @konvik-hbd certainly did not buy 600k more HIVE than it sold.

I'll look into it

Thanks for the data. HBD finally settled at $1, but sometimes it falls below $1 and sometimes it rises above $1. Along with the HBD interest, the amount of HBD in the market increased and so did the buying and selling of HBD.

I use a lot the internal DEX, is truly one of the best features of Hive Blockchain.

Do you have any historical chart of the HBD value in the internal market?

Probably not on an hour to hour base, but on a daily level yes

Nice new profile picture :)

Also I hope the influx of new accounts goes higher.

Tnx!

HBD is the most traded coin and Konvik is always on the market and trading. A lot of information will be useful to us.

We remain very stable over time, but the shame is that we are not taking advantage of the market growth like other chains.

!PIZZA

$PIZZA slices delivered:

(6/10) @danzocal tipped @dalz