Introduction:

Let me take a moment to introduce myself to the Splinterlands community. I may not be the most active participant, but I've made some contributions that reflect my values and vision for the crypto space. Notably, I voted against the "Allocate up to 30 million SPS to pursue exchange listings" proposal (#25), underlining my belief in the importance of decentralization and liquidity pools over reliance on centralized exchanges. I also initiated the "Convert BUSD DAO holdings into DEC-DAI LP" proposal (#24), aiming to optimize our community's resources for maximum benefit.

In my journey through the Splinterlands, I provide liquidity on both Ethereum and Hive networks, primarily because I first entered the world of Splinterlands through Credits (small amounts) and then Ethereum, and Ethereum remains my preferred route for handling larger sums (+5k USD transactions). Additionally, I'm proud to manage and continually develop splinterboard.org, a platform that serves as a testament to my commitment to the growth and innovation within the Splinterlands community.

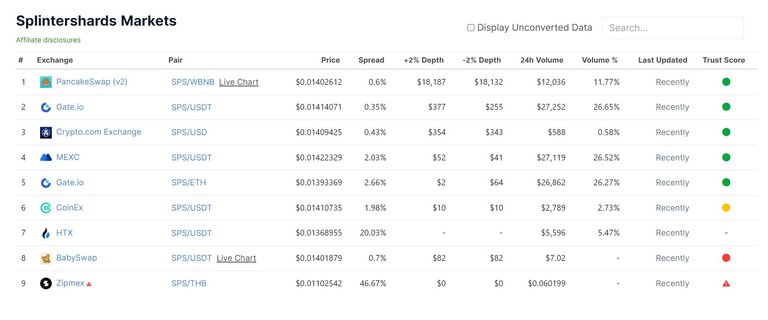

The Splinterlans community is at a crossroads, and a significant debate has arisen regarding the listing of our crypto token called SPS on centralized exchanges. While some argue that such listings are vital and even propose paying for market makers to remain on these centralized platforms, I firmly believe that our focus should shift away from centralized exchanges and instead turn toward liquidity pools and decentralized exchanges.

Centralized vs. Decentralized:

Centralized Exchanges:

Centralized exchanges have long been the go-to platforms for trading cryptocurrencies. They offer liquidity, ease of use, and a familiar interface. However, they come with their own set of challenges, such as custodial risks, regulatory scrutiny, and limited control for users. Moreover, the heavy reliance on centralized exchanges perpetuates a centralized infrastructure, which goes against the very ethos of blockchain technology.

Decentralized Exchanges (DEXs) and Liquidity Pools:

Decentralized exchanges and liquidity pools represent a paradigm shift in the world of crypto trading. They operate on blockchain technology, eliminating the need for an intermediary. Users have full control of their funds, reducing the risk of hacks and exit scams. Additionally, DEXs are often more open and inclusive, fostering a sense of community participation in the decision-making process.

The Power of Demand:

An excellent example of the shift toward decentralization is the case of tokens that don't actively seek centralized exchange listings but still get listed due to market demand.

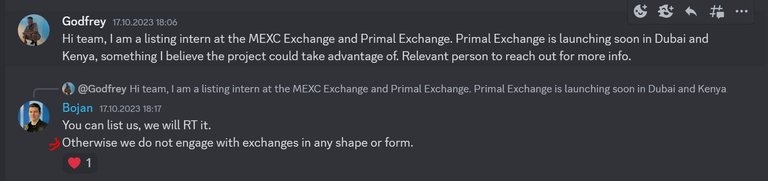

A compelling illustration of this principle can be found in the case of the LQTY Token, a completely unrelated yet highly successful DeFi project. What's truly remarkable here is the protocol's immutability, a feature that underlines the core tenets of decentralization. In their case, even if they were inclined to engage in exchange listings, they simply couldn't alter their code to facilitate such deals. As a result, you might come across Discord messages similar to this:

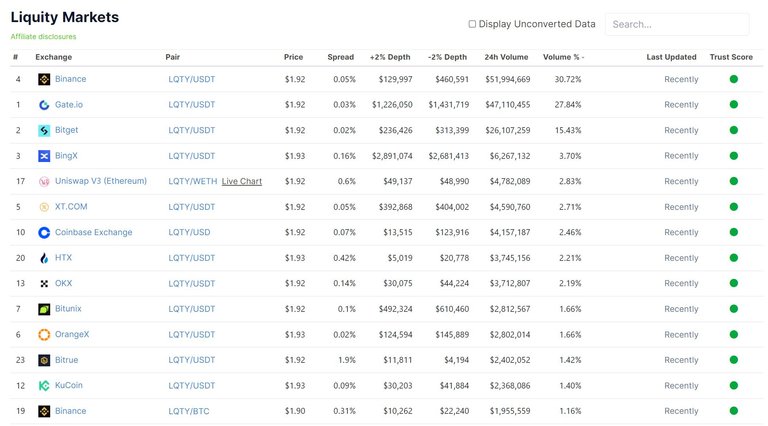

Strikingly, this hasn't posed any issues for their token. Take a look at the impressive volume and the multitude of top exchanges listing them:

While it's true that they boast significantly more volume and size compared to our project, the message here is clear.

These tokens understand the principle that demand drives adoption. When a cryptocurrency's utility and community support are strong, it becomes highly desirable. As a result, it will find its way onto various top exchanges without the need of our intervention.

Conclusion:

It is crucial to acknowledge that metrics such as trading volume on centralized exchanges can be deceptive. Market makers and exchanges, driven by their interests, can engage in practices that artificially inflate their trading volumes, raising questions about the integrity of these statistics. In contrast, DEXes adhere to the core principles of blockchain technology, offering transparency and immutability that centralized counterparts cannot easily replicate. This underscores the importance of refraining from an exclusive focus on these seemingly impressive metrics.

Furthermore, let's rethink the allocation of resources within our DAO. Instead of providing funds for market makers or channelling them into exorbitant centralized exchange listing fees, we should explore more meaningful avenues. One effective approach is to incentivize liquidity providers to create and maintain more extensive and deeper liquidity pools on decentralized exchanges. These pools are the lifeblood of efficient trading and can significantly benefit the community. This incentives could also be ingame related as some of the community pointed out.

Additionally, there is immense value in educating the community on how to access our tokens and relevant resources. We should consider adding information to prominent platforms like CoinGecko, making it easier for people to discover our token. It's baffling that one of our most substantial pools, SPS/ETH, isn't listed on CoinGecko, a primary source of information for many. Bridging this information gap and ensuring the accessibility of our tokens is pivotal.

QuoteWere is the SPS/ETH Pool on UniSwap?

In closing, we should reassess our priorities. A holistic approach to decentralization, coupled with incentives for liquidity providers and community education, can foster a stronger, more knowledgeable, and more inclusive crypto ecosystem.

You did a great job of making very important points on this topic. I highly recommend everyone read it and understand what you are saying! Great job @mangowambo