Maybe it is clear from my posts that I like to look for passive earning methods which are more prudent and do not put capital too much at risk.

In my post yesterday I talked about PACs in the field of cryptocurrencies and its long-term benefits, if you like take a look at the post here.

It would be nice to be able to have a stable source of income through passive income related to the world of crypto currencies and blockchain in general, the good news is that it is no longer a dream and everyone has the opportunity to access it.

The very fact that you are on this platform already means that you are inclined to have a stable income through your contribution whether it is a post, an upvote or a comment, in short, you are ready to monetize your presence on a platform based on blockchain technology whose decentralization makes it accessible to all.

So today I want to talk about another passive earning method which is STAKING, which consists of holding one or more cryptocurrencies for a certain period of time and earning a reward or interest from it.

Said so it seems a bit simplistic, but staking is crucial to supporting the operations of a blockchain network.

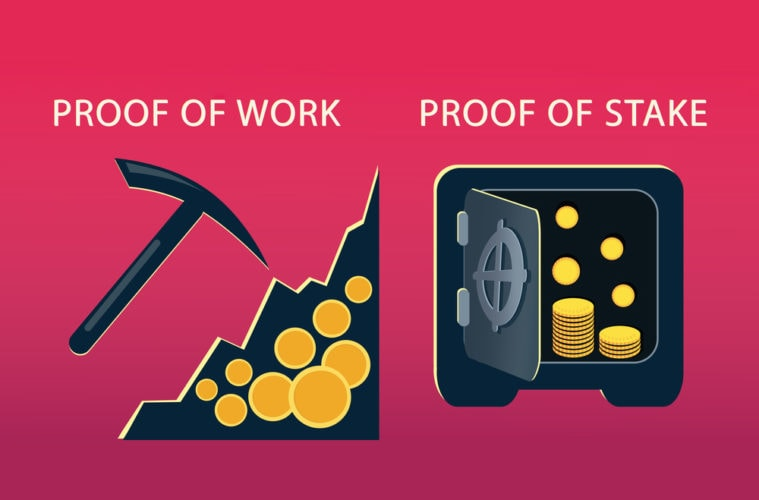

Keep in mind that BLOCKCHAIN ECOSYSTEMS use a consensus algorithm to validate every transaction and this happens precisely through MINING and STAKING.

Mining Networks use consensus called Proof-Of-Work (PoW), in which participants or miners must resolve hash values to get the reward; and Staking Networks use consensus called Proof of Stake (PoS), where a person can mine or validate based on how many coins they hold in a wallet.

In short, staking is a less demanding alternative than mining as users are simply required to deposit and possession of coins and does not require the same energy expenditure on the part of the computers involved as it happens in mining.

Where to start for STAKING?

We start with the choice of the project that convinces us the most and that offers the highest percentage of earnings but also of guarantee, at this point through the Staking we can obtain a passive gain by committing ourselves to keep a certain number of coins blocked for a pre-established period.

To orient ourselves in the world of stakers, it is good to know that there are various types of staking, the most common are:

- the Delegated-Proof-of-Stake or DPoS, to protect the network and validate transactions, a number of validators are delegated, those who have received a higher number of votes from the holders of crypto;

- Hyo-roof-of-Stake or HPoS, the network is protected using a mix between Proof-of-Work and Proof-of-Stake usually miners produce new blocks via PoW and PoS validators vote on the validity of these;

- Proof-of-Burn or PoB, blockchains that use this type of consensus destroy a specific amount of coins for a predetermined period of time, they are not technically destroyed but sent to a non-expendable address for which no one has the keys;

- Leasing-Proof-of-Stake or LPoS, allows the customer of a given wallet to lend their tokens to a mining node to increase the chances that the miner will find the next block.

It is clear that the passive earnings linked to staking cannot ignore the vulnerability to changes in the market.

There are pros but obviously like everything you must also evaluate any disadvantages, for example with Staking we block our cryptocurrencies for a certain period of time and cannot be withdrawn at any moment except at the expiry of the set time.

There are platforms that offer online staking services such as StakeCube, Mycontainer, Stake fish, Atomic Wallet, just do a careful search to find many others that offer their services on different coins and under different conditions.

A list of all the major providers of this service can be found at stakingrewards.com .

If you are interested in this investment method take a look at Binance Academy, you will find even more detailed information on Staking by clicking here .

What will be the most profitable crypto currencies to stake in 2020?

Wandering around the web for a while in the world of crypto, I noticed that a lot of attention is paid to some coins, but mine is not meant to be a purchase advice just sharing information, according to cryptonomist Tezos (XTZ), with about 6% annual earnings, DASH, with about 6.5%, Tron (TRX), with about 4% , NEO, about 2%, Ontology (ONT), about 3.5% and VeChain (VET), about 1.5%, while Cosmos (ATOM) offers almost 8% and are the ones that offer more stability than others.

I hope I was helpful with my post and made you curious about Staking.

Thank you so much for stopping by.

👇 👇

If you like read my last posts:

Not only traders make money with cryptocurrencies!! - HOW ABOUT PAC? -

Very good and pleasant article for newcomers ! 😄

Thanks a lot.