Good day everyone

Gold has had a nice break above the all-time high for the year, this chart showing the price from December 2016:

Late last night the price went over $1335/oz. That is a nice rally from December 15 at $1122.81 and is showing strength to breach our Fibonacci level at $1345.43, capitulation above is expected to go through $1500 (short term).

Francis Hunt, the Market Sniper on the Here's Why:

Silver has also had a significant increase in price from Spring Day to $17.69/oz, shown here (in the next few years, this is set to go beyond $600):

Legendary trader, David Morgan, on precious metals:

Both of these assets are supremely undervalued and the stock market has had a major divestment in funds to the tune of billions, this means that smart money is shifting - you should do the same.

Yes, the Dollar is failing due to the debt based system. Any recent news about John McCain's warmongering in the East and battleships crashing into others? Let's look at how the Gold-backed Chinese Yuan is performing against the Dollar:

The Force is strong in this one. Any nukes going off in the vicinity? Missiles over Japan? I wonder if North Korea has a central bank? More on this later in the letter.

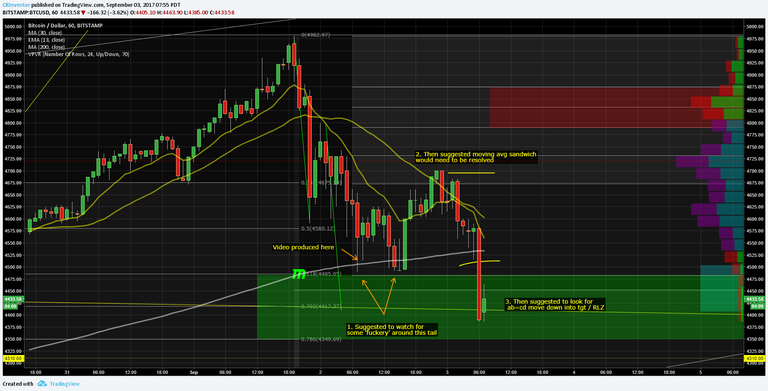

Let's get to Bitcoin. Crypto legend, Canadian Rational Investor, Brian Beamish put out this short term chart over the weekend in light of the correction:

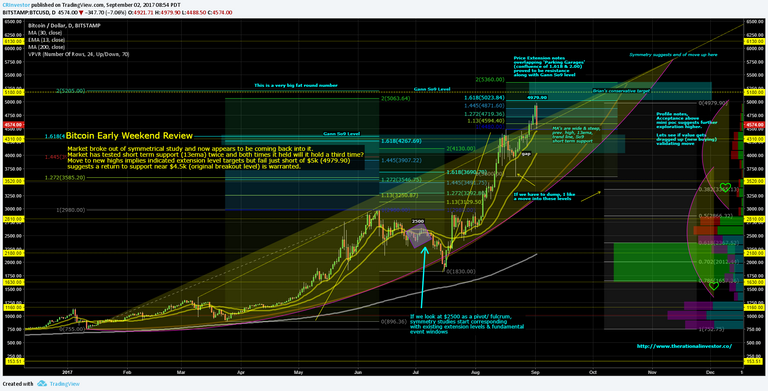

His bigger scale chart is here, targeting $5180 modestly:

The market symmetry suggests a high of just under $6000, where a monstrous correction could be due to the reload zone, circa $1650. This is theory, as we are literally in uncharted territory, and with fiat currency taking plunges everywhere as well as crypto getting newer investment by the public, Bitcoin may have more support so it would be interesting to see where this scenario leads and how it plays out. Support circa $4000 would be epic for a potential run to $6000.

On a logarythmic chart, here's the bigger picture by Altcoin Godson (this blew me away):

People still don't understand that Bitcoin requires a lot of energy to be created, much like mining precious metals. As it is backed by energy input, it holds value. Current statistics show that Bitcoin mining expenses as much energy as Albania, and is set to grow as we approach the 1% global adoption scale.

Current world analysis states that we are actually in the region of 0.015% of world populous that are in touch with crypto currencies. Bitcoin has had a 125 000% increase since inception in 2009 , we haven't even reached 1% yet. We are way ahead of the curve. Imagine what 10% is going to look like. Interestingly, the housing market collapse in the States triggered a world-wide economic collapse in from 2008. Necessity is the mother of invention.

What I don't understand is why trading/charting isn't presented at schools from a young age, there is so much truth in charting, unsaturated by the controlled media and fake news.

So in order to do an overhaul on a defunct system, one has to take down the tiers that prop it up and hold it in place. One of those tiers is the financial tier, which is being overrun by Bitcoin and crypto currencies as a norm for exchange. Next would be energy, so free energy would become the focal point of the industry.

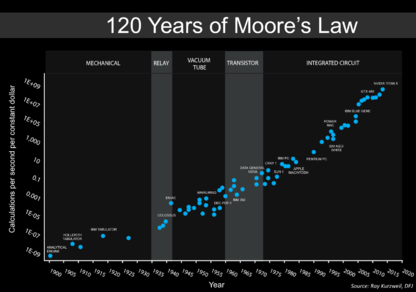

The world economy is centralised around energy, strange how Moore's law doesn't seem to affect change in the oil cartel.

From Wikipedia: "An updated version of Moore's Law over 120 Years (based on Kurzweil's graph). The 7 most recent data points are all NVIDIA GPUs." - those GPUs are being used to mine Bitcoin algorythms ; )

Investopedia writes: "Moore's law refers to an observation made by Intel co-founder Gordon Moore in 1965. He noticed that the number of transistors per square inch on integrated circuits had doubled every year since their invention. Moore's law predicts that this trend will continue into the foreseeable future."

A great conversation between two crypto legends, The Dollar Vigilante's Jeff Berwick and BitClub's Joby Weeks:

Again; necessity is the mother of all invention.

In other news:

I spotted a very detailed, intricate video last week by Dane Wigington about how the Deep State is structured. Again, conspiracy 'theory' has proven to be conspiracy FACT:

The only countries IN THE WORLD left (after the invasion of Iraq, Syria) without a Central Bank owned or controlled by the Rothschild Family are (from eventchronicle.com):

Cuba

North Korea

Iran

Some more perspective by thefreethoughtproject.com:

Quite notably, the BTCCNY (Bitcoin/Chinese Yuan) Tether token on Bittrex has recently been de-listed on August 25th, makes one wonder, doesn't it? Our gold hedge is at vaultoro.com, where you can buy Gold in Bitcoin from your exchange directly.

Another option would be to get in touch with Zoltan Erdey from www.silver-sphere.co.za:

I know from our subscribers that they are a trusted supplier of Bullion and that Silver-Sphere is capable of handling large quantities. From what I gather, they are trying to incorporate the option to purchase Bullion with Bitcoin so we wish to extend our congratulations to them in keeping with the times. Good work.

To our readers: swap your government printed money for the real deal, immediately!

Take care, trade safely and stay blessed.

Rgds,

EscapeVelocityOrdinance

Ps. Some more reading from Coindesk as well as Armstrong Economics (watch The Forecaster, Martin Armstrong. He predicts markets using mathematics).