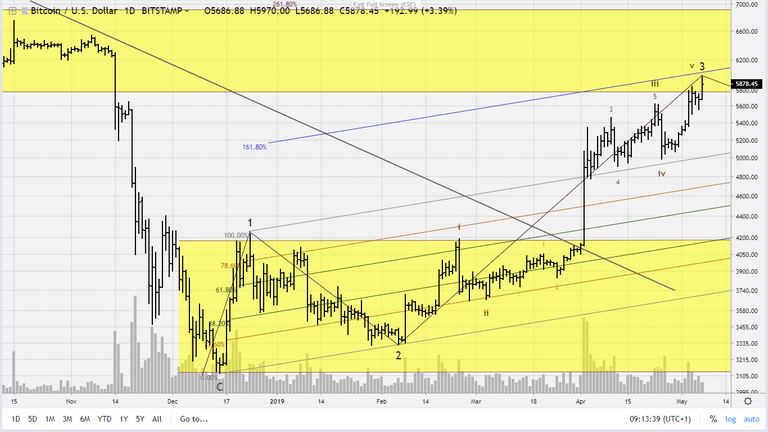

I think minor wave 3 is making a top here. As you can see wave 3 is subdivided into a number of smaller five waves, with the last five wave completing wave v of 3.

Now, it can be that this minor threewave is just one big correction within the downtrend and we're going to make new lows. In that case the threewave needs to be relabeled as an ABC-zigzag consisting of 2 impulses. If that happens we should get a relatively strong five wave down. Although, I don't expect prices to fall very low, but going towards or just below $3000 is certainly an option.

Another, somewhat extreme scenario is that the current five wave is not minor wave 3 but only the first wave of an extended minor wave 3. In that case we'll go higher quite quickly.

But my preferred scenario remains the one below.

You might want to say that having 3 fairly different scenario's is above all an argument in favour of the uselessness of technical analysis and Elliott Waves in particular. To some extent that's true. However, you can also say that we've established, with relative certainty, that we're at a critical juncture in the ongoing battle between buyers and sellers. Also, in all 3 scenario's we'll first go back to approximately $5000. There you buy. If it drops deeper, you buy more. Simple and good.