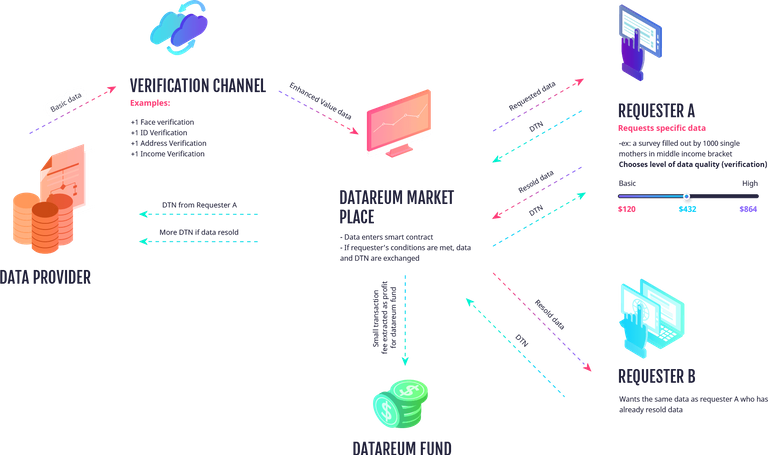

Datareum’s platform provides a marketplace for high quality data. Data Providers continuously earn DTN as the data they have provided is resold. Data Requesters pay for customized data, which can be resold for profit.

-1 000 000 000

MARKET CAP

-600 000 000

TOTAL TOKEN

FOR SALES

-$ 0.03

1 DTN

-Bonus tokens

Min. contribution = 5 ETH

Presale = 20%

“Information is the oil of the 21st century, and analytics is the combustion engine.”

-Peter Sondergaard. Gartner Research

If information is the oil of the 21st century, then each and every one of us is sitting on an oil well.

We all generate absurd amounts of data in the course of our daily lives. Every (electronic) purchase we make, every Google search we make, every website we look at, where our pointer hovers on each of the websites, every social media post we see, comment on, share, like, skip, pause and look at for more than half a second — all of this is logged in exponentially growing global databases.

The rate of production of data is increasing such that, according to an IBM Marketing Cloud study, 90% of the data currently on the Internet has been created since only 2016. And as more and more devices — like the sensors in your Fibit, your smart refrigerator, and your countertop Alexis — are connected to Internet, the production of data is only going to accelerate.

All of this data has value. It’s currently used mostly for marketing and academic research but increasingly, it is being used to make useful suggestions for and predictions about ourselves and to feed the artificial intelligences that will eventually be the most valuable things ever created.

But that’s all in a still fairly distant future. For now, data’s true value is mostly out of our reach — none of us have been able to retire off the profits generated by it after all. IDC research shows that 90% of the data produced so far is still unstructured, meaning that it is hard to extract any tangible meaning from it.

What structured data we do have is mostly not in our personal control. “Data Custodians” like Facebook, Google, and Amazon use it for massive profit. Then there are “Data Brokers” who scrape together whatever they can and sell it to the highest bidder.

The result: almost all of that precious data is beyond our control and capitalized on by others.

But there’s change on the horizon and it comes in the form of a movement towards decentralization. The rise of the sharing economy has led to an emerging new ethos concerning the nature of ownership. This is a movement away from centralized corporations and government as custodians of information or money, towards decentralized peer-to-peer interactions.

This decentralization movement has recently been given a huge boost thanks to advances in cryptography and the even more recent rise of cryptocurrencies.

Now, for the first time, it’s possible to exchange value on a peer-to-peer basis without the need for a trusted authority. As we know, the first application of this has been money in the form of Bitcoin and other peer-to-peer cryptocurrencies. Decentralized money is truly revolutionary and it will have a huge impact in the coming years and decades, but money is just the first application. This technology enables us to exchange value of any kind. All that’s needed is the infrastructure and network to allow it to happen.

The infrastructure to enable the trading of data is what we aim to build at Datareum. Our long-term vision is a world where data providers have complete control of the data they produce and data requesters have access to ethically sourced, high-quality, structured data at a fair price. In this world, providers will be fairly compensated for the value of their data and researchers of all kinds will have access to the high-quality data they need. To enable this vision, we are building a decentralized peer-to-peer marketplace for data: the Datareum Marketplace.

While our long-term vision is grand, we recognize that it is essential to start small.

Just as in the early days of the Internet many wonderful ideas were just too soon for their time, in the newly emerging world of blockchain / decentralization that people are calling the Web 2.0, many — perhaps most — ambitious projects are doomed to failure.

Determined not to fall into the failure category, we are drawing heavily on the lessons from R3’s multi-year collaborative blockchain research investigation (the world’s largest research programme of its kind thus far) into the likelihood of success of a given enterprise blockchain project. We are designing our platform — in both its initial form and in the long-term rollout of additional features — to satisfy the recommendations of the report. The key recommendations are:

Provide an integrated application, messaging, workflow and data management architecture.

Build on an existing technology “mega-ecosystem” to maximise skills and code reuse.

Eliminate unnecessary data “silos” to unlock new business opportunities by allowing real-world assets to move freely between all legitimate potential owners.

Embed legal entity-level identification into the programming model to enable legally enforceable and secure transactions.

Enable the inevitable move to the public cloud without requiring high-risk technology bets

Taking these recommendations into consideration, we have identified online surveys to be a suitable starting point for our decentralized data marketplace. The legacy online survey industry is a good target for disruption with the decentralized model because:

It lacks guaranteed security and privacy of information.

- Information gathered is stored on centralized servers and as such is vulnerable to hacking.

- By joining a membership site, there is a good chance users have allowed it or its “marketing partners” to solicit them.

There are potentially several tiers of intermediaries. - Online paid surveys are typically conducted by market research companies acting as intermediaries between the client company and the data provider. These market research companies may in-turn employ smaller companies to carry out surveys for them, adding another intermediary layer. Even if the payout by the original client companies is generous, the many layers of commissions reduce the profit margin for everyone involved.

There is a high degree of payment friction. - Due to high transaction fees within legacy banking infrastructures, minimum payments are often set at prohibitively high levels.

- Payments in most cases are available only to residents of a certain country.

- Payouts are commonly offered in the form of vouchers rather than cash.

A decentralized online survey marketplace built on blockchain architecture has the potential to solve the above problems by offering secure, peer-to-peer access between data requesters and data providers. The marketplace must contain all of the necessary incentive mechanisms to ensure its proliferation. We’ve outlined these in our whitepaper and will be posting a summary in this blog space shortly.