Seems like everyone is obsessed with buying coffee with cryptocurrencies. But the main problem everyone is pointing out is the volatility of cryptocurrency. Let’s explore this problem with a quick refresh of the fundamentals.

Money as a language

Money is a form of information, that happen to be made of paper in its primitive Dollar bill form, and in a digital form when into a bank account. So, when you buy a coffee with $1 you’re exchanging your proof of work information, to the coffee shop. Well, someone may say, you could steal that. Stealing is another form of work, dishonest, but still takes some work, and it is actually necessary to improve the system.

Cryptocurrencies are digital information that can be transferred via P2P uncensorable transactions.

What is a Price?

Any price is a relation between two tradable items. That relation is established by the free market and it changes continuously during a period of time.

Economic stability

Complete price stability is unachievable, but we can redefine stability as a reasonable price fluctuation in a period of time, or more precisely:

An economy can be considered stable and healthy when the fluctuation in the macroeconomics is relatively small and when growth/inflation = ~1.

The Swiss Franc and the US Dollar are probably the best examples of stable currencies. Especially the US Dollar, considering that 85% of the total Forex market is in the dollar, the 39% of the world debt being issued in the dollar.

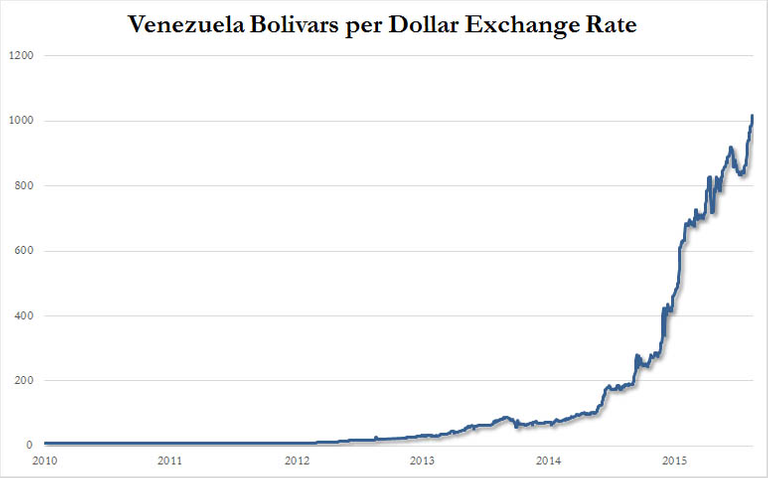

On the opposite side of stability, there is the Venezuelan Bolivar which experienced an incredible hyperinflation. A fun fact, I just called a Starbucks in Orenjanestad island in Venezuela, and a Tall Latte costs $4, pretty much as much as in NYC.

The amount of Bolivar necessary to buy $1 increased drastically this last 2 years

Crypto volatility

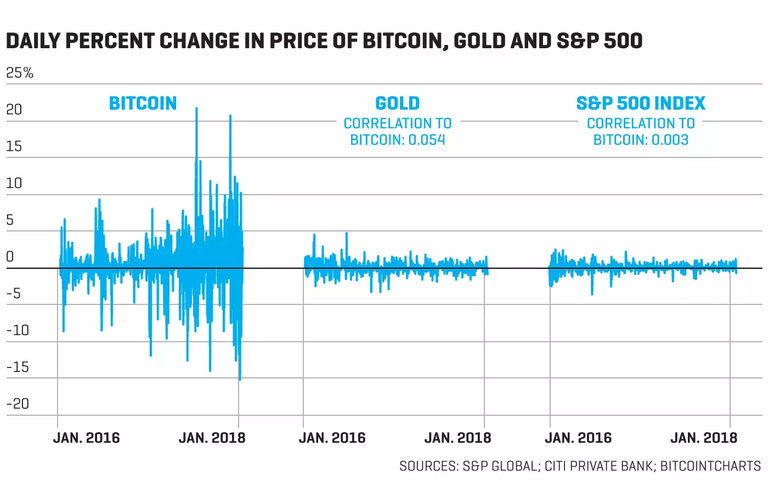

The cryptocurrency market is probably the most volatile market in the history. Bitcoin experienced a 1,731% value growth in 2017 and a 60% drop just from January to February in 2018.

Cryptocurrency stability solutions

In the cryptocurrency space, there are a few interesting ways to maintain the price of your “coffee” stable.

Stablecoins

Stablecoins are an attempt to create a cryptocurrency with the only purpose of holding a stable value. They can be divided into 3 categories:

Centralized IOU based, consist of a central entity printing an IOU token that can be exchanged back into the nominal value. Tether is the most obvious example.

Collateral based cryptocurrency, this approach allows users to create stablecoins by locking up collaterals. My favorite example is MakerDAO, which collateralize ETH to create DAI. The problem with this solution is that below a threshold the collateral can be margin called.

Seignorage Shares, in this model the supply is variable like in a FIAT model, but in this case when the price drop we can burn the money, to increase the unitarian value. Basecoin achieves (on paper) this solution with 3 tokens: stablecoin, bonds, and shares.

It’s important to notice that most of the above cryptocurrency, is created on top of Ethereum as ERC20. Most likely to raise ICO money.

Dual token economy

In a dual token cryptocurrency, one token is used to raise funds in an ICO and the other token is usually a token that has some utility, and it’s pegged to the USD or to an asset. In our research we explored two types of dual token cryptocurrencies:

Decentralized dual token, in this model, the utility token is pegged to the USD by locking the main token as a collateral, in a similar way of the Seignorage Shares Stablecoin model. An example of this model is Gnosis.

Centralized broker based, in this model the utility token is as an IOU that can be used only inside the dual token economy, and that is exchanged by a broker. In MadHive the customer can exchange USD for MadCredit, pay ads space with it, then the advertisers sell the MadCredits to a broker to get USD.

Bitcoin solutions to stability

Back in December 2017, the CME and the PBOE introduced the Bitcoin Short Futures, economic tools to edge price drops. Miners use them to survive bear markets, traders use them to get REKT, and someone can use them to “freeze” the price of BTC on a specific time, if for example, you want to sell your house for 100BTC and you want to wait for 7200 confirmation (~1 month) to have a more secure transaction, you can short 100 BTC for 1 month. When the transaction is completed then you can close the short, and sell your BTC.

Papa-Wassa is advising African central banks to adopt Bitcoin as an alternative currency to the US Dollar, shorting could be a necessary tool at that scale to reduce volatility risks.

Conclusion

Today is theoretically possible to create a stable crypto-economy but we’re still far from a practical use because the current implementation is too expensive, complex, or centralized and therefore censorable. The research is still in its infancy, we’ll need patience.

Meanwhile, it’s interesting to notice that most economists believe that the price stability is a necessary characteristic of any currency, so they say that Bitcoin adoption is far.

Well, they’re right about the stability of a currency, except that Bitcoin IS NOT a currency, is the fundamental protocol of a new economy. In my opinion, the adoption of Bitcoin is only one app away:

Bitcoin adoption is just one app away. One app with such great incentives that everyone cannot do otherwise than to use it.

When are we going to buying coffee with crypto on a daily base? Honestly, I’ve no idea! But, in the meantime, I’m having fun buying blockchain from StarBlocks using Lightning Network :)

You can follow me on Twitter @feulf, follow my company SeeThru here, or if you’re an engineer you can join the Lightning Network NYC meetup.

References

- https://multicoin.capital/2018/01/17/an-overview-of-stablecoins/https://bravenewcoin.com/assets/Whitepapers/A-Note-on

- Cryptocurrency-Stabilisation-Seigniorage-Shares.pdf

Collateral-backed IOU stablecoins: Tether, TrueUSD, Arccy, Stably

Collateral-backed on-chain stablecoins: Bitshares, MakerDao, SweetBridge, Havven, Augmint

Seigniorage Shares stablecoins: Basecoin, Fragments, Carbon, Kowala

Starbucks in Orenjanestad, Venezuela

StarBlocks, lightning network coffee shop

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://decentral.market/2018/03/17/creating-stable-crypto-economies/

Kudos to you if you actually called that Starbucks!

I think that USDT is already a stable but I have to look into it more as to what is backing it.

Great post!

Followed and Upvoted, Keep up the good work and looking forward to more from you.

Congratulations @rainelemental! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!