Your One Stop Source for Daily Cryptocurrency News and Commentary

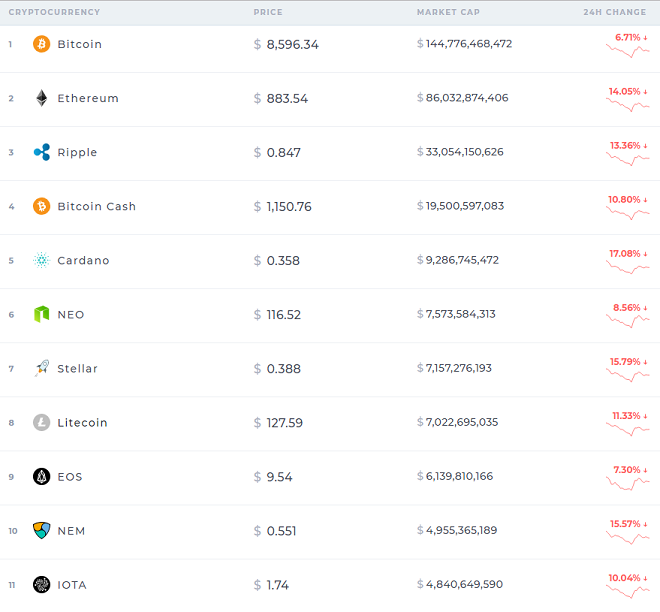

Another day, another big sell-off in the cryptocurrency market. It’s been two days in a row that all the major currencies saw red.

Source: Coinranking

Interestingly, the only Top 50 Marketcap coin that made gains both days was DigixDAO (DGD). DGD tokens have another arm called DGX tokens, which is backed by the physical gold. Since each DGX token represents one gram of gold stored, it’s supposed to stabilize the price of the token, unless there’s a substantial change in the price of gold. DGD then takes a quarterly claim on the transaction fees that are collected on the DGX token. So the more DGX tokens get traded, the better DGD does. Perhaps the DGD token could be good alternative when the cryptocurrency market is tanking the way it has the last few days.

Source: Coinranking

Regulatory measures and scrutiny from different countries government continued again. Inspectors from Japan’s Financial Services Agency, went into Coincheck’s office to monitor their response to the recent $500m heist. Interestingly, when reading the article, it seems to be the case that the FSA is simply trying to monitor the exchange and make sure they’re doing everything they can to reclaim the stolen currency. However, in reading the headlines for the this story, mainstream media made it sound much worse than it actually was, using words such as ‘raid’ or ‘crackdown’.

Source: Cryptovest

This event, together with their coverage of India’s finance minister’s comments during his budget speech, sure makes it seem as if the media is trying to use rhetoric that would intensify the FUD in the market right now. For more on the finance minister’s comments, please see yesterday’s post.

Source: Cointelegraph

Venezuela’s government just released the white paper for their oil-backed cryptocurrency, petro. They are targeting a $5 billion ICO, which if hit, would almost equal the revenue generated for all ICO’s in 2017. It will be the first government issued coin, but Venezuela’s government isn’t looked favorably upon by the US government, and it could potentially make cryptocurrency’s acceptance within the US market more challenging. In fact, the conservative Breibart put out an article in which they quoted the opposition party describing it as a “forward sale on Venezuelan oil” and “tailor-made for corruption”. We’ll see how all this shakes out.