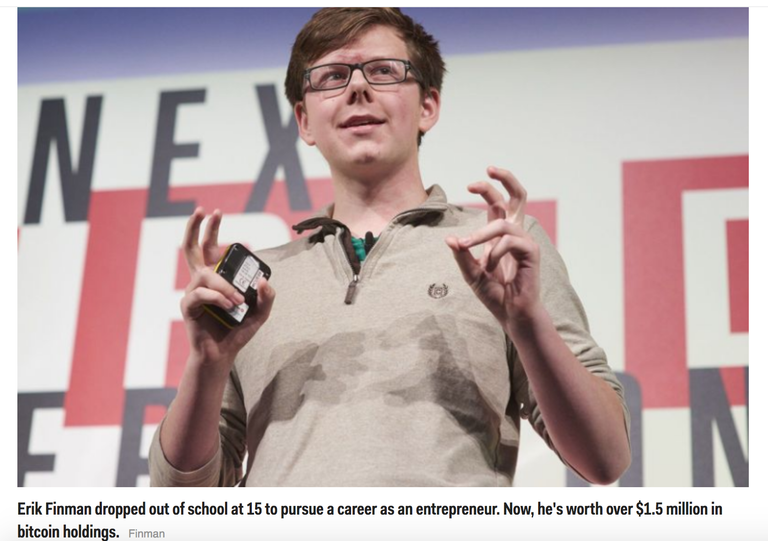

Seven years ago, Erik Finman made an unusual bet with his parents. He bet them that if he could become a millionaire by the time he was 18 his parents would let him skip out of going to college. They would ultimately accept and watch him drop out of high school and embark on an incredible journey from his venture into cryptocurrency using funds meant for tuition from his grandmother.

In a recent interview with Business Insider, Erik believes HODL during the lows and highs will ultimately result in the best outcome for those invested in the future currencies.

I happen to agree with his analogy. The volatility in prices and worth is an explainable phenomena as the market equilibrates those exiting and those hopping on board. A recent study from SurveyMonkey showed that 6 out of 10 Americans know (or have heard of) Bitcoin.

What the study didn't test was the knowledge of other alternate coins other than Etherium, Ripple, and Litecoin. The space to learn and develop a strategic path to financial success - or demise - is there.

One will have to be consistent and diligent, focused on the goal - whatever that goal is, because that is truly the best way to make sense of all the chaos in cryptocurrency space. Otherwise to the "pit of misery" for the loses of hard earned fiat.

"So... what does this mean for me?"

It means if you are a big player, a noob, or a novice - stay in the game.

It means if you are on the sidelines? Get in. Now. Not yesterday because thats gone.

It means if the prices are cheaper now than they were yesterday, or last month? Buy some more (law of averages).

Dilute your initial costs over time and accumulate more coins.

It means HODL!!!

Cheers!