When I woke up this morning I wasn’t rich but that’s not how I’m going to bed.

Today opportunity knocked and I flung the door open so hard one of the hinges is going to need repair. No frame damage, I think. Maybe just a little wood glue and a small shim so the screw will bite in the stripped hole.

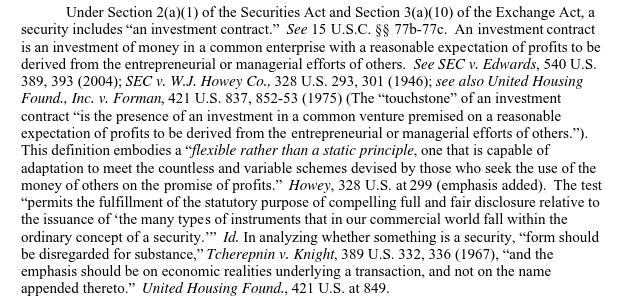

So what happened, you ask? Well, I read earlier today that the SEC has issued a ruling, or maybe a decision, or was it an opinion? It really depends on what article you read but they all agree on the same thing: crypto-tokens can be considered securities. Sometimes. At the very least the ones that issue dividends fall under the SEC report’s definition of such. See for yourself...

Man, these guys are masters of mellifluous prose. I bet they go home and write twisted Cosby Show fan fiction in little sticker-covered notebooks just to cleanse the palate.

It’s pretty clear from the report, if you can get through it, that any publicly traded token that carries with it an expectation of profit from someone else’s effort is pretty much considered a security like a stock or bond.

Now why this idea has gotten everyone leaping around and foaming at the mouth is because when you start to apply US securities rules to ICOs and tokens it gives the SEC the authority to pop by the office of any issuer they choose and piss on the ficus trees to mark their territory. The only ironclad way to avoid that particular mess is verify any US citizens standing in your lobby trying to hand you money are “accredited investors.”

If you haven’t seen it defined it in some inflammatory blog post already, an accredited investor is defined simply as someone who has made in excess of $200,000 in annual income for at least two years and is on track for a trifecta or has $1,000,000 in net assets, not counting their primary residence. That pretty much screws the normal US citizen who is worth, on average, the price of a fast food value meal.

The idea that only rich people are being allowed invest in things that could potentially make new rich people but instead it just turns the already rich people into stronger, more powerful rich people sounded pretty cherry to me so I started thinking... How to become an accredited investor and get in on the action? There were only two small roadblocks.

Despite my constant enumeration on the benefits of vastly overpaying me, my employer has yet to come around to my way of thinking so income was out. I was forced to move on to net worth. Now, I do have a 401(k) and own some stock and bonds in addition to it but even stacked on top of one another they irritatingly refused to reach a million dollars.

Damn, if only I could just create some sort of valuable asset out of thin air.

That’s when opportunity bounded up the front steps and began pounding for entry: I had just read something earlier in the day that said the SEC has gone on record to tell me that I can totally make valuable assets out of thin air! At least I can as long as I back them with a promise that they will profit anyone who buys them.

Time to head over to the Waves Distributed Exchange. I fired up WavesLiteClient 0.4.31a on my trusty Chromebook and signed in. I shut it down immediately because it wasn’t showing any of my balances, but the second time it worked great!

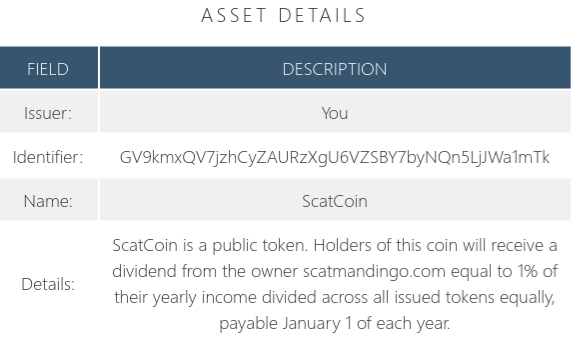

I immediately created my signature token ScatCoin and indelibly etched onto the blockchain via the token’s description the following pinky-swear level contract:

Yeah, it was supposed to say “owner of scatmandingo.com” but what’s a little preposition between friends, right? Also, the “their income” bit could have been a little clearer, I guess. For the record, it means my income as the owner of the domain, not the holder of the token.

So now I had my token and had promised, on the record, boundless riches to those fortunate enough to hold a ScatCoin in the form of 1/500000000 of my annual income even if the wording was, admittedly, a bit dodgy. I owned an SEC-defined security but it wasn’t worth anything yet. In order to calculate monetary value it has to have a conversion rate with something that can link it back to fiat currency.

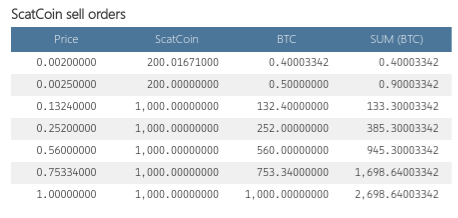

So I put it up to trade against that old favorite, Bitcoin. I was a market maker now. As such, I didn’t want to freeze out any takers right off the bat by setting a single price so I put a few different asks out at various prices.

Lo and behold, bids started to come in from some other accounts (which are very easy to set up on Waves.) They must have heard about the coin from CNN Money or something. I didn’t ask, I’m not nosy.

Bids and asks sitting at the same table means a spread; my market had formed. It, as markets do, writhed around a bit, those bids and asks coming ever closer together until, like Michelangelo foretold on the ceiling of the Sistine Chapel a few years back, they touched. A sale was confirmed.

Turns out 1 ScatCoin, which I have just now decided to abbreviate as SCT to look cool, has a market price of .002 BTC which is about thirty times the price of Ripple. That’s not too shabby for my freshly-minted little fellows, at least in my opinion.

So now SCT was, as far as the SEC was concerned, a bona fide traded security. If you don’t believe me you can go buy some. Just to warn you, however, I was so ebullient from its infinite increase in volume I slid the asks up a little higher.

Buy a lot, belief should not come cheap.

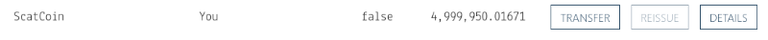

Back to getting accredited: Now, in addition to my 401(k), stocks, bonds, and an almost complete mint-condition Garbage Pail Kids series, I could now add my holdings in ScatCoin to my net worth because even after the day’s bullish stampede I still had a few left.

So that’s 4,999,950 SCT at .002 BTC each, so 9,999 BTC or about $25,689,000 depending on how BTC is doing at any given millisecond.

Well, heck. I can save time and not even bother with the other assets. If anyone asks I’m just going to show them this giant pile of Scat.

I would say “I hope these newfound riches don’t change me as a person,” but what’s the point in having them if they don’t? I have already made moves to block the contacts of the friends from the old life I had this morning. I have little tolerance for urchins and their constant bombardment of whining for handouts.

Before I close, I would be remiss to not give a huge Thank You! to the SEC for allowing me to so easily become an accredited investor and for not actually having any formal process of verification defined to be entitled as such. I’m going to contact a lawyer to write up a letter stating my net worth based on my SCT holdings which is apparently sufficient to give legal protection to the seller and get me past their velvet ropes and into the champagne room where a man of my means belongs.

Nice & very informative article! I'm also planning to create my own token, can you developp a bit on those aspects?:

Please give an update on those interrogations ;) Thanks!

Apologies for the delayed response.

I believe you may have taken the article a bit too literally. The concept I was trying to convey is the SEC's arbitrary interference in the ICO/Crypto world is so badly thought out that it can be turned around and used against them by following the exact rules they are laying down.

Now that being said, I am totally committed to following through on the contract that is described for the coin. If you wish to buy $50,000 worth of SCT I will happily give you $100 every year. :)

Thank you for taking the time to read the post; I hope it was at least entertaining.

I noticed the entertaining/ironical tone and that's usually my taste of writting/reading, and don't worry I know that your SCT were an example to illustrate your point.

But my point is that you brought up a very interesting information about the badly conceived SEC's arbitraty interference, you might have discovered a kind of loophole and that's why I asked you all those questions, especially my last one about having a lawyer doing all the stuffs in your favor (notably stating that the remaining tokens you hold do count for "real money") so am I just "dreaming"?

Well, I spoke to a local attorney but they felt it would be a better idea to talk to a law firm that specializes in crypto. They liked the idea, though.

I'm gonna try to find some (I'm located in europe), so it might even different for me, but i can still be very interesting if I decide to settle & invest into the US, which is planned.

If you can provide any updates (if you decide to talk to the law firm for instance) that would be appreciated

If you aren't a US citizen then the whole accredited investor limitation doesn't apply to you. If you solicit US citizens to invest with you then you would need to worry about it, however.

yeah that's the plan actually, that's why i'm really interested, it could be less than 18 months so i'm definitely excited about it,so I will be able to apply later on

Well written story and nice to read. Did you add any particular features in SCT to elicit this type of demand? Surely people investigate before just putting buying orders in? Hope you stay an "accredited investor" ;)

I assure you the person who created the account(s) that bought those coins had the exact same amount of information I did. ;)

I like your answer :-)

This article is criminally undervoted

As long as you don't have to pay income tax on those $25 million...

I could live with paying taxes on $25mil as long as I get the income to go with it.

Long-term capitol gains tax wouldn't be too painful, just hold for 1+ y. https://www.irs.gov/taxtopics/tc409

Hilarious post. The comments here are even more hilarious...

Now sitting here with an estimated $2,000,000 of crypto. What's next?

So can this actually work? And could you get yourself into trouble legally or with taxes?

Any updates?

So here we are 8 month latter and the real question is sis it work and are you now a accredited investor