Since I've started my journey in the world of cryptocurrency I have heard so many times from so many people this advice: "...just buy low and sell high." Probably everyone has heard this phrase at least once in the lifetime, maybe just in a different variation? It sounds almost like a cliché - so simple and obvious... Who in the world would even do the opposite, right? You will be surprised to hear that 90% of the market does EXACTLY the opposite. But why is it so? What makes people abandon such a straightforward and successful market strategy?

Actually many things...

You see, there is this one simple but very important thing that traders (especially new ones) forget to turn off while they make trading decisions:

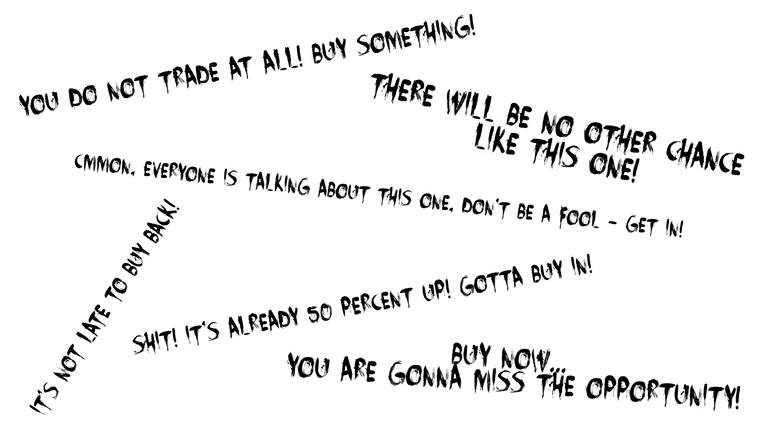

That's where the emotions come from in form of the infamous FOMO (fear of missing out). That's where people start to listen to all the other opinions except their own ones. That's where people start to fail because they do not read enough, they do analyse enough, they do not think enough... Of course people will struggle to listen to these four words, when there is such a chaos happening inside their head while they put a buy/sell order on their cryptocurrency of choice.

And no emotions! That's what an avarage cryptocurrency trader lacks! That's where the "simple and obvious advice" turns out to be "not so obvious and simple after all".

I hope you get me right - it is not like I write these lines without feeling a little bit hypocritic - when I started I had to get over this barrier as well. It is not that long time ago when I was among these 90%. After all - it's not really about knowing the advice, it's about embracing it, understanding it and exploiting it via experience, mistakes and bad moves. It is not easy (who said it is?) to turn off emotions, to become a robot for a while, to cut off the voices that sit in your head whispering on repeat:

Still though - it is far away from impossible...

Another wise person (unfortunatelly I do not remember who it was exactly anymore) told me another thing that I started to understand just few months ago: "Once you get into business you will start to see patterns that loop from time to time."

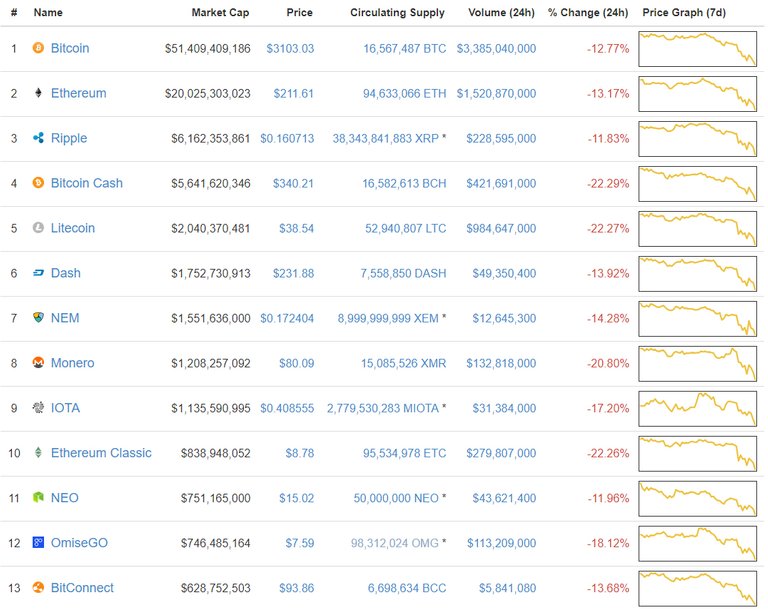

For me that was the turning point - that's where I really understood the "psychology" behind buy low & sell high. Have you ever noticed those major downtrends, or, as they say: "times when markets are bleeding?" They occur almost every month because of price corrections, market uncertainty, bitcoin fud etc.

Like the one happening right now, for instance

And then once in a while we have these days when markets are green, bitcoin rises, new all-time-highs occur, everyone is enthusiastic and happy. If you want to play it safe and never lose money - that's the only time when you should buy & sell! That's your receipt of success! Boring, I agree - it nears the point where it's almost like a deja vú: you have seen that before... you have done that before, but guess what? It works!

But to be honest - I am glad for the 90/10 ratio that rules the markets because if there was no 90% of "buy-high-sell-lowers" there would be no 300% spikes, there would be no hyperbullish trends, there would be no fast $$$ that everyone loves so much. So FOMO is not such a bad thing after all, not for the people that are not among the participants of this psychological phenomenon. Are you among them?

I will donate this money to the victims of FOMO, I promise...

Thanks for following me :)

@cryptotrader007 You're welcome, pal :)