The US Commodity Futures Trading Commission (CFTC) has created a bounty to encourage whistleblowers coming forward in exposing “pump-and-dump” schemes. “Customers should not purchase virtual currencies, digital coins,” the CFTC warned, “or tokens based on social media tips or sudden price spikes. Thoroughly research virtual currencies, digital coins, tokens, and the companies or entities behind them in order to separate hype from facts.”

Pump-and-Dump Bounty

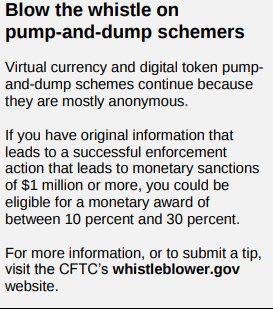

To eat at scammers’ anonymity at least, the CFTC is offering, “If you have original information that leads to a successful enforcement action that leads to monetary sanctions of $1 million or more, you could be eligible for a monetary award of between 10 percent and 30 percent.”

Customer Advisory: Beware Virtual Currency Pump-and-Dump Schemes is a two-page effort from the CFTC, “advising customers to avoid pump-and-dump schemes that can occur in thinly traded or new ‘alternative’ virtual currencies and digital coins or tokens.”

$100,000 Bounty Available to Crypto Pump-and-Dump Whistleblowers

As these pages have long documented, scams and schemes of old are reappearing anew in a space filled with inexperienced investors. For those familiar with, say, the American stock market experience, boiler room cold calls of yore, penny stocks, hot tips, and sure things are all haunting phrases investors have encountered at one time or another.

The ubiquity of message boards and of stock trading websites only encouraged scammers in this regard. Price action moved on pumps, on posts and general chatter about the potential of a given stock only a few were privy. Greed did the rest. Regulatory bodies in the US have had enough time to see their likes come and go.

$100,000 Bounty Available to Crypto Pump-and-Dump Whistleblowers

Old Wine, New Bottle

And while such scams seem new under the cloak of hip lingo such as cryptocurrency and blockchain and disruptive and game changer, it’s all pretty much the same old dance. Indeed, “Pump-and-dump schemes have been around long before virtual currencies and digital tokens. Historically, they were the domain of ‘boiler room’ frauds that aggressively peddled penny stocks by falsely promising the companies were on the verge of major breakthroughs, releasing groundbreaking products, or merging with blue chip competitors.”

The artifice of demand, such as it was, reflected in the price. “When the prices reached a certain point, the boiler rooms would dump their remaining shares on the open market, the prices would crash, and investors were left holding nearly worthless stock.” What might be slightly different in our present era is the relative sophistication and ability to hide true identities. And with basically one click, thousands of people can be reached rather easily.

For the broader ecosystem, self-regulation often happens in the form of news, Youtubers, message boards, and generally works itself out. Some enthusiasts insist it’s crypto’s charm, the engine of innovation, to police itself with heavy doses of caveat emptor. Part of the problem with accepting rat traps of the government regulatory body variety is what’s being invited. Running to Big Brother empowers Big Brother, a concept easily missed in the heat of pursuing justice. Often such bounties are used as metrics to buttress future enforcement budgets and to encourage more activist legislation. But these too are lessons this brave new world must learn anew.

What do you think about the CFTC bounty? Let us know in the comments section below.

Images courtesy of Pixabay, CFTC

source

![]()

![]()

- Click on theand get your reward's $ in after 7 days

pump & dump is not illegal.. Im on few huge discord groups.. they are a community of thousands of people and they all pump and dump cryptos together.. there is no way law can punish for something which isn't illegal in the first place

just all these are not in the soul of financial institutions, because they are not in favor of enriching the people, if people become secured, then to whom will they give these damn loans? , if they are so worried about the ecosystem of the people for losing money, then let them close all forex and casinos, they have one goal - do not allow enrichmentDear @skreza you said it right,

well I don't know about others but I was once victim of these pump and dump scheme.. I bought some Verge at $0.20 and now price of Verge are $0.08 so yeah I did lost a great deal of money.. oh well I'm still holding the coins.. maybe I will sell them off in the upcoming bull market

Dear @skreza, don't only you have a drawdown , if you don't need the amount urgently,it is better not to sell, sooner or later will lifting ))

we don't really know when where why we might have urgent need for cash.. and there is another thing.. when the coins we buy don't perform well but another coin we didn't buy starts performing well.. it gives mental pain 💔

@skreza first, it is necessary to study deeply the particular coin,look at the chart to make Fibonacci analysis and then only buy . if you are a beginner it is better to buy ETC, NEO, LTC, BTC -- on these coins you earn at least certainly not immediately but in time (about later 3-4 month )

I do not understand Fibonacci.. how/where do I learn it from?

Unhealthy ? Depends whose health we are concerned about.

As above, most of these ETH Token sales offer little more than the right to re-sell your token. Similarly to how ICO's were public and now going private, the whole "buy solely so you can re-sell something with no intrinsic value" will likely seem less awesome later in 2018 - 2019.

Do we raise via Private or Public ? Have been asking myself the same question. Private can be quick and more certain, but only makes the wealthy wealthier.

I am still inclined to try to incorporate doing the hard yards and making opportunities available to individuals at home in their spare time, but this could take a lot more work for a lot less return.

Our Coin/Token will definitely NOT be offering only the right to re-sell the Coin. This could be attractive to a LOT of individuals to not need to go private, but maybe not. So will be going hard on a separate revenue generating project toward reducing the need to rely solely on ICO funds and/or be able to expense more on reaching the desired target audience instead of just whoever is willing to pay.

Does it matter who buys your Coin/Token or what they do with it? It does to us but should it?

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/cftc-offers-100000-bounty-to-crypto-pump-and-dump-whistleblowers/

This year, do not explain the transfer, SSH is encrypted, there are people trying to break the brute force. Public online VPS, while 22 ports are open, a lot of scans and an attempt to log into the system will be conducted every day. I had to look for fail2ban.