There is consensus between crypto enthusiasts that Crypto moves in certain market cycles. From boom to bust, and back down again. Analysts are trying to predict the market bottom and while often wrong on their short term predictions, we can't say they missed the bear or bull markets.

History suggests that the cryptocurrency market enters a frenzy mode when close to the end of it, with BTC having made an extreme rally, and an altcoin season sending all cryptocurrencies into parabolic trajectory, and this comes to an abrupt end with a massive sell-off.

While cryptocurrencies rallied, and the market reached 2.5 trillion in USD, which was in accordance with most predictions, a crash was looming. And it did happen, with Bitcoin reaching a price lower than $30,000 (more than -50% from ATH) and the whole industry losing more than a trillion dollars in just two days.

This is one trillion dollar lost from the industry, yet there was this bounce to $40,000 and a repeat today after what was looking short of a double bottom.

I am still not certain if this drop will significantly affect prices, or if there is more to come. The chart gives me the impression it is all over, but bulls still want this to go on for some more time.

The reason is obvious, the price reached, the times expected and the charts did not seem that the bull run was going to end so abruptly. Previously, in September 2017, it was during the same chart-time of the bull run that China once again banned Cryptocurrency. It affected the market greatly but it was a moment when everybody bought that dip. The drop was a 30% one though, while now it was more than 50% from the top.

Odds tell me that we are in a bear market now and as with every bear market before it will be a lengthy one. One that will bring all cryptocurrencies down by 85-95%. We have seen how intense it was for every cryptocurrency.

This is my opinion, however many in the industry claim there is still more to come.

Image Source: Twitter

Pomp is someone that understands money. He may not be the brightest when it comes to the tech side of things, and quite often may have called to buy the top, however, this tweet is one of importance. In the Bitcoin tweetstorm, only a few tweets have value. And this one is one of them.

Pomp knows that the bull run will eventually end, just as everybody also knows. It is still a big problem that the price of BTC is too far from its ATH and not just in price, but also in time passed. In fact, those that entered BTC since February, are now at a loss. Of course, most that entered invested in many of the top cryptocurrencies, and most of them, after the 40% bounce they are again in profit. However, this market is now scary.

New investors have no idea what they are messing with and do not understand how the cycles work. As Pomp explains, it is not over yet, but it will be in one or two month for sure.

Whales were not happy with the crash

Some whales with inside info knew about everything and made good profit. Usually whales accumulate when prices drop and they plan to hold and sell in incriments as price reaching their target levels. It is programmed for whales and they will re-accumulate during the bear market. The problem is that many don't think a bear market is something inevitable.

Listen now, it is innevitable. It works like that, this is not a rise only market, prices rise and fall and those that buy last, will keep holding the hot potato for years. Some investors bought XRP at $3-4 and didn't ever made their money back. Even in these market conditions, XRP didn't make it. So many cryptocurrencies appeared and reached the top-10 out of nowhere, but this is usual. This is a market reaction that is explained by the immaturity of most cryptocurrencies and the lack of intrinsic value, liquidity and support.

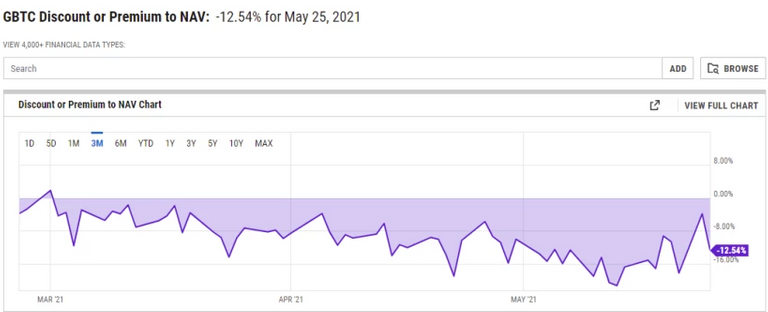

The main reason that could prolongue the bull run, is that whales didn't reach their targets this time. They didn't find prices or enough buyers to offload and there is a secondary problem that didn't help them at all. Grayscale's GBTC price is on a huge discount for months, something that I reported since the first weeks it appeared (on this article) and while it looked like it wasn't going to be a problem, it was certainly an indicator about declining institutional interest and huge profit taking.

GBTC on a discount since February

Image Source: Yahoo Charts

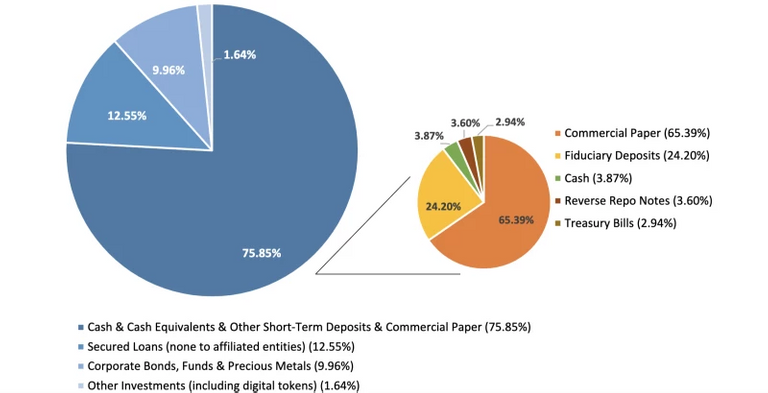

Source: Coindesk

As usual, investors took a good lesson from this market. And as once again we will witness the same mistakes made, with a massive exodus and the market to be played down again by the media, as those that had to profit have already done so.

If the market suddenly somehow becomes bullish again and makes a new ATH, then it will be 200-300k for BTC price for this summer. I give very small odds for this to happen after what we have seen lately, but once again, we can't know for sure what is going to happen. Maybe Tesla buys another 2 billion in BTC. Musk has proven he changes mind very often.

Lead Image from CoinPage

This article is reposted from my Publish0x account. link

Currently active on the following networks:

Noise Cash

Read Cash

Publish0x

Twitter

Reddit

Den.Social

Hive

Yay! 🤗

Your content has been boosted with Ecency Points

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more, by @pantera1.